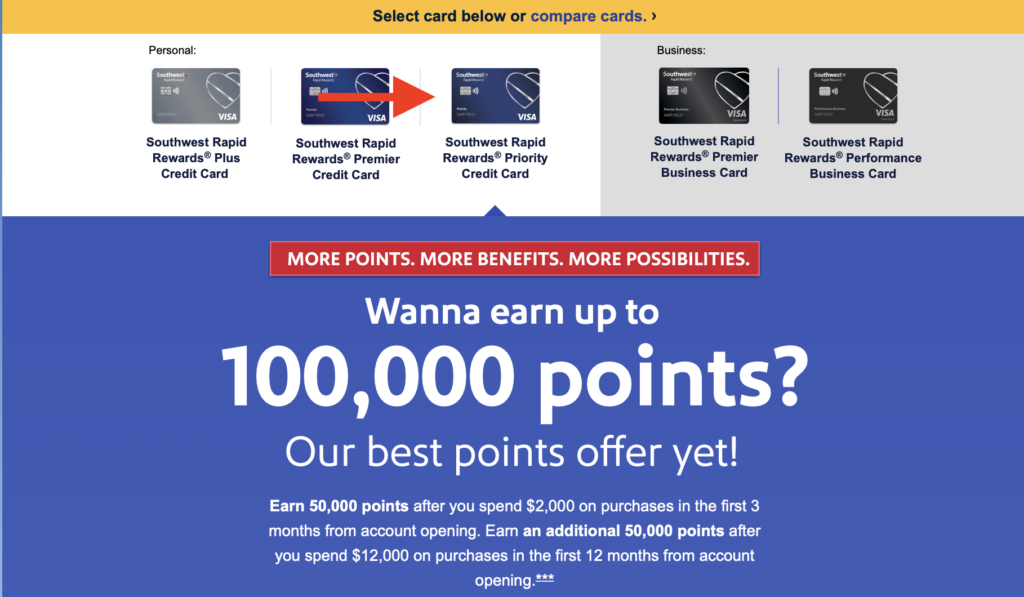

If you are a fan of Southwest, this Southwest Priority card is one that you should definitely take a very good look at right now. As if the 100,000 Southwest Rapid Reward points are not enough, you can also get a bunch of features to help you with your Southwest flights.

The Southwest Priority Card is a Great Card Right Now

Link: Southwest Priority Card (this is a personal referral link that helps us earn points also if you are approved – thanks!) – Make sure you click on the Southwest Priority card on this page!

Here are the details on this Southwest Priority card bonus offer:

- Earn 50,000 points after you spend $2,000 on purchases in the first 3 months from account opening

- Earn an additional 50,000 points after you spend $12,000 on purchases in the first 12 months of the account opening

- Annual fee: $149 not waived and does not count towards the spending

-

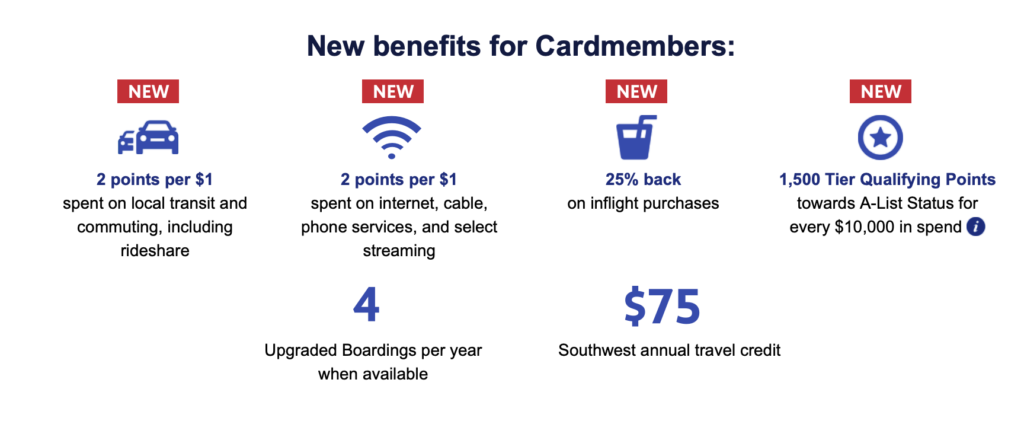

2 points per $1 spent on Southwest® and Rapid Rewards hotel and car rental partner purchases.

-

1 point per $1 spent on all other purchases.

-

7,500 anniversary points each year.

-

$75 Southwest annual travel credit.

-

Four Upgraded Boardings per year when available.

-

20% back on in-flight drinks, WiFi, messaging, and movies.

