If you helped out a friend or family member (or fellow blog reader) with an American Express card and earned a referral bonus for it, you will likely be getting a 1099 for referral bonuses. Here are some of the details about what is being sent and the values being assessed.

American Express Sending 1099s for Referral Bonuses

If you follow other blogs (and you absolutely should), you probably have already read about this yesterday. I am writing about it now because I have talked a lot about the American Express referral system (and have had many readers earn bonuses by posting their links on my site) and I wanted to make sure readers were not surprised when they see these 1099s arriving in the mail.

1099s for Referral Bonuses?

If you had read the terms carefully on referral bonuses, you would have seen this language:

“The value of the Referral Bonus may be taxable income to you, and we may be required to send you a Form 1099-MISC and file it with the IRS. You are responsible for any federal or state taxes resulting from the Referral Bonus. Please consult your tax advisor if you have questions about the tax treatment of a Referral Bonus”

While many places will say language similar, not everyone does send out a 1099. The point that separates these referral bonuses from card bonuses is that these are not rebates (it is a form of compensation for you referring someone for a product). So, don’t get worried that these are for or will be for the bonus you earn on a new card!

That being said, it is somewhat odd that American Express is choosing to send these out since they are not really required to do so for amounts under $600 yet many people are getting them for those amounts lower than that.

My guess is that American Express has been having another intense audit of themselves since some bonuses are posting for people that had not previously posted and Amex is going the 1099 route to cover everything as well.

American Express Values for 1099s for Referral Bonuses

American Express has set the reported value for these bonuses for their Marriott/SPG cards, Delta, Membership Reward earning cards and Hilton cards and the Hilton one is quite confusing. It is actually a good thing that American Express has pinned their own MR point value to 1 cent per point (especially when, in the past, they have valued them at 2 cents per point when sending checks for bonuses that had not posted).

- American Express Membership Reward Value – 1 Cent per Point

- Hilton Honors Reward Value – .67 Cents per Point

- Delta Airline Miles Value – 1 Cent per Mile

- SPG/Marriott Point Value – 1 Cent per Point

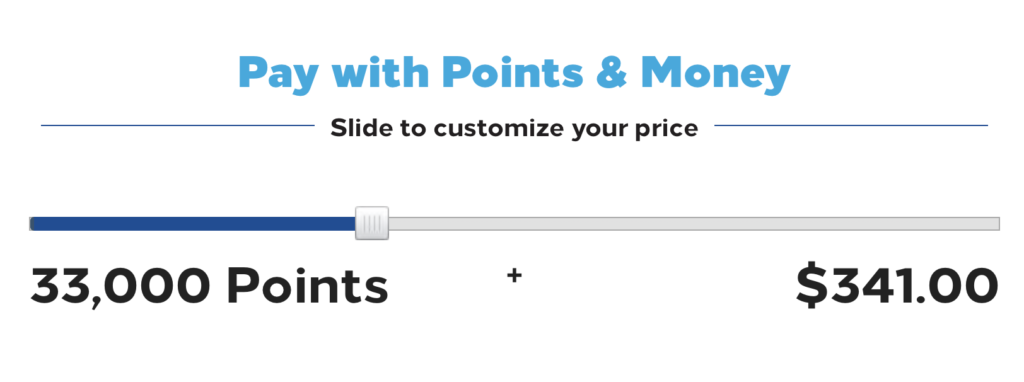

It is the Hilton Honors point valuation that is odd. With Hilton basically having a revenue-based redemption amount with their point slider, the Hilton points are typically worth about .4 – .5 cents per point. It is possible to get more than that but it will typically be when you have calculated in the fact that you don’t pay taxes on full award stays.

An example of Hilton’s points and money slider that gives around .4 cents per point

Hilton runs sales quite often to let you buy Hilton points at .5 cents per point. So, it is odd that American Express is telling you they value them at .67 cents per point. Refer to this post at Reddit for some information on disputing the value for your taxes (but you are better off referring to your own tax professional for your situation).

Taxed for the Points But Cannot Claim Redemption 🙁

The thing I find regrettable is that we have to pay taxes on these points but cannot claim them on our taxes when we actually go ahead and use them. I understand that these are a form of compensation, but if we were being paid cash, we would be able to deduct when we use that cash on expenses.

For example, if you received 15,000 Membership Reward points for a referral, your taxable amount, according to American Express, is $150. However, if you were an American Express affiliate, you would have received $150 in cash (or more) for that same referral. You could claim the money spent on an expense but you cannot claim the points.

There is some hope in that Chase had actually issued an amended form after they did this and zeroed out the taxable amount for people. So, if you can hold off on filing your taxes for now, maybe we will get adjusted values later.

Takeaway

I am not thrilled with this development as I did max out the referrals on my cards. The ones I feel the worst about is the Hilton cards. I completely disagree with their valuation on them and it really makes me not want to refer for Hilton points at all this year. I am not going to get that .67 cents per point in redemption value.

As a matter of fact, I have just been accruing Hilton points for things like airport hotels or even experiences. Having to pay taxes on them will make me rethink my process on that.

HT: Doctor of Credit

Anyone know WHEN I might receive this 1099? I received 15,000 points for a referral when my brother signed up for a platinum card.

Will it be available for me to download from their AMEX website?