Today, August 20, the Apple Card application went live for US applicants. No doubt, many iPhone owners have already gone through the very simple process to sign-up for the Apple Card. But, if you truly want the best bang for your credit card spending buck, here are 3 credit cards that are better than the Apple Card.

3 Credit Cards That Are Better Than the Apple Card

What the Apple Card DOES Have

Let’s face it – there are a few things that the Apple Card has going for it that will be the draw for many customers. Two big things are Apple branding and simplicity. See this post for how the Apple Card will draw people and what things about it are good.

The things that the Apple Card does not do well is to properly reward its customers. While the 2% cash back selling point is nice, there are still places where Apple Pay does not work so that means whipping out the white, titanium card (hello, Apple branding) and earning just 1% cash back on those purchases.

So, if you like simplicity and seeing everything in front of you on your phone for what you spend, the Apple Card will likely make you pretty happy as a user. But, if you value getting every little bit out of your spending, there are better credit cards for you.

Chase Freedom Unlimited

Link: Chase Freedom Unlimited (this is a personal referral link – I will receive a bonus as well)

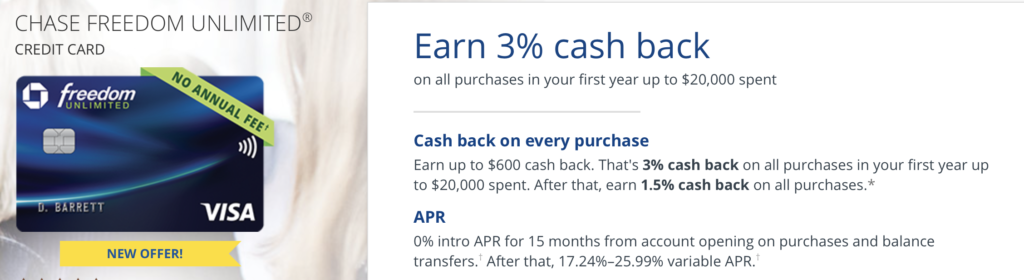

The Chase Freedom Unlimited normally offers 1.5% cash back on all spending. But, there is a special offer going on for a few months that will let you earn 3% cash back on every purchase up to $20,000. After your first year, it goes back to 1.5% cash back on all spending.

Here is how it lines up with the Apple Card:

- Both cards have no annual fee – draw

- Apple Card has no foreign transaction fee and Chase Freedom Unlimited has a FTF – Apple Card

- Apple Card earns 2% on everything with Apple Pay and Chase Freedom Unlimited earns 3% back on everything the first year – Chase Freedom Unlimited

Of course, the Apple Card gives you your cashback the next day while the Chase Freedom Unlimited will not give it to you until after your statement closes. Still, it is not bad to have to wait for it.

Also, while I don’t recommend it, if you need it, the Chase Freedom Unlimited gives you 0% interest for 15 months. This could help if you have some major purchase you need to make and you will still make monthly payments to wipe that out before the 15 months are up.

The Power Part

If you want to really unlock that Chase Freedom Unlimited, you could also get a card like the Chase Sapphire Preferred. This will let you transfer your cash back into Ultimate Reward points that can give you a lot of travel potential. Not only does it let you book travel through Chase at 1.25 cents per point but you can also transfer to partners.

PayPal CashBack Mastercard

Link: PayPal CashBack Mastercard

You want simplicity? How about a card with no annual fee and 2% cash back in your PayPal account – on everything you spend? That is the PayPal Cashback Mastercard. They advertise that there are no rotating categories (like some cards from Chase, Discover, and Citi) and it is a straight 2% back.

The catch? You must have a PayPal account. If you do, you can apply and start earning 2% – whether you use Apple Pay or the actual card.

The Power User Option – The US Bank Altitude Reserve

Link: US Bank Altitude Reserve

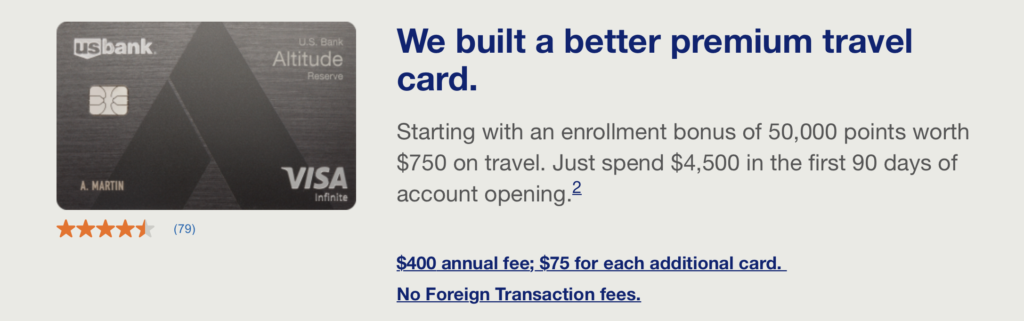

Now, if you want to go all-in with a powerful card chock full of benefits and rewards, this is the card for you. But, that full wallet of rewards and benefits does have a fee tied to it so let’s break it down.

The US Bank Altitude Reserve awards 3 points per dollar on all digital wallet (ie. Apple Pay) purchases. That’s not all – those points can be redeemed at 1.5 cents per point for travel meaning your rewards are actually helping you earn 4.5% in value on every Apple Pay purchase.

Plus, this card comes with a 50,000 point sign-up bonus (after spending $4,500 in the first 90 days) – that is equal to $750 in travel! You also get things like free WiFi passes for GoGo in-flight internet and lounge access. In addition, you will receive $325 in statement credits when you book directly with airlines, hotels, rental cars, etc.

The card also does not have a foreign transaction fee. But, all of that goodness does come with a hefty annual fee – $400. The good news is that you can redeem 35,000 points to cover that annual fee! That would still leave you 15,000 points from the sign-up bonus!

One more important note – you must already be a US Bank customer to apply. So, look at this card as a more advanced competitor to the Apple Card. It lacks the simplicity but has more than enough power to make up for it!

Summary

If you wanted to use your Apple Card to earn the 3% cash back on Apple purchases, know that there are even better cards out there for that than the Apple Card also! Basically, it comes down to this – if you want the simplicity of basic cash back and colorful graphs to help you with your spending, the Apple Card will give you that.

But, if you want to take your rewards game up a notch and get better rewards for your spending, these 3 cards offer that for you. The Chase Freedom Unlimited, especially, is a very compelling card since you will earn 3% on everything (up to $20,000) and can convert that cash back into ultra-valuable Ultimate Reward points!

To get some more ideas, check out my buddy Dustin’s YouTube video about this as well!

There are a slew full of cards that are better than the APPLE card- none of this logical and rational reasoning matters to the folks that are going to apply for this card. Its sleek and shiny and metal, all the boxes have been checked to make this card attractive to the youth

Thanks for the reminder about the US Bank Altitude Reserve. The requirement to be an existing US Bank customer has been the main reason holding me back on getting this. However, it may just be worth the trouble…