After my latest binge of credit cards, I couldn’t restrain myself and open 2 Citi AA Platinum Select credit cards. Now having both the Aviator Red Card and the Platinum Select, is there one a better option to keep? Since I have no interest in keeping all 4 of these cards, so I thought I’d compare these 2 American Airline cards.

Battle of 2 American Airline Cards

Credit Score Needed:

I always give the same advice to anyone starting out in this game. If your credit score is under 700, I would work to improve your credit score before trying for these travel cards. You might be able to squeak by with a high 600 score, but I would really wait until you are over 700.

Sign Up Bonus:

The Barclaycard Aviator Red, currently, has a 50,000 miles bonus after your 1st purchase AND paying the $95 fee in the first 90 days.

The Citi Aadvantage Platinum Select bonus is, currently, 60,000 miles after spending $3,000 in the first 90 days.

Winner: Split. Based on the number alone, the Citi Aadvantage Platinum Select is the winner with 10,000 more miles. I think you could make a case for either though.

Although you need to pay the fee upfront on the Aviator Red, you are getting 50,000 miles for $95. Which comes to buying the miles for 0.19 cents each. If you would prefer not to spend the $95 fee up front and have no problem spending $3,000 in 90 days, then the Aadvantage Platinum select is the better option.

Many bloggers will say get both, which is an option. If you decide to do that, you should have a plan for them. Earning miles without a plan is not a great idea.

Earning Rates:

Both Barclaycard Aviator Red and Citi Aadvantage Platinum Select earn 2x American Airline miles on all purchases made on American Airlines. All other purchases will earn an terrible 1x American Airline miles.

Winner: Tie. The earning rate on these cards aren’t great, but they earn at the exact same rates. One card isn’t better than the other in this case.

Annual Fee:

The Barclaycard Aviator Red has a $95 annual fee that is not waived for the first year.

The Citi Aadvantage Platinum Select, has a $95 annual fee, but it is waived in year 1.

Both of these companies have been pretty good to us when it comes to retention offers. When it comes time to pay your annual fee, you’ll want to make sure to reach out to the banks to see if there are any offers on your account.

Winner: Citi Aadvantage Platinum Select. This is a pretty easy choice as the Citi Aadvantage Platinum Select fee is waived the first year.

Foreign Transaction Fees:

Both the Barclaycard Aviator Red and The Citi Aadvantage Platinum Select come with no foreign transaction fees. These are solid options to save money when traveling abroad.

What makes these cards good for charges abroad? They are World Elite Mastercards. There are plenty of data points showing Mastercard has a better conversion rate than Visa. If everything is equal, then using a Mastercard would be the better than using a Visa card.

Reward Program:

I don’t think it is any secret that American Airlines lack of availability (especially saver business) is frustrating. I have had more success finding saver coach tickets, but even that seems harder to come by.

The great thing about both of these cards is they will both quickly build up your American Airline mile bank. That being said, I wouldn’t apply for these unless you have plans to use American Airline miles or are held hostage with no other options at your airport.

There is a growing trend to not even use American Airlines miles on their own metal. You can find some great redemption options on partner airlines. You just need to do a little homework to see which one works out best for you. I won’t go into detail about those, because there are resources out there that will explain it way better than I ever could.

With both of these credit cards, you are given access to American Airlines reduced mileage awards, which will save you 7,500 miles on select flights totaling 500 miles or more. You also receive 2,000 mile discount on flights less than 500 miles, on select routes. Having both of these cards will not have an additive effect on the awards. These unfortunately are not available to book online, so you will need to call in.

Both of these credit cards also have a 10% rebate on points you redeemed. The rebate limit is 10,000 miles (meaning you redeemed 100,000 AA miles). This is a 10% limit, you do not receive 10% from Citi and 10% from Barclaycard, although that would be great! This is a pretty solid perk of the card and 10,000 miles is enough for a short haul one way ticket.

Other Benefits to Consider:

For the most part, these cards are pretty similar, but where things separate are some of the benefits. The benefits are really what could be a deciding factor in keeping one card over the other.

Travel Delay Coverage:

The Barclarcard Aviator Red does come with Travel Delay Coverage:

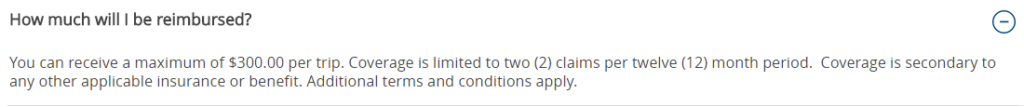

This benefit is a maximum of $300 per trip. You are limited to 2 claims in a 12 month period and can file a claim if your trip has been delayed for 6 hours or more.

The Citi Aadvantage Platinum Select also comes with Travel Delay coverage:

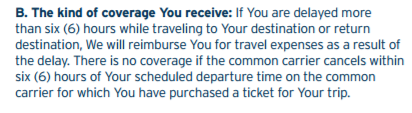

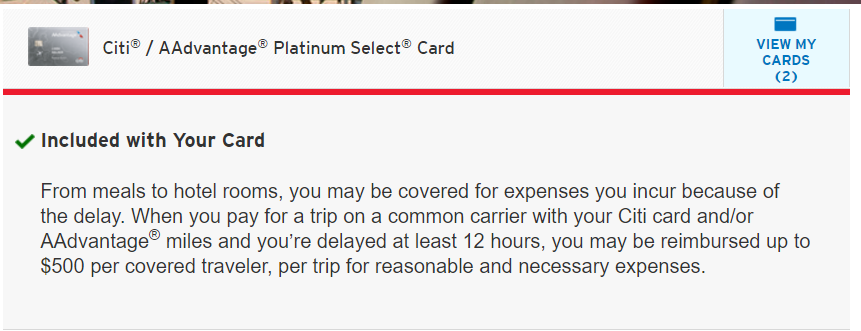

The Travel Delay coverage is up to $500 per traveler, per trip. There is no mention in any terms and conditions on a limit, but they are very clear it is per person, per trip. You can file a claim if you flight has been delayed for more than 12 hours.

