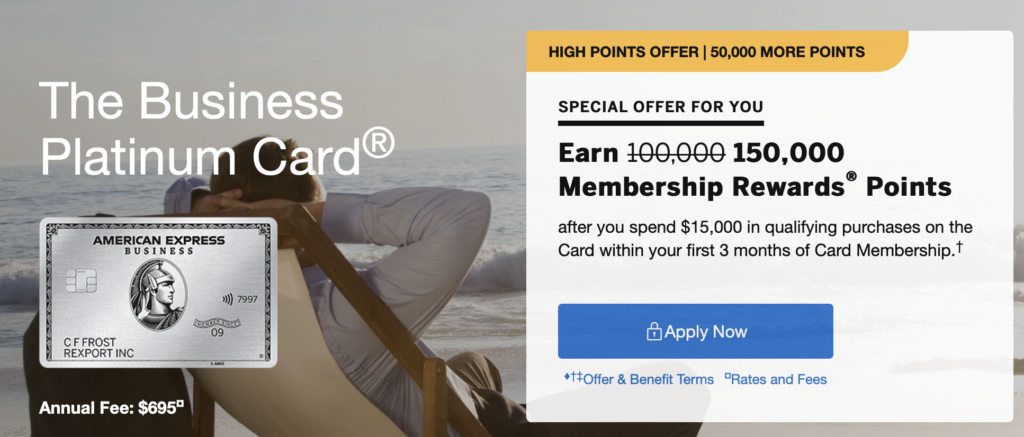

The American Express Business Platinum card is currently at 150,000 points through referral offers. That is a nice bunch of points, but of course American Express is not giving them away for free! Let’s break down the offer and see if you will want it.

150,000 Point American Express Business Platinum Offer

Link: 150,000 Point American Express Business Platinum (this is a referral offer that gives points if you are approved to either me or one of our readers)

How to get the 150,000 point offer – the regular offers are all at 120,000 points but if you open the above link in a private browser, you should see the 150,000 point offer instead. So, make sure you right-click on the above link and choose to open in an incognito browser window or a private window – whatever your browser calls it.

The Points – 150,000 Membership Reward Points

Right off the bat, this is a very rich points offer. The value of these points is between $2,600 – $3,000, depending on how you value Membership Reward points. If you can transfer to a partner to book business class or first class, you will get a lot of value out of these points!

Also, by having the Business Platinum card, you get a special 35% airline bonus. That means that if you book a first or business class ticket through the American Express Travel portal (or an economy ticket if it is on your selected airline), you can choose to use Pay With Points for a 35% rebate on the points you use. So, for example, let’s say you use 100,000 Membership Reward points this way to pay for a $1,000 ticket, you will end up with 35,000 points back. This means you only spent 65,000 American Express Membership Reward points, giving you a value of 1.5 cents per point. This is a great way to earn miles on flights that you make.

To get those points, you need to do $15,000 in spending in the first 3 months of having the card opened.

The Annual Fee – $695

Yes, that is an almost $700 annual fee (let’s just say “$700”). That is huge and you will pay it up front (and it does not count towards your spending!).

So, the elephant in the room is that annual fee (also the spending requirement though if your small business is doing a lot of spending, it shouldn’t be too hard). That is a huge annual fee so we need to break things down to see if you can make your peace with it!

We recently upgraded to this card for a 140,000 point bonus and just got hit with the annual fee so what we are going to talk about is what we are currently doing to make the card pay for itself – other than by just having the points.

The Rebates / Credits

First off, the American Express Business Platinum comes with the usual $200 reimbursement for airline incidentals. This means things like lounge passes, baggage fees, change fees, etc. This is based on a calendar year. So, if you get the card now or in the next month or so, you get it for this year, for 2023, and you could even get it for 2024 before downgrading the card (and getting a prorated part of the annual fee back).

Even if you don’t hold it for the first part of 2024, you will still get $400 in airline incidental reimbursement credits. Now, since this cannot be outright used for tickets, let’s put the value of this at around $320 or so. This drops the pain of the annual fee down to $375.

Next up is the Dell Technologies statement credit. For each half of the year, you get $200 in statement credits when you buy from Dell. Now, for us, this is a bit harder to really get the full value from. The reason is that most of the things we would want to get can be purchased cheaper elsewhere. We are Mac people so getting a Windows computer isn’t something we are looking at. So, instead of a full $400, let’s say another $320 or so. That brings that annual fee pain down to $55.

For another $120 back, you get this in wireless credit on your wireless service provider charges. This is at $10 per month. This is nice but many people may use other cards to pay these fees since those cards pay 5X points and offer cell phone damage coverage. So, I wouldn’t even count this in our tallying since you are giving up other benefits by moving that bill to this card.

Oh, it also comes with Global Entry reimbursement – but it also is on like over 20 other cards so I won’t even count that!

Lounge Access

This comes with the Centurion Lounge access, which is spectacular. For those times you aren’t in cities with Centurion lounges, you can still use any of their other lounges in their Global network, including Airspace lounges.

Bottom Line

For a pure play on earning points, I think there are plenty of ways to justify the annual fee and pocket the 150,000 points. We did it for a 140,000 point offer so this is even nicer!

But, first see if you have had this card before and if you are able to swing the $15,000 in spending in 3 months. Remember that if you spend $5,000 or more in a single transaction, you get 1.5x points so that is nice!

I think this is a good offer and if it shows up for you and you can justify the annual fee and the spending, you may want to go for it!