The best offer around for earning Ultimate Reward points via a credit card bonus is the Chase Ink Plus which has been at 60,000 points for a few weeks. Today is the last day to receive that increased bonus (up from the normal 50,000 point offer). If you have forgotten about it or put it off, today is the day to take advantage of it!

The Chase Ink Plus Offer

Last day to get the 60,000 point Chase Ink offer

– chase ink plus application link

Today is the last day to receive 60,000 Ultimate Reward points after spending $5,000 in 3 months. The card comes with an annual fee of $95 if you apply online. This offer may continue through branches after today and, if it does, it normally is presented as having the fee waived the first year.

Chase Ink Plus Details

- 5x points per dollar spent at office supply stores, and cable, internet, landline, and wireless bills (up to the first $50,000 per year)

- 2x points per dollar spent on gas and hotel accommodations (up to the first $50,000 per year)

- 1 point per dollar spent on everything else with no limit on the points that can be earned

- The annual fee ($95) is not waived for the first year (unless you apply at a Chase branch)

- Ability to add employee cards with different numbers to protect the account and provide for easy sorting of transactions

- No foreign transaction fee (typically 3%)

What Can You Do With 60,000 Ultimate Reward Points?

There are a lot of things you can do with that many points! I will just cover some of them:

- Redeem for $750 in travel – if you want to, you can redeem those points through the Ultimate Rewards mall for travel at hotels, in airplanes, rental cars, and cruises for $750 in straight value

- Redeem for economy to Europe – If you transfer to United (1:1 transfer partner), you can get a round-trip award ticket to Europe in economy.

- Redeem for economy to southern South America – Again, transferring to United will get you enough for a round-trip to southern South America.

- Redeem for economy to the Caribbean or Central America – almost 2 round-trips! – That’s right! 2 roundtrips to those destinations will cost you 70,000 United miles. Once you factor in the minimum spend of $5,000, you will be 5,000 miles away from two tickets.

- Redeem for 13 one-way short-haul trips on US Airways or American Airlines – If you transfer to British Airways, you can redeem your Avios for 4,500 points on one-way short-haul (less than 650 miles) with US Airways or American Airlines. Great value here!

- Redeem for several nights at Hyatt hotels – You can transfer your points to Hyatt (another 1:1 partner) for multiple night stays at various Hyatts – 2 nights at a category 7, 3 nights at a category 5, and 5 nights at a category 3!

Questions About The Offer

What if I already have them? Can I get them again?

The language for the offer says that you are eligible to get the card again if you have not received the bonus in at least 24 months and you do not currently have the card. However, I (and many others) have had success getting the card again if it is applied for under a different business name. If you want to use a different name, you should be ok in getting the bonus a second time (or a third, fourth, etc!).

What do I need to apply for a business card?

The application will ask you for your EIN but you can use your social security number if you do not have an EIN for your business (if you are a DBA or something similar). Many people have gotten approved for all sizes of small businesses – from those who do resale to long-established businesses. If there is something you do on the side that you would like to get a card specifically for that purpose, go ahead and apply. Just be ready to answer some questions on the phone about your current business expenses and income (if you need to call in). I have talked to them before about a new business that I was just starting and honestly told them that I had not made any money yet and envisioned my expenses to be quite low for a while. I was approved.

What if I already received the bonus recently?

If you have applied for one of these cards within the last 90 days, you can message Chase to receive the extra 10,000 points. They are excellent about this!

Getting The Extra 10,000 Ultimate Reward Points If You Already Received 50,000

Fortunately, it is possible to get the bonus if you have recently applied for the Chase Ink Plus! Chase is actually quite generous in allowing customers to be matched to higher bonuses than they applied for – if it is was within the last 90 days. This is not something that is advertised but has been experienced (and enjoyed!) by many cardmembers.

If you have already applied and received your card, all you need to do is secure message Chase to ask to be matched to the current offer of 60,000 points. If you have not yet met your spending requirement, you will need to continue working to meet the $5,000 requirement before all points post. If you have met your spending, you should just receive the points within days after being matched.

What To Do

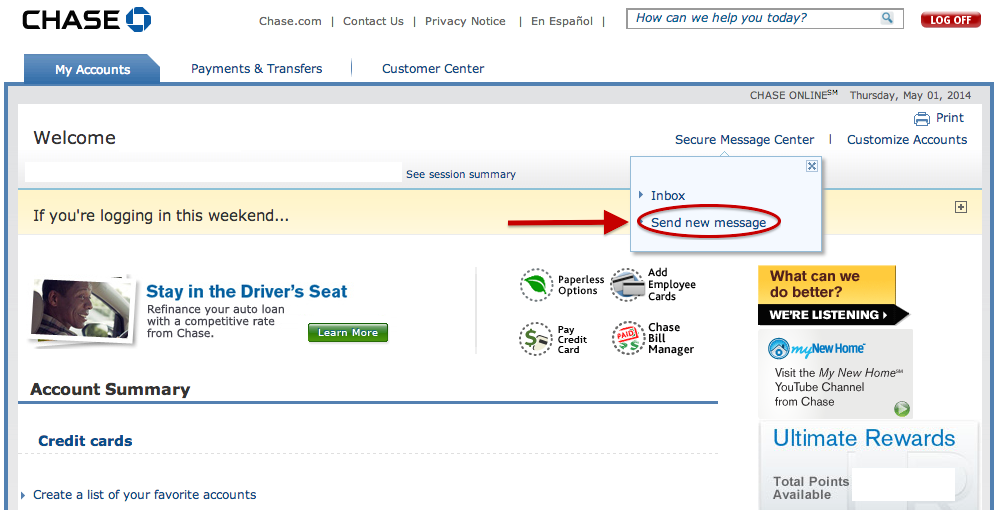

So, how do you go about doing this? Start by logging into your Chase account (the one that is tied to your Chase Ink Bold or Ink Plus card). Once you are logged in, go to the top to send a secure message.

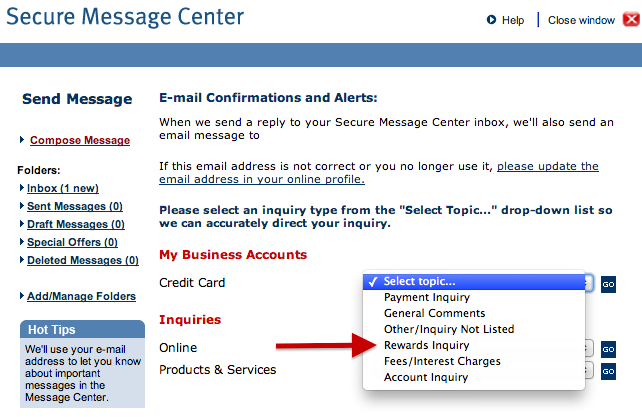

After you select to send a message, a window will pop up that will ask what type of message you want to send and for what account.

Write Chase a message – explain that you opened your Chase Ink card within the last 90 days and you are asking if you could receive the extra 10,000 UR points that matches the current offer for the card that you have. Be polite – don’t demand or be rude! ![]()

Just wait! You should receive a response within 12 hours. Should you receive a denial, just reply and kindly mention that you know that Chase always matches the better offers within 90 days of the application and if there is some reason why they cannot extend that same kindness to you.