If you have been following along this week, chances are that none of this will be surprising to you. But, if you are just now learning about the new Uber credit card, here are some surprising/interesting things about this card.

4 Surprising Things About the New Uber Credit Card

Link: Uber Credit Card (application goes live on November 2)

See the bottom of this post for the full details about the Uber credit card.

It Has No Special Perks/Benefits with Uber

Yes, it is called the “Uber” credit card but other than the name and the fact that you can apply for it through the Uber app, there are no real ties to the ride sharing service. This is somewhat odd since co-branded credit cards (almost?)always have benefits with the company that has their name on it.

You can use the rewards you earn for Uber credits but it would be much better to take that as cash back and buy the discounted Uber gift cards that pop up. Also, you will earn 4% back on UberEATS but that is not the sole retailer at the 4% level (see the next point).

It Has Generous Earnings for Dining and Travel – For a No-Fee Card

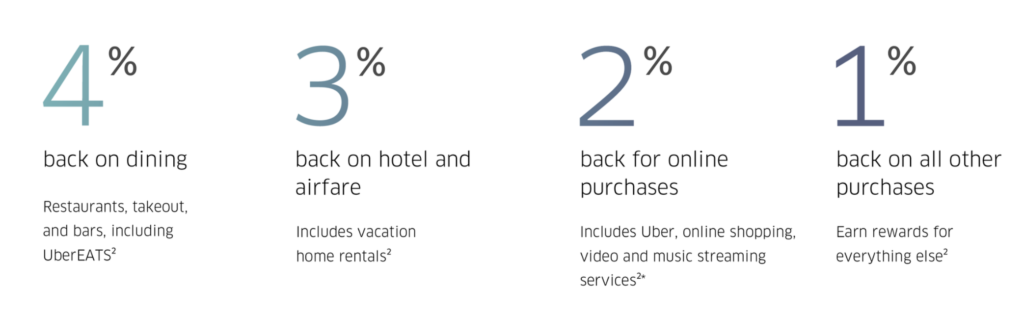

This is a no fee credit card. With those, we are used to having some smaller benefits and earning potentials. But, not with the Uber credit card! Here are the earning categories for this card:

- 4% back on dining

- 3% back on hotel and airfare (including vacation rentals like AirBnB)

- 2% back on online purchases (not made through third-party wallets like Apple Pay, Samsung Pay, etc)

- 1% back on everything else

Those are some strong earning points for a no-fee card! The 4% dining even tops the $450 annual-fee Chase Sapphire Reserve (though you are receiving Ultimate Reward points with Chase that can be redeemed for travel at 1.5 cents per point so it would equal a 4.5% return).

Also, “you may earn up to a $50 credit for net purchases from eligible digital music, video and shopping subscription services after you spend $5,000 or more in total net purchases on your account during each 12-month period through and including your account anniversary date. When you meet the $5,000 spend threshold, you will receive statement credits for each new eligible digital subscription services transaction when it posts to your account.”

Again, not bad at all!

Up to $600 In Cell Phone Insurance

This is a nice one! If you pay your total monthly cell phone bill with your Uber credit card, they will cover you for up to $600 in “insurance coverage against theft of, damage to or involuntary and accidental parting of your cell phone not otherwise covered by another insurance policy.”

That is very nice indeed! It is also a nice play by the Uber credit card to get one of the higher, repeating payments for most Americans monthly – one that would normally earn 5 points per dollar on something like the $95 annual-fee Chase Ink Plus or the no-fee Chase Ink Cash.

Possible Point Transfers In 2018

This is one that just popped up last night and was confirmed to View from the Wing by Barclaycard. He had this to write “However Barclaycard confirms to me that “we are exploring other travel redemption options for 2018, like point transfers, that could be used for Uber and some of our other card products.”

This is great news indeed, especially for a no-fee card! However, there is no knowing at this point what those transfers would look like. If I had to guess, I would say that the points earned on the Uber card would transfer at a ratio less than 1:1 to travel partners. Remember, Barclaycard now has a nice, tidy little group of airlines that they are co-branded with so it would not be surprising to see them negotiate to have transfers to them. They are:

- American Airlines

- Frontier Airlines

- Hawaiian Airlines

- JetBlue Airways

- Lufthansa

That would give access to oneworld airlines and Star Alliance airlines so that would be a great start! Again, my guess would be that they will not be 1:1 but we will have to wait and see what 2018 brings us!

Uber Credit Card Details

So, here are the highlight points on the Uber credit card details:

- Earn $100 after spending $500 in the first 90 days

- 4% back on dining

- 3% back on hotel and airfare (including vacation rentals like AirBnB)

- 2% back on online purchases (not made through third-party wallets like Apple Pay, Samsung Pay, etc)

- 1% back on everything else

- Up to $600 in cell phone coverage

- a $50 credit for certain subscription services after spending $5,000 in a year

- Link will go live November 2

The only thing that I do not like about this Uber credit card at this point is that it is issued by Barclaycard. Barclaycard is an issuer that many people tend to have problems getting new cards from but hopefully they will lighten up a bit.

Takeaway

I do know this – even though Uber is not getting much out of this card in the way of benefits, they likely still stand to make a lot of money from this relationship. The credit card market is all about targeting newbies and novices right now. People that use Uber will now be presented with an attractive no-fee credit card that has bonus categories that will likely suit the many people who use Uber in large cities – dining, travel, and online shopping. I think this will be a great card for many people and I think Uber will do very nicely as well.

agreed.