We are at a travel standstill pretty much around the world. While it will get better eventually, many people are still not ready to think about traveling just yet given the uncertainty. Which makes the timing for the early adopters of the US Bank Altitude Reserve difficult – for both customer and bank.

US Bank Altitude Reserve – Keep or Cancel with Current Travel Issues?

Link: US Bank Altitude Reserve

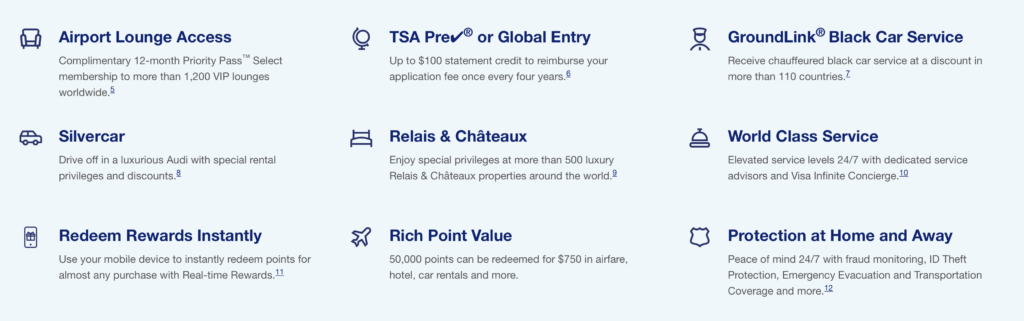

The US Bank Altitude Reserve is one of the cheapest premium travel cards with an annual fee of $400. It is also the premium travel card with the least out-of-pocket for the annual fee since it comes with an annual travel credit of $325. While not as easy to use as the Chase Sapphire Reserve credit, it is infinitely easier to use than the American Express Platinum travel reimbursement.

This card was first rolled out 3 years ago this coming month. Many people applied for it on day one, or at least in the first week (that was including me). It did require that you had an existing relationship with US Bank (having another US Bank credit card worked) so it didn’t have a huge mass of applicants but many of us travel award nerds did jump on it.

