Recently, the public offer on the Citi Premier card lost the bonus points. While it is a strong card for earning potential, there are only a couple of cards that I would suggest to get without a bonus – and the Citi Premier card is not one of them.

The Citi Premier 40,000 Point Offer

Fortunately, there is still a Citi Premier 40,000 point link. All the card issuers have had these ghost links that hang around after a bonus ends but most of them have really cleaned that up (especially Amex). Thankfully, Citi has not quite done that as well so we do have a Citi Premier 40,000 point link available.

The best public bonus on this has been 50,000 points, as recently as February. Then it dropped to 40,000 points before disappearing on the public scene altogether. This card link does have the new language in it regarding the 24 month waiting period between opening/closing the card to get the bonus, so do make not of that.

– Citi Premier 40,000 Point Link

The Citi Premier has this on the card and offer:

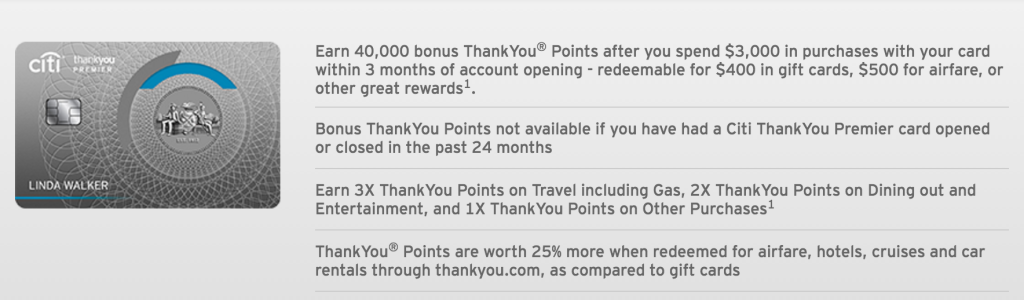

- Earn 40,000 bonus ThankYou® Points after you spend $3,000 in purchases with your card within 3 months of account opening – redeemable for $400 in gift cards, $500 for airfare, or other great rewards1.

- Bonus ThankYou Points not available if you have had a Citi ThankYou Premier card opened or closed in the past 24 months

- Earn 3X ThankYou Points on Travel including Gas,

- 2X ThankYou Points on Dining out and Entertainment

- 1X ThankYou Points on Other Purchases1

- ThankYou® Points are worth 25% more when redeemed for airfare, hotels, cruises and car rentals through thankyou.com, as compared to gift cards

- Enjoy no foreign transaction fees on purchases1

- Annual Fee $95 waived the first year

To see how this card stacks up, check out the card battle between the Citi Premier and the Amex SPG card. Also, check out this card review of the Citi Premier.

Using The Points

If you use these points for travel, you will get 1.25 cents per point in value when going through the ThankYou Travel Center. If you want to transfer them to a travel program, here are their partners:

- Hilton – 1,500:1,000

- Asia Miles (Cathay Pacific) – 1,000:1,000

- EVA Air Infinity- 1,000:1,000

- Etihad Guest – 1,000:1,000

- Flying Blue (Air France/KLM) – 1,000:1,000

- Garuda Indonesia – 1,000:1,000

- Malaysia Airlines Enrich – 1,000:1,000

- Qantas – 1,000:1,000

- Qatar Airways – 1,000:1,000

- Singapore Airlines KrisFlyer – 1,000:1,000

- Thai Airways Royal Orchid – 1,000:1,000

- Virgin America Elevate – 500:1,000

- Virgin Atlantic Flying Club – 1,000:1,000

Summary

This is a great card and one with very strong earning potential. If you get it, you can earn 3X points on all kinds of travel, even gas! When it comes to redeeming those points, they do not have the same partners as Chase or Amex but they do have some interesting ones. If the partners do not interest you, you can always use the points directly for travel at a rate of 1.25 cents per point. No matter how you look at it, it is a great card.