Last year, I decided I was going to earn points or cash back where I needed to spend the least to make my travel more affordable. I stopped caring (for the most part) about the “point value,” since I feel it is a skewed way to look at information. Since I have a few trips I am looking to plan, I have become more aggressive in opening cards. I guess I didn’t notice it was all with one bank! While aggressively opening new cards, am I setting myself up for trouble?

Aggressively Opening New Cards, Bad Idea?

My Reasoning

During our move, I was unable to apply for credit cards for a couple of months, During those months, I used about 90% of my points stash. I’m not sitting on a million points, but I was in the six figures of them.

After booking a few trips here and there, it was clear that I was draining them quickly. Once we closed on our home in December, I began opening them again.

Currently, I have a couple of trips I am looking to book:

- Rome and Athens in the Fall

- Columbus, Ohio to see Oklahoma play Ohio State. BOOMER 🙂

- A couple of weekend trips with Kristin

- Trip with a friend.

- And whatever else I impulsively book.

Since I have a hefty travel wish list (well for me at least) for 2017, I wanted to earn the most points. Points that will give me the most travel for the least amount of spend. Notice I didn’t say most value?

My Most Recent Applications:

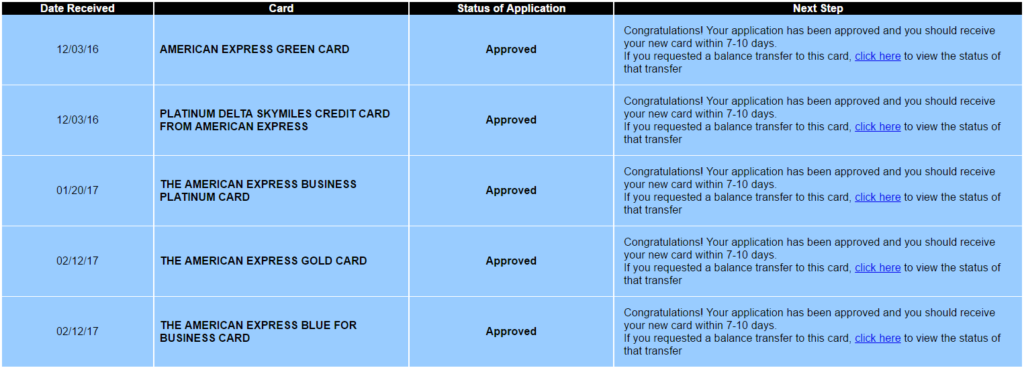

I apparently have been only opening cards from American Express. I like these points, because I am able to get the most from these points. Although, there are plenty of things I’d like to see American Express change, they are still very valuable.

My preference has always been earning flexible bank points like Membership Rewards to specific miles, like American Airlines. Although, airline specific cards have their place, they aren’t great options for everyday earning.

I didn’t realize I had been so aggressive in opening American Express cards! I am currently opening a card on average every 2 weeks! That is more than what I’d ever recommend to someone!

In opening these cards, I have had ZERO issue getting approved though. I haven’t made any phone calls and they all have been instant approvals. While opening all these cards, I have hit 5 credit cards with American Express.

Why did I select these cards?

I have opened quite a few American Express cards over the last couple of years and my list of cards to select are dwindling. It is important to earn the largest sign up bonus with American Express since they are currently “once per lifetime.”

I wrote about why I selected the Delta Platinum and Green card before, so I won’t go into to much detail. The bonuses were the main reason and possibly the companion pass for the Delta Platinum (still on the fence if I’ll renew it).

Maximizing Hard Pulls:

Now, I know I have said it in the past, but I think it is important to maximize bonus offerings while having lowest amount of hard pulls.

American Express will combine your hard pulls when you apply for cards the same day. They will also allow you to be approved for 1 credit card and 1 charge card in the same day. You have nothing to lose by doing this, just make sure you can meet the minimum spending requirement!

If you are looking for cards that do not have an impact on acquiring Chase cards, American Express Business cards are not reported to them.

In total, I received 5 cards for 3 hard pulls.

