Three years ago this month, Chase dropped the best credit card offer in a long while – and charged $450 as an annual fee. That did not matter as the number of people who applied for the Chase Sapphire Reserve far exceeded what Chase had expected. Now, we are 3 years later. Is the Chase Sapphire Reserve still a great card?

3 Years of the Chase Sapphire Reserve

Link: Chase Sapphire Reserve

Pro Tip: If you have not yet had the Chase Sapphire Reserve or Preferred, I highly suggest getting the Chase Sapphire Preferred first. Not only does it offer 60,000 points currently, but the annual fee is only $95 per year and you can always upgrade to the Chase Sapphire Reserve down the road! If you choose to use this link to sign-up for the Chase Sapphire Preferred, I will earn 10K points as well!

I have been a Chase Sapphire Reserve cardholder from the very beginning – and we still have it today. In fact, it is the card I use more often than any other card (thanks to the Chase Freedom Unlimited not having waived foreign transaction fees yet!). But, with all the changes over the years since the Chase Sapphire Reserve launch, is it still a great card?

What Has Changed About the Chase Sapphire Reserve Since Its Launch

Read: 3 Negative Changes with the Chase Sapphire Reserve in 2018

Sign-Up Bonus

Part of what drew the droves of people to apply – even outside of the reward hunters – was the huge 100,000 Ultimate Reward points it gave a sign-up bonus. With the ability to use Ultimate Reward points as 1 cent per point as a statement credit or cash, it was a no-brainer to apply for. That redemption method meant people could use 45,000 points to wipe out the $450 annual fee!

But, for those of us savvy about the value of Ultimate Reward points, they were worth a lot more than just 1 cent per point! Transferring them to partners could unlock some awesome award redemptions or people could book travel through the Chase portal and take advantage of the new 1.5 cents per point redemption value.

Since that time, the sign-up bonus has dropped from 100,000 Ultimate Reward points to 50,000 Ultimate Reward points. It is still a nice haul but the better avenue for most is to get the Chase Sapphire Preferred with its $95 annual fee and 60,000 points and then upgrade at some point in the future.

Priority Pass Guest Policy

Many people thought there must be a missing word or something when it appeared that the Chase Sapphire Reserve’s Priority Pass membership allowed for unlimited guests with the member. But, no, that was true! However, it was also unsustainable.

Some people were taking this to the extreme by even charging random strangers in the airport to get them into the Priority Pass lounges. With some people bringing in 15-20 people at a pop, this was never going to last.

Now, you can only bring in 2 guests per visit. But, each authorized user also can bring in 2 guests so that is a great way to still get the family in if you have more than 3 people in your family (the authorized user fee is $75 per year).

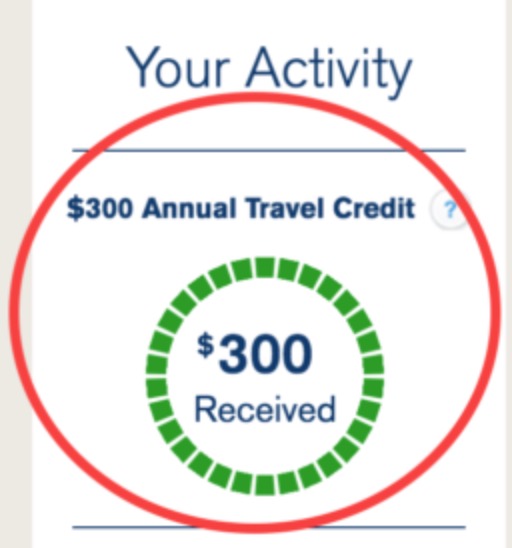

Annual Travel Credit

Chase Sapphire Reserve Annual Travel Credit

When it was first introduced, the $300 annual travel credit was able to be used once per calendar year. That meant people could use that $300 credit from August to the end of December the first year and then use it again after January 1st for a total of $600 in travel credit the first year. This was huge – and also unsustainable (since the annual fee was $450, they would be paying more than that in just the travel credit for those that maxed it out).

Since Chase uses the travel credit in a very simple way (no choosing particular airlines, no booking only through an airline website – all travel charged is issued a statement credit within a couple of days from the time of the purchase), people don’t even need to think about the credit – it just works!

