Oh, American Express! For years, they have been a staple of many reward lovers, thanks to the strong Membership Rewards program and the bonus categories.

A few years ago, they made the awesome move of introducing the Bluebird program that let many of us generate miles and points at a very low cost. Well, that ended – and even before they ended it for many of us, they clearly said they don’t like the manufactured spending being done.

American Express Takes Another Swipe at Manufactured Spending

What is “Manufactured Spending”?

In case you are wondering what that is, very simply, manufactured spending is the practice of generating spending on a credit card that you would not otherwise spend. The spending is being done for the purpose of earning miles or points.

So, using a credit card for everyday business/household expenses is normal spending. Using a credit card to purchase things like coins, person-to-person payments, and gift cards (in large quantities for liquidating later) are some of the ways people generate spending – ie. manufacture spending.

The Latest Amex Swipe at Manufactured Spending

American Express has some nice categories (like grocery stores) that carry gift cards. By purchasing those gift cards, in large dollar amounts and/or quantities, it is possible to generate points with your credit card without much expense on your side.

With credit cards that can earn a lot of points, it makes hitting something like 90,000 Hilton points for a top-tier award stay much easier than spending away at 3 points per dollar on just everyday spending.

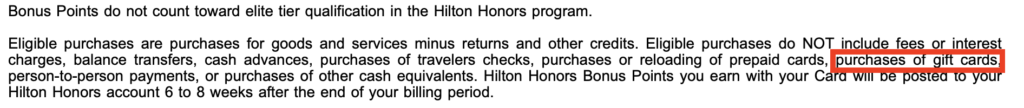

However, American Express really does not like this kind of spending by their customers. While they have excluded gift card spending in the past from counting for the minimum spending required for the sign-up bonus, it appears (from Doctor of Credit) that some cards are now getting language added (while some cards have already had the language) that excludes even regular points from being issued when gift cards were purchased (the following is from the American Express Hilton Aspire card).

Many retailers share a deeper level of purchase activity with credit card issuers. This allows issuers like American Express to not just see the category of spending being done but also what kind of purchase it was. This is what allows them to exclude gift cards from earning points.

While they may not actually do this to everyone on a regular basis (excluding points earned by buying gift cards), they do now have it in their terms to back them up should they decide to go wholesale against the practice.

Summary

American Express has made things very difficult for people that enjoy their cards for the rewards they provide. While Amex clearly loves the people that use the cards without the rewards being the goal, it is short-sighted move by Amex to swipe again at those that generate spending using gift cards. After all, these people are customers as well and if they find that they are not earning points on the purchase of gift cards, it could be enough to make them not want to put any purchases on their Amex cards again.

American Express is spending a lot of money on rewards but I don’t think making a move like this is the answer to making more money.

Very shortsighted of them. They are ok with a person spending $2k on groceries, but not ok with someone spending the same $2k on gc’s at the same grocery store. In either case, they get the same interchange (so from a business standpoint, it should not matter to them what the customer is purchasing). Also, they have limits in place to prevent abuse (amex blue cash pref only gives 6% until about $6k in spend a year if i remember correctly) – modifying those limits may be a better option than not awarding rewards post purchase.

That’s absolutely wrong. Amex loses money with each swipe paying out 4x in grocery stores. Interchanges fees are 2.2-2.6% for Amex. There is an annual fee which mitigates it. That’s why Amex limits the 4X to grocery stores because based on their metrics the average family isn’t spending $1000 a month on groceries. Of course Amex takes issue with gift card purchases to the tune of $1000-$2000 a month because it is not normal spend but specifically designed to take advantage of Amex against the terms of the credit contract. The limit of $25,000 spend on groceries a year for the gold card still means big loses. While a couple of people will reach that with normal spend most doing it are doing it through manufactured spending. The type of people who are upset by the gift card exclusion are the unprofitable customers to Amex.

That’s where the market comes in. Let’s be thankful that there is Chase out there standing ready to take business away from Amex. Unfortunately, Citi in my view is no longer competitive.

My wife and I used Amex when it was the only game in the Costco town, but not any more.