The Business Platinum:

I had a special offer in my American Express account for 75,000 points after spending $5,000. I felt this was a better option for me, than then 100,000 point offer for $10,000 spend.

Although this came with a hefty $450 annual fee that wasn’t waived the first year, I felt it was worth it for at least year 1.

The driving factor to have this card was the 50% rebate on airfare through the Amex travel portal. Since Delta is my main airline here in Bangor (I’d prefer more competition though!), this allows me to get more from my points.

The benefits of the card, like lounge access, and GoGo WiFi were also a nice addition, but really it was the 50% savings on travel that got me to apply for this card.

I plan to write a full review on the card soon.

I’ve already hit the spending requirement on this card and the bonus posted the next day.

It is interesting that American Express had mentioned 92 days for meeting the requirement. I haven’t seen that before on any of my previous posted bonuses.

Gold Card:

This is not the Premier Gold Card, this is the stripped down down version which has absolutely no use to anyone for daily use.

The first year is waived, then it is $160! That means this card won’t see the 12 month mark in my collection. 🙂

After going into incognito into Google Chrome about 80 to 100 times, I was finally able to make the “Special Offer” of 25,000 points after $1,000 spending appear!

The Gold Card is only valuable for the bonus. When you add in the 50% rebate with my Business Platinum this bonus (to me) is worth a minimum of $375

Blue for Business:

When I was writing my Business card comparison, I actually left his card out! Not sure what I was thinking, but I didn’t realize the potential for this card at the time (a complete oversight!).

The Business Blue card will become my go to for non-bonus spend, once I meet my bonus spends. The bonus itself is easy to earn, but relatively unimpressive.

Reason for this card:

- Bonus of 10,000 points after first purchase. That is worth $150 minimum to me

- 10x on US restaurant purchases over the next 6 months (up to $2,000)

- 2x on the first $50,000 spent in my first year

- 30% bonus on all spending (not points earned).

In year 1, that means I will earn 2.3x on all purchases. If I redeem for Delta flights with my Business Platinum, that is around 3.5% on all non bonus spending. That’s a fantastic return on everyday spending!

Total Points and Potential Value from Bonuses:

- Green Card – 25,000 Membership Reward points

- Delta Plantinum- 70,000 Delta miles + 20,000 miles for referral bonus

- Business Platinum- 75,000 Membership Reward points

- Gold Card- 25,000 Membership Reward points

- Blue for Business- 10,000 Membership Reward points

Total: 135,000 Membership Reward points, 90,000 Delta miles

Value: Delta miles at 1 cent per mile, due to pay with miles option is $900 minimum. The 135,000 Membership Rewards are worth a minimum of $2700, since I will have the 50% rebate.

My minimum estimated miles worth is: $3,600. Add in the total annual fees of $645 and I still have a minimum value of $2955.

Being too Aggressive:

I enjoy opening new credit cards, it’s always exciting to get a new one in the mail. At the rate I am currently going, I am only asking for trouble. I’d never recommend opening new cards at the rate I have been.

I don’t follow the 91 day app-o-rama cycle as some people. Historically, I apply for a card when the bonus is right and I have a need for those points. Cherry picking American Express cards is not a smart idea and frankly if I had realized it, I wouldn’t have done it.

Since I do not MS, I am not overly concerned about a financial review from American Express, or worried about my points being frozen. If they were to look, they’d probably be very bored. By opening so many cards in a short amount of time, I could have drawn flags to myself and could put myself in that situation.

I’ve always thought being too aggressive is never a good thing, so I will be cutting back on my applications for a bit. I’m actually quite surprised that American Express has allowed me to open so many cards in a short period of time.

When I do decide to open a new card probably 5-6 months from now, having taken advantage of American Express for combing hard pulls will be beneficial. When I do decide on a new card, months from now, it will not be an American Express card!

Conclusion:

Overall, I am quite happy with my recent haul of points. I am pleasantly surprised that American Express has allowed so many cards so quickly, including hitting the 5 credit card limit with no phone call.

This doesn’t mean that it was smart of me to open so many cards by one bank! I guess I didn’t realize how aggressive I had been over the last 2 months, but I think having a great history with American Express helped.

