When it comes to earning the big miles and points, the best way is obviously through credit card bonuses. I mean, the ability to earn 50,000 miles through one purchase and paying an annual fee (like with the US Airways MasterCard) is so easy it is almost ridiculous!

Nickel and Diming Your Way To Free Travel

But what about after the bonus? Some people continue to roll from one bonus to another through various credit cards but others prefer to be more cautious and just stick with a few credit cards. After that initial windfall of points, what do you do to continue earning the points for future travel?

Don’t Neglect The Little Points

I have been very guilty of this myself – ignoring small point earning opportunities because I felt that it was not worth my time for something so “insignificant.” However, that is completely the wrong attitude to have towards miles and point earning. Every mile or point that you can get with very little effort or inconvenience should be looked at as a mile and point worth having.

I am not saying to spend 20 minutes of your time for 500 Hilton points just like I am not saying to spend 20 minutes of your time to get $1. The best way to approach the earning of miles and points is to view them as currency. What would you do for $10? Would you take 1 or 2 minutes of your time to pick up a spare $10? Then take a moment or two for an opportunity to earn 500 Starpoints, which is worth about $10.

When To Ignore The Little Points

On the flip side, I recently received a request to do a survey and earn 400 Jetblue points, which are worth about $6. If it took me less than 4 minutes to complete, I would have done it. Note: If I was saving for a particular use, I may have allowed for more time to complete. After going through the whole sign-up process, I was informed that it would take 20 minutes to complete the survey! I do not value $6 worth of points that highly that I would give 20 minutes of my time. If it was a cash payout, that would be making $18 per hour for a survey.