Winner: Citi Aadvantage Platinum Select. The only benefit the Aviator Red has is the delay coverage kicks in after 6 hours. Outside of that, Citi’s travel delay coverage is just overall better. There is no limit to use, a higher reimbursement per traveler, and not just per trip.

Price Match:

Both cards have a Price Match, or Price Protection benefits which is an underrated benefit, in my opinion.

The Barclaycard Aviator Red card’s Price Protection:

- You must purchase the new item entirely with your covered card and/or accumulated points from your covered card for yourself or to give as a gift.

- Purchases You make entirely with Your covered card are covered for 120 days from the date of purchase as indicated on your receipt for the differe

- Coverage is limited to the difference between the actual cost of the item (excluding taxes, storage, shipping, and handling costs) and the advertised lower price, up to $250 per claim. There is a maximum of four (4) claim(s) per cardholder account per twelve (12) month period.

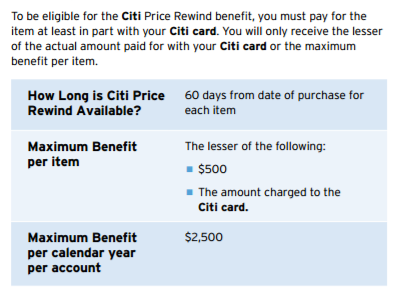

The Citi Aadvantage Platinum Select Price Protection:

Citi has probably one of the most underrated price protection programs out there, Citi Rewind. I actually wrote about my experiences with Citi Rewind a little while ago.

- You must pay for part of the item with your Citi Card to be eligible for Citi Rewind

- Citi Rewind is from the date of purchase for the items

- Max refund is up to $500 per item, with a max benefit per calendar year of $2,500.

Winner: Citi Aadvantage Platinum Select. I don’t think this one is close. The limits for the Aviator Red card are much lower and you need to pay for the whole purchase with your Barclaycard. Citi doesn’t have that restriction, so it is easy to stack gift cards with your purchases to save more money.

The idea of setting and forgetting it is a huge time saver, although Barclaycard does give you 120 days vs Citi’s 60 days. I would gladly take Citi’s 60 days and not have to do a thing.

Baggage Delay Coverage:

With both of these cards, you receive a free checked bag for up to 4 people. When checking a bag, you risk the bag being lost or showing up late.

The Barclaycard Aviator Red baggage delay coverage:

- This benefit kicks in when your bag is delayed to your destination 12 hours after your scheduled arrival time.

- Up to $100 per day for 3 days in the event of a Baggage Delay.

- Limited to expenses incurred for the emergency purchase of essential items needed by the Insured Person while on a covered trip and at a destination other than the Insured Person’s primary residence

The Citi Aadvantage Platinum Select baggage delay coverage:

- You’ll be reimbursed the cost of necessary personal and business items until their baggage arrives.

- You are covered for up to $100 per Covered Traveler, per Trip if the Covered Traveler’s checked baggage doesn’t get to their destination within 6 hours of arrival.

Winner: Split. I’ll give Barclay the nod for amount of money they give you based on baggage delays, but the 12 hour time before it kicks in is not as good as Citi. Plus the odd language of “emergency purchase of essential items,” somewhat confuses me. What do they consider essential?

Citi gets the nod for having a shorter time until the baggage delay coverage kicks in, but only limited to $100 per trip (for each traveler). Their language seems more broad as well in “necessary personal and business items.”

Conclusion:

When you look at the cards at face value, they look very similar. That is due to the fact they are very similar in earning rate and some benefits.

Once you dig a little deeper you can see some of the lesser talked about benefits start to sway in Citi’s favor. When it comes to which of these cards are worth keeping, I would say the Citi Aadvantage Platinum Select is the keeper when comparing these 2 cards.

Which of these 2 American Airline cards would you keep? Do you agree with my choice?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

The 3k EQDs the red offer after spending 25k is the biggest differentiator alone IMO and not mentioned here

Hey Jeff,

To be perfectly honest, I didn’t even think of that. It is a nice perk, especially if you do spend $25k on the card. Maybe one day they’ll give it a full waiver like Delta if you spend $25k 🙂

Thanks for reading! I appreciate it!

Dustin

Good show you got right to it at the top of the topic credit score need it to apply for good approval odds on these cc this is helpful wish more people with these blogs would do this.

Hey Trinette,

Thank you! I always try to help give useful information. I think knowing (and protecting) your credit score is one of the best things you can do, if you decide to play this game!

Thanks for reading! I appreciate it!

Dustin

One version of Citi AAdvantage Business Platinum offers 60K bonus + 2X on gas and some business purchases but forgoes 10% reward rebate in terms. That may be helpful to some people who can take advantage of 2X earning.

Hey Aleks,

That is very true! Maybe I’ll throw together a post of airline business cards soon and compare them.

Thanks for comment! I appreciate it!

Dustin

the Barclay card is a chip and pin card. This is a useful feature in Europe at places like train kiosks or toll booths that don’t accept chip and sign cards

Thank you for sharing this information.

I prefer the Barclays card due to the EQD waiver after spending 25K. Additionally, you get a $100 travel credit after spending 30K in a year which is the hidden benefit that really makes this card the better option. Both give the 10% off mileage redemption, so I’ll take the EQD waiver and $100 over Citi.