Disclosure: I do not receive a commission for any of the cards in this post.

Disclosure: I do not receive a commission for any of the cards in this post.

According to many reports, May 1 is the day that American Express will no longer allow customers to receive sign-up bonuses if they have already held the card. This is a big change for American Express who used to allow customers to churn the cards often before making it that you had to not have held the card for 12 months. Now, this move will be that customers will no longer be able to get the repeat bonuses.

Does Never Mean Never?

Does this mean that former cardmembers will never be able to get the bonus again? Technically and according to the rule, that is correct. However, with actual implementation, only time will tell if that is indeed the case. Chase has a similar policy of one bonus per lifetime but Chase customers have been able to get the bonus again after having waited a few years.

Also, if the product changes at all, there may be the possibility of getting the bonus again. This is the case with Chase and many people have been able to use it greatly to their advantage. The problem is that American Express has not made any changes to their main cards in quite some time. Will they change their American Express SPG card soon? My guess would be no. Most of Chase’s changes have come from switching from Mastercard to Visa. American Express is not only the issuer but also the network by which the charges are processed so that will not happen with them.

Targeted Bonuses?

What about targeted bonuses? I would guess that former cardmembers may receive targeted bonuses after a couple of years of not having the card. American Express may well see many people drop cards like the American Express Premier Rewards Gold because of the high fee and no chance of getting the bonus again. That is especially true with the introduction of the Amex Everyday cards that have much smaller fees (or no fee) and feed into the same Membership Rewards system.

What Should You Do?

So, what should you do? If you have any cards in mind that you have not had for a least 12 months (but you have had them before), apply for them right now! Not only do you need to apply before May 1 but you need to be approved before May 1. Here are the cards that you may want to consider applying for if you have had them before. If you have never had these cards before, there is no rush as you can get them at anytime. Also, remember that the policy for right now only deals with consumer cards – the small business cards appear to be untouched. Again, I do not receive a commission for any of these cards.

- American Express SPG – 10,000 Starpoints after first purchase, 15,000 additional Starpoints after spending $5,000 in 6 months.

- American Express Hilton Surpass – 75,000 Hilton points after spending $3,000 in 3 months

- American Express Premier Rewards Gold – 25,000 Membership Reward points after spending $2,000 in 3 months

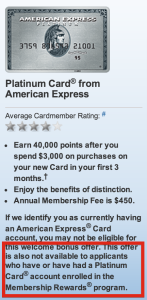

- American Express Platinum – 40,000 Membership Reward points after spending $3,000 in 3 months

- American Express Mercedes Benz Platinum – 50,000 Membership Reward points after spending $3,000 in 3 months

- American Express Delta Platinum – 5,000 MQMs and 35,000 Skymiles after spending $1,000 in 3 months

- American Express Delta Reserve – 10,000 MQMs and 10,000 Skymiles after first purchase

There you have some of the cards worth getting again (if you have already had them) before May 1. After that, we shall see what happens!

Check It and Get It Approved

Remember, these applications need to be approved by May 1. Not only that, but you also cannot have more than 4 credit cards tied to your account – business and personal combined! So, chances are very good that you will need to call in if you have 4 as your card application will go into pending state. The phone number for talking to someone about your card is 800-582-6471. If you would like to check on the status before applying, check here.

My partner and I each have 3 personal + 3 business cards with AMEX, so I don’t believe 4 is the limit.

What leads you to believe that the application must be approved (rather than simply applied for) by tomorrow April 30?

It is a policy for credit cards so either two of those are charge cards or you have slipped through. As to the approval, amex is notorious about not giving bonuses if the account has not been opened by the particular date – when it expires, etc.

I currently hold the Amex Benz plat.. Do you know if the regular personal plat is still considered separate?

Reports have been that they do not consider it separate for bonuses. They have updated the language on the apps to expand it between the cards.