I have plenty of open credit cards, but I haven’t had a US Bank credit card yet. The other day I changed that, but did I make a mistake in applying?

Applying for My First US Bank Credit Card

The other day, I was floating around Twitter and reading different articles. I happened across a Doctor of Credit article, where there was a targeted offer of 25,000 points after spending $500 for the Flexperk Travel Rewards Visa.

After I finished the article, I popped on over to US Bank to see if I was targeted. Once I entered in my information to see if I was pre-qualified for he Flexperk Travel Rewards Visa, this is what I saw.

Sure enough I was targeted for this offer.

Sure enough I was targeted for this offer.

My Reservations for Applying:

US Bank is known to be difficult for approvals, especially if you have many inquiries. While I haven’t opened a credit card since September (feels like a lifetime!), US Bank has plenty of reasons to deny me.

But…

Earning $375 in rewards was a pretty good return in value for only a $500 spend. After debating this internally and probably talking to myself, I decided to go for it. After all, you can’t win the game if you don’t play, right?

The Return on Bonus:

What I really like about this offer is the high earning rate for the bonus. The math works out to 50 points per dollar while I am working not the bonus. Since Flexperks are worth 1.5 cents per point, I will essentially be earning 75 cents for each dollar I spend.

That is a pretty stellar amount to earn at any level.

My Increasing Story:

In 2017, I was pretty aggressive in opening credit cards. Early in my points/credit card career approvals were almost too easy.

Now that I have been playing this game for a few years, the number of cards and inquiries have increased as well. I have begun to see more pending applications. I think this is due to a few factors:

- I’ve been opening cards pretty regularly and last year was fairly aggressive in opening cards

- Banks are looking to reduce less profitable customers

Sure enough, I entered in all my information for the Flexperk Travel Rewards Visa and I received a message saying they will let me know in 7-10 days of their decision.

My Impatience:

I have never been good at waiting. Especially when it comes to knowing if I am approved for a new credit card.

I decided to wait a day and check online to see if there had been any movement on my application. After 24 hours there had been nothing loaded online and even when I called for an update the message said no information could be found.

Wanting to know the possible outcome, I decided to speak to an agent. It didn’t take long before the person pulled up my account information, but she told me something I didn’t expect to hear.

The application was in the final stages, and a decision would be made within the next 3 business days. I asked if I could speak to someone to give them the information they were needing and I was told I’d have to wait. The agent informed me I could check the automated system in a few days for the decision.

I called about 24 hours later and was able to finally hear US Banks decision…Approved!

Did I Make a Mistake?

Definitely not the thing you want to say right after you were approved for a card, right?

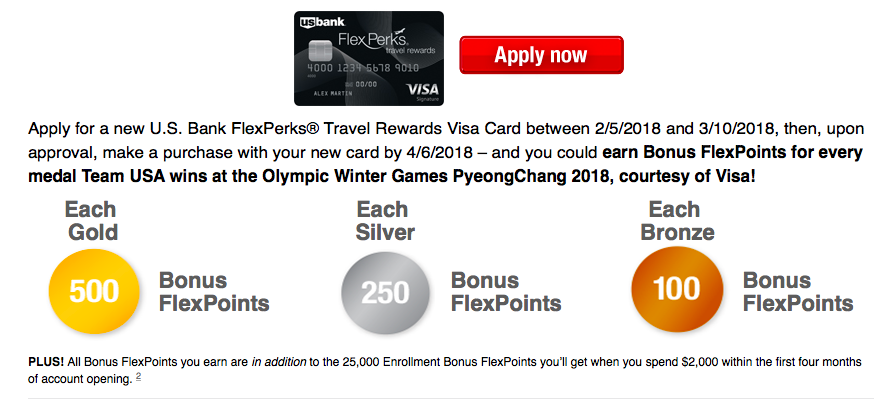

US Bank just made a slight adjustment in their sign up bonus for the upcoming Olympics.

Now there are 2 pieces to look at when it comes to this offer.

- The higher spend requirement of $2,000

- Obviously, the extra points from the Olympic Medals

My offer is definitely better when it comes to the spend requirement. I need to spend 1/4th the amount for equal amount of points.

Where I hurt myself is the lack of points I will earn from the Olympic Medals, which last Olympics was 7,450 points. This would be an extra $111.75 in travel rewards.

My Goal:

Since I have already been approved for this card, I am now at the mercy of US Bank to match the Olympic bonus to my account.

There seems to be very little information about US Bank matching bonuses, but I plan to ask them to match the Olympic bonus after I reach my $500 spending requirement.

Hopefully, they will be willing to match the Olympic bonus, but I could be out of luck.

If US Bank is willing to match (based on last Olympics point total), my math from above changes to earning 64.9 points per dollar. Meaning I would earn over 97 cents per point in value.

Two is Better than One:

After I applied, I immediately looked for my wife to see if she was targeted for this offer as well. Luckily for me, she was targeted. She even filled out the application while she was sleeping 😉

My wife’s application took a few days longer, but in the end she was approved 🙂 . I have no idea why it took longer as I applied for them both the same day.

With Kristin’s application being approved we will have a minimum of 50,000 Flexperks ($750 in rewards) for $1,000 spend. With the possibility of the US Olympic bonus match.

Conclusion:

I am happy to finally have my foot in with US Bank, because this now opens the door to the US Bank Altitude for me in the future.

While I’m hopeful US Bank will match the bonus, earning $375 back on $500 spend is pretty awesome. With both applications being approved, I think earning $750 for only $1,000 spend is a solid amount of rewards. Now if I can only convince US Bank to match the Olympic bonus 🙂

Were you targeted for this offer? Do you think US Bank will match the Olympic bonus?

Don’t forget to Subscribe to my YouTube Channel, Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

why were you approved?

Hey Andrew,

That is a good question. I would assume my credit score (>800), income, and recent inquires were within range of what US Bank liked. I’m sure if there were any flags, they would have denied my application.

To know the exact reason though, we would need to ask US Bank.

Thanks for reading! I appreciate it!

Dustin

Thanks. It appears that, with a good score, they will bend on their no. of recent enquiries rule. Good to know.

– A

Flex Points do expire if I recall. So be sure to check that (it was around 2 years). Try to book travel before they do. I ended up buying gift cards which lowered the value (return) for me, but at least I was able to cash out before my Flex points expired.

It looks like they expire 5 years after the quarter in which they were earned. There is no way to extend expiring flex poiints like other programs by making current purchases or other account activity.

One more consideration. If you plan on getting additional Chase cards, the Chase 5/24 rule will count this as one of your 5 applications. If you are planning on getting the Southwest Companion pass you will need to reserve two of the 5 spots to get Southwest card bonuses (or wait two more years)

Hey Traveller Tom,

I did see they expire after 5 years, but I can assure you these points won’t be around that long :-).

Also, I am so far over the 5/24 rule that I have given up on Chase. Too many cards out there to wait for Chase. Waiting 2 years is too long, especially with the value out there. I hope you aren’t waiting either 🙂

Thanks for reading! I appreciate it!

Dustin

My wife is on hold for another 8 months or so. I currently have the SW Companion pass and I am milking it pretty good right now. Vacations in Bahamas, Grand Cayman and Destin Florida so far. I have Los Angeles and Tampa booked for later this Spring. So I am still churning where I see value. Keep pointing out those deals!