I’m hoping I didn’t set off any red flags for that coveted financial review!

How aggressive are you in opening credit cards? Do you think I am asking for trouble?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

I worry about the same issue. It would be very easy and very logical for an issuer to decide to review their files to identify serial churners and then to blacklist those customers or worse (try to claw back bonuses).

Hey TCW,

I think banks have been trying to limit serial churners with more restrictive language. Such as one bonus per lifetime, with Amex.

I think we are following their rules as far as opening cards and earning bonuses. Opening many can definitely bring unwanted attention though! I’m hoping to avoid that 🙂

Thanks for reading!

Dustin

My wife and I have recently done one Amex card after another because the bonuses were about the best we have seen for Amex once in a lifetime rule and we are both locked out from Chase cards by their 5 in 24 months curse. Each pooling MR points for the Business Platinum 50% off discount is very attractive as is the easy approval with Amex . I was going to try one more but now I will heed your advise and go to another bank for 6 months min.

Hey Larry!

That 50% rebate is very enticing! There are so many banks out there, so spread the love around :-). I do love Me points though!

Thanks for reading!

Dustin

You would think if they (Amex or whoever) had a concern they wouldn’t have approved them all. Or do I give them too much credit?

Hey Carl,

You would think they’d be up on their game. Something tells me that they look randomly (?) At accounts especially if something is out of the norm. Time will tell :-).

Thanks for reading!

Dustin

You do realize that financial reviews and frozen points don’t just happen to churners or MSers, right? There are numerous reports on FT of frozen points and FRs on accounts that have no “churner” type activity. It can just be atypical behavior that catches their eye. Be careful, man.

Hey Beck,

Thanks! I’ll try to be careful. Anything that draws extra unwanted attention is probably not a good thing. Even if I don’t MS or pay my bills on time. If something does happen, I’ll be sure to let you guys know about it!

Thanks for reading!

Dustin

Hello, My name is David and I have a scenario that I’d appreciate your advice on, as I don’t trust a lot of the other sites out there.

I have an equi# at 767 and a TRANS# at 773.

I’d like to put $ 2200est. a month on the card, and will pay it off each month.

utilities $460, cell/internet/cable $282, Gas $300, grocery (target) $490, entertainment eating out 660

The kicker is this: we take an annual trip to walt disney world each year (jan or Feb). We rent a vehicle $990 (this year with insurance), and our meals $5040, room is paid and no balance owed on Disney Vacation Club( paid it off and never carried interest etc.), entertainment $750

We budget $565 per month for this trip annually.

Our kids are getting a bit older ( 4&6) so we would like to begin incorporating weekend getaways for my wife and I( 2 flights a year, domestic), a flight for my parents to MCO annually but still rent the van for the disney trip above, and a flight for the 4 of us(my family) abroad 1x every 2 years.

Is there a card, or an array of cards that we could begin utilizing to start gaining rewards for expenditures per month, or the Disney expense, or the desire to incorporate more flights into the equation?

Each calculator that I’ve seen doesn’t take into account the disney trip and how we’ve been budgeting it as per month, but not gaining any CC reward.

Also, we have a Discover card that we don’t use or utilize and carries no balance.

Also utilize RDU and Delta airlines most frequently.

I know you meant this for Dustin, but do I read that as $5,040 for vacation meals? How much of the van is insurance? A card that includes primary insurance can do away with that cost. Keep that percent utilization low to keep your credit score.

The $ value on the van, although full coverage is minimal compared to the price of the van

Rental.

Hey David,

I have sent you email to follow up with you :-).

Thanks for reading!

Dustin

This is a great post. I worried about not getting approved for Amex cards after I closed 3 cards days apart. But got approved for a personal platinum and the everyday card. Yaay.

I’ll also apply later in the year for Business Platinum. Even if I can’t the minimum spend, at least i can get 50% of my redeemed points. Planning to redeem a few hundred k.

Hey P,

That’s great! Enjoy those MR points!

That 50% rebate is definitely huge IMO.

Thanks for reading!

Dustin