Little Points Add Up

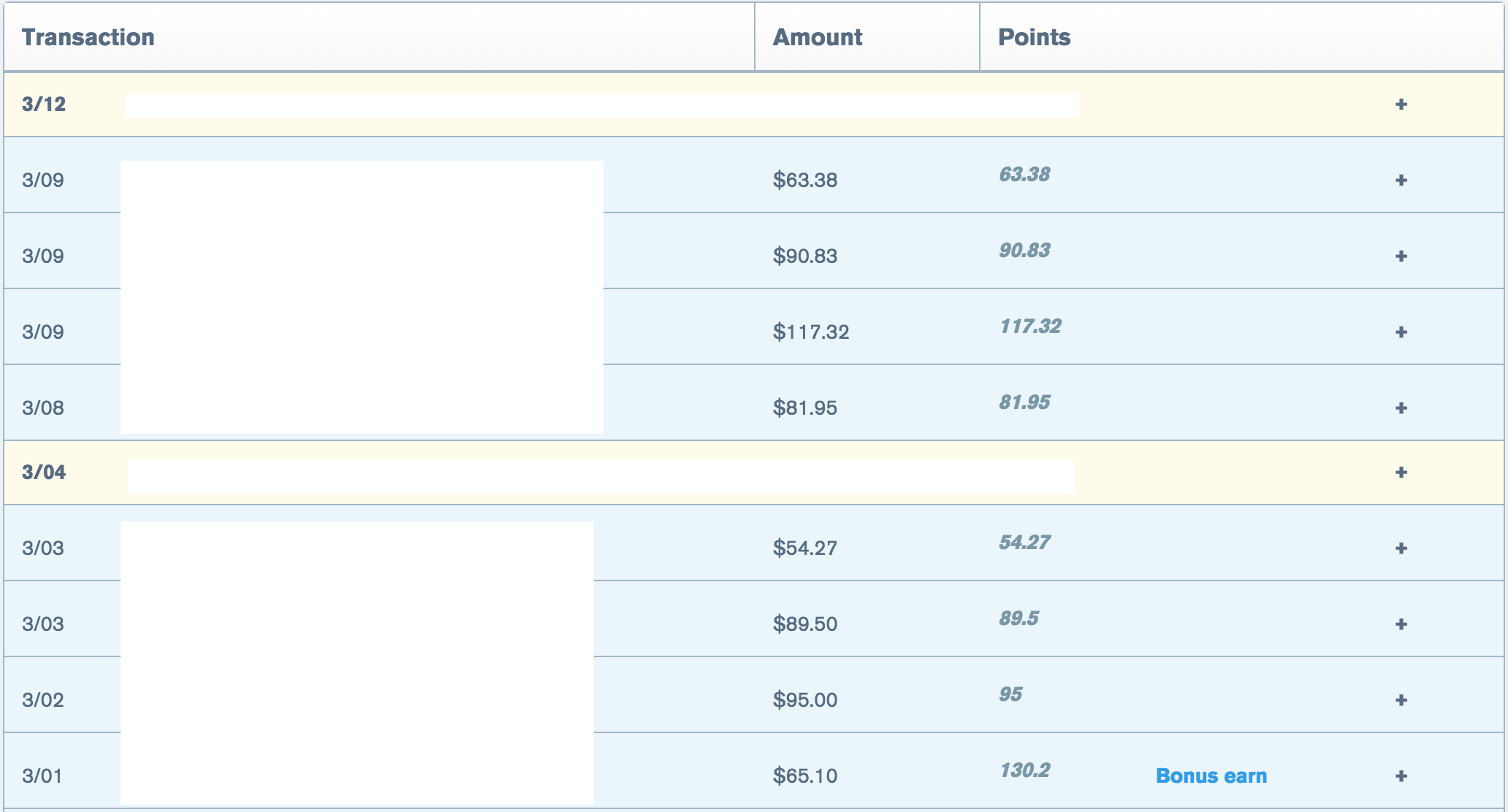

Some people ask me why I bother using a credit card to earn points when that piece of pizza I just bought for $2 is only going to give me 4 points (when purchased using my Chase Sapphire Preferred card). Why not just use cash? Honestly, what is 4 miserable points going to give me?! 🙂

The truth is that they add up. If you put between $1,000 – $2,000 on a credit card each month, that totals a minimum of 12,000 – 24,000 miles/points in a year. If it is on a mileage earning card, that is just about enough to let you fly anywhere in the continental US for free. How many of the transactions that make up that amount are little ones? Not all of our credit card purchases are triple digit amounts!

It constantly is adding up. You would be completely surprised how fast those seemingly little point accruals amass into something usable!

Hit The Portals

Let’s say that you were going to shop at a department store. Instead of going into the store to make your purchases, go through a mileage/point earning portal to earn more for that purchase! What may have been a simple $30 purchase (and therefore a 30 point accrual) may turn into a 300 point purchase if the portal payout is high enough!

In fact, once you get near the holiday shopping season, the portal payouts become very lucrative! Do not forsake the portals because it may seem like you are only going to get another point or two per dollar for your purchase. Those points add up and you should maximize every opportunity you can to earn them!

Those Little Points Could Be Worth A Lot

Let’s say that you are earning into a particular point program – let’s say SPG’s Starpoints. Those points are worth at least 2 cents a piece and are very valuable given their extreme flexibility. Well, you have about 23,000 and you were going to redeem for the Liberty Hotel in Boston for the marathon.

Oops, news came out about the category increases and that hotel was going to go from requiring 12,000-16,000 points per night to 20,000 – 25,000 points per night! Your credit card statement has already closed for this month and you are about 700 points shy of the points you would need to redeem at the current level for 2 nights. What do you do?

Since American Express pays out the points a few days after a statement has closed (from earning the prior month), you have no shot at earning more points by credit card spending in order to book your rooms at the current rate. There are some options available to you – such as transferring from American Express’ Membership Rewards program – but the transfer ratio is really favored to the value of your MR points. You could purchase the points you need, but it will cost you $35 for 1,000 points to top off to the amount you need. In this scenario, that may be your best bet but it is no longer “free” travel!

Instead, let’s break down that necessary 700 points over the course of a year. It breaks down to only $13.50 in spending per week. That means that the piece of pizza you used cash for, the coffee you used cash for, the lunch at McDonalds you paid for with cash – all of these things could have added up over the course of a year to total the 700 points you needed when it came right down to it (by the way, those things are not part of my normal diet for sure!). Those “little” purchases could have earned you the points you needed and saved you the $35.

Takeaway

If you can reasonably and responsibly keep track of it, put all your spending on credit cards! It will end up adding up to that free trip much faster than you would have originally thought if you do! Also, shop through mileage/point portals to further maximize your earning! You will be thankful you did when the time comes for the redemption.

Go ahead and look in your AwardWallet account right now and notice how many of your accounts are just a small amount of miles/points from the round numbers necessary to redeem for travel. You may be surprised and, hopefully, it will encourage you to nickel and dime your way even more for free travel!