One other thing that changed was that you could no longer earn 3 points per dollar on travel that was part of that $300 travel credit. That meant a loss of 900 Ultimate Reward points per year that had been previously issued. This was understandable since there was a statement credit for that so points really shouldn’t be given anyway.

Why the Chase Sapphire Reserve Is Still Great

So, with those changes (negative ones) over the years, why do I say it is still a great card? If we add it up, we are looking at over $1,000 in value that is gone from the initial offering if you were to apply today!

While there are other cards that compete in various ways (points earning, etc), here are the reasons I still think the Chase Sapphire Reserve is great and why we still have it.

Travel Credit

We do spend money on travel – of course! Even if you travel only on miles and points, you still have taxes/fees on airline awards or even things like tolls when you are driving on interstates. The Chase Sapphire Reserve travel credit wipes all of those things out!

It is super simple to use – just use your Chase Sapphire Reserve for any travel items and you will see the statement credit within a couple of days for the travel you spent on! We don’t even have to “manufacture” ways to use this travel credit, it will be spent!

That means we are getting refunded for $300 in travel we would spend already. While many would argue that shouldn’t automatically make the $450 annual fee a $150 annual fee card, it does work that way for us.

Primary Rental Car Insurance

There are other cards that offer this as well but since I like to use my Chase Sapphire Reserve for all things travel, this is the card I use when renting cars. That means that I don’t have to worry about any damage that may happen to the car that is my fault. With primary insurance, Chase picks up the whole thing instead of serving as a backup for a regular insurance policy.

Chase Travel Portal Value

There are plenty of posts to show that some of the prices of Chase’s Expedia-powered travel portal are higher than via other sites but that has not been the case with me. I do end up booking much of my paid airfare through the Chase portal since I get 1.5 cents per point on my Ultimate Reward points when I book from the Chase Sapphire Reserve account.

Here is an example – if I were to transfer my Ultimate Reward points to United to book a roundtrip business class ticket to Europe with Turkish Airlines, I would need to transfer 140,000 points.

Instead, I could take those same points and buy a Turkish Airlines business class ticket for $2,100 (the value of 140K UR points through the Reserve account) and actually earn miles flying it! Plus, believe it or not, you can buy such a ticket almost any day of the week from various cities in Europe to certain cities in the US.

Lounge Access

Again, there are other cards that offer Priority Pass memberships at various levels. But, it is easy and unlimited (for the cardholder and up to 2 guests) and it applies to the authorized card users as well.

I have Star Alliance Gold status so since I mostly fly Star Alliance carriers, I have lounges at every airport. My wife, however, doesn’t have elite status. So, when she travels, it is nice that she can use lounges for free with her card. Or, if our family is traveling, we can get everyone in between the two of us.

Point Earning

At the risk of sounding like a broken record, there are other cards that offer the same or better than the Chase Sapphire Reserve with dining and travel. However, it is just so easy with the CSR!

For example, unlike some other cards, I can buy airline tickets through Kayak, pay for award fees, buy from the airline – and earn 3 Ultimate Reward points per dollar. With something like the American Express Platinum card, you need to spend at the airline’s website to get the 5X points.

Summary

Is the Chase Sapphire Reserve as big of a hit as when it launched? Absolutely not! But, it is still a compelling card to keep for those of us who travel. It makes the earning in those categories easy and the $300 travel credit is very easy to us.

Plus, you are still earning Ultimate Reward points that transfer to some great partners at 1:1! All in all, unless Chase makes some really negative change, I am a holder of the Chase Sapphire Reserve and will continue to be one for a while.

What do you think – is the Chase Sapphire Reserve still a great card? If you dropped it, what did you replace it with?

The [edit] identify themselves

“With some people bringing in 15-20 people at a pop, this was never going to last.”

The credit card companies must ban select people and allow the original benefit for the rest of us. Credit companies must be socialists. Make everyone pay for antics of a select few.

For a net $150 this card is my go to almost everything travel related, especially out of the country where fx is an issue. The 100K points when we first got it was kinda awesome too.

Awesome car, I wonder if they will create a business version of the CSR, too

My favorite “insurance” benefit is reimbursement when I’ve had to overnight or have additional meals due to weather cancellations and delays.

I have this card and the Citi Prestige. Taking away the Lounge access, I don’t know how this card can compete with the prestige. Can someone please enlighten me? I have surplus on the Prestige simply with the 2 refunded nights.