-

No foreign transaction fees.

-

Earn tier qualifying points towards A-list Status

Reason 1 – 100,000 Points!

Of course, such a big haul should be reason number 1! Yes, the other personal Southwest cards have the same point amount but we will get to why this card in the next couple of points.

The great thing about this offer is that you not only get 100,000 points which is worth around $1,400 in Southwest flights. That is a huge value, even while considering that you have the $149 annual fee to pay.

But, another great thing about the points is that they can get you very close to the Southwest Companion Pass for 2022 and 2023! You need 125,000 points in 2022 so here is the strategy.

- Apply for this offer before December

- Do not do any spending on this card before the statement that closes in January – for example, if your card closes on the 12th of the month, you can spend in January and easily have the points count for 2022.

Since you earn 12,000 points from the spending by itself, after including that with the bonus, you are at 112,000 points – just 13,000 points shy of the amount needed for the Southwest Companion Pass. Remember, you just need to hit the threshold, you do not trade your points for the pass.

Reason 2: 4 Upgraded Boardings

This perk is certainly a nice one for those longer trips! I paid twice last year for A1-A15 boarding because I either needed to disembark quickly or I needed some extra legroom to get some sleep on a long flight.

That perk is worth about $40-50 for each upgrade so that is a nice bonus of $160-200 each year. You get these 4 upgraded boarding on the Southwest Priority card and it is the only personal card that offers this.

Obviously, if you get the Southwest credit card, you are flying Southwest. Now, you can get a better seat on at least 4 of those flights!

Reason 3: 7,500 Bonus Points and $75 Travel Credit

I lumped these two together because they kind of go hand in hand. With an annual fee of $149, the $75 travel credit for Southwest flights is a nice way to cut that almost in half (I count it as a a little less than $75 but figure it to be at least like $65 or so since you can get discounted gift cards).

The 7,500 bonus each year is another way to equalize that annual fee. Those points are worth about $110 so it is a really nice way to squeeze a lot of value out of this card!

Should You Get the Southwest Priority Credit Card?

If there would be a 4th reason, I would say that it is that I earn Southwest points if you apply through my link also. 🙂 But, should you get the card?

Remember that this is a card that falls under the Chase 5/24 rule so you will not be eligible to get this card if you have opened 5 or more new accounts with any banks in the last 24 months. Also, you cannot get this card if you currently hold another Southwest personal card and/or if you have received a bonus on a personal Southwest card in the last 24 months.

I think this is a great time to get any Southwest personal card with this huge sign-up bonus. I think the Priority card is great for anyone that wants to squeeze as much value as possible out of a Southwest card.

Yeah you get close to the requirements for the CP and can have it for 2022 and 2023… IF, and that’s a big IF, IF you can spend $12,000 relatively fast. I don’t know about your reader demographic but $12,000 in spend in 2 or 3 months? Kind of tough when you can’t put your mortgage payments on it.

I’m working on $5,000 for the business card and even for that I need to get creative.

I’m open to any and all suggestions. 🙂

It depends – some put their taxes on cards or advance pay on utilities, insurance premiums, etc.

But, no one needs to do it in 3 months, that was just to demonstrate that you could get the pass for almost two full years if you do. But, with this offer, you only need to do the first $2,000 in the first 3 months. For the remaining $10,000, you have 12 months to do it from the time of opening the card. That should be within the range of just about anyone that would get this card!

For your $5k, same thing – tax payments (you will pay a 3% fee but worth it for the sign-up bonus), buy gift cards for months worth of gas, advance paying insurance premiums/health costs that can be reimbursed (we have to pay for our kids’ hospital treatments and then get reimbursed a while later so we get $38,000 in spending per year this way!), buy grocery store gift cards for future spending, prepay cell phone bills for a while. Even if you needed to pay interest for four months or so (I know that is a no-no in this game but if you needed to), the interest payments on half the spending for four months would likely be around $120. Look at it as buying the points cheap – if you need to do that.

[…] If you’re interested in the Southwest Companion certificate, as well as the 100,000-point welcome bonus, you might want to apply now, by Running With Miles. […]

I tried to refer someone today and said referral was only 40,000. Did they end it early?

The referral offer of 100K ended on December 1 but the actual links through Chase for the 100k end today or tomorrow.

The referral links themselves are good until next year, just at the 40k number instead.

[…] Well, this is relevant and please show support to a blogger you appreciate to keep them going okay? 3 Reasons to Get the Southwest Priority Card with 100,000 Points – Now! […]

Can you explain how you value the $75 travel credit as $65, and the bit about buying discounted gift cards? Or do you have it in another blog post somewhere?