On Monday, Apple announced their new Apple Card, a credit card issued by Goldman Sachs. This card is definitely not the kind of card that is going to get many of us reward seekers excited but it does have some features that I would love to see other cards adopt.

3 Great Features of the New Apple Card That Other Cards Should Adopt

Where’s the Money???

First of all, I am a bit surprised about Apple’s approach to earning money with this new card. I think it has more to do with Apple’s future goals with the card than turning major profits with it at launch.

Credit cards earn much of their money through these paths:

- Interest (Apple is promising lower interest rates)

- Fees (Apple is promising no fees)

- Payment transaction fees (Apple had reportedly negotiated smaller fees for Apple Pay use)

- Co-branding relationship (unknown what the earning relationship is between Apple and Goldman Sachs)

- Selling information (Mastercard sold information to Google about card use for millions of dollars – Apple is promising it won’t – and can’t – sell this information)

When you look at that list, it is not immediately clear how Apple is going to really be turning much of a profit from their new Apple Card. This is especially true since Apple is giving 2% cash back on all purchases made through Apple Pay. So, I would not imagine (or hope for) other issuers copying any of the fee-based side of things from the Apple Card.

I do think that Apple will be using the Apple Card as a means to an end, probably something like Amazon has done with their tablet market, as a loss-leader. Time will tell how they will use it this way but it certainly seems to be just the start for the Apple Card.

One thing: One thing going for Apple is that they will not need to spend money on the outside marketing that other issuers rely on. This includes blogger/affiliate payouts. That payout can often cost issuers more than they get from a customer in a year so Apple would already be ahead of the curve on that.

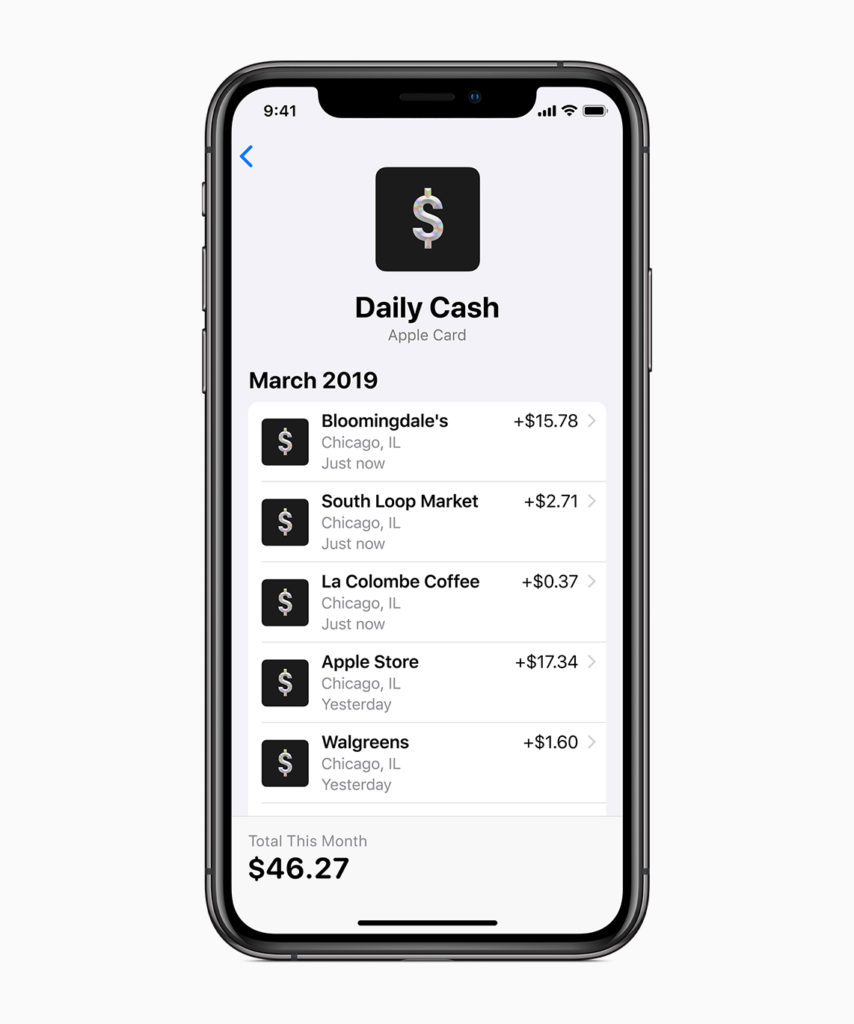

Daily Rewards

Daily Rewards from Apple Card

While CapitalOne does this, all other issuers make you wait at least a few days or even days after your statement closes before you get the rewards. The new Apple Card is going to shine consumer’s attention on the fact that it is 2019 and credit card issuers are still taking as long to issue rewards as they did in the last millennium.

I do think that there will be some that will take advantage of this new feature with the Apple Card (returning something after taking a large amount of cash back) but I am sure Apple has a plan to deal with this (probably something like charging you that amount on your next statement).

In 2019, we should at least be able to get rewards in a more timely manner than we do already. Sure, it complicates it a bit when you can transfer other rewards out to partners but they could still just debit your rewards account like Apple will do if you return something. The current system used by other issuers is not efficient. If it is to protect against returns, that argument falls apart since you could still return something right after a statement closes.

Easy, Secure Account Updates

One of the things I heard Monday that I thought was pretty cool was that you could send a simple iMessage to update your Apple Card account – things like address, contact info, etc. While issuers have moved some messaging ability into their apps and their response time is pretty good, it would be nice to move some of this to a secure, automated system.

With an iPhone, only the person who has the fingerprint/face/passcode can unlock the phone and send such information so this is more secure than the mailbox by the road. Other issuers should be using this device security to make account updates and alerts easier and quicker.

Another aspect of this is the new Apple Card automatically adding the card to your phone’s wallet as soon as you are approved. That is a great thing if you want to use it right away on any purchases!

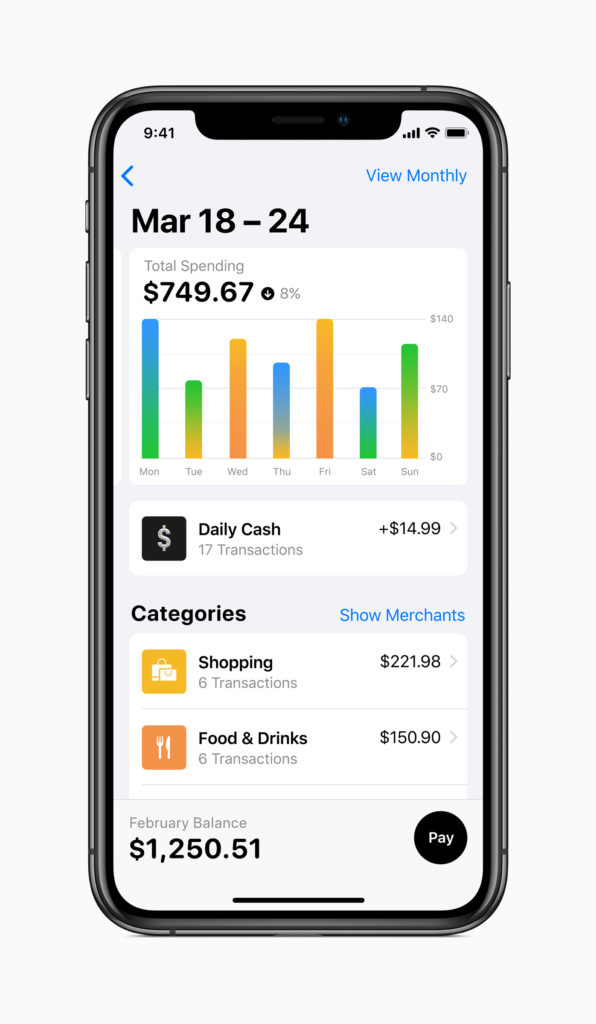

Simplifying Spending

Simplifying spending with the new Apple Card

While issuers have made some improvements to their apps to show you more simply how your spending is, Apple is taking this to another level by marrying their maps software with your purchases to show you exactly what, where, and how all of your spending is going (you know all those transactions that make no sense because they are processed by a parent company?). They will also make it more simple when it comes to seeing how your spending is allocated.

Having a more simple and immediate view of spending can help with saving on your spending. It will also be something that will encourage people to use the Apple Card more to have this kind of access. Once it becomes easier for people, people will be drawn to this.

Summary

Something I am excited about with the Apple Card is that it is going to force credit card issuers to innovate in many ways. This is what Apple does in every market they play in. Look at the various companies that have tried to imitate some of the Apple products over the years. With the new Apple Card, you can bet that there are going to be millions of Apple lovers signing up for it.

Once they do, they will be drawn to the simplicity of the Apple Card that follows the Apple attitude of “it just works.” That could be what all of us reward-lovers can get excited about as the other issuers will need to step up their game to get that spending back.

[…] 3 Features of the New Apple Card That Other Cards Should Adopt Running with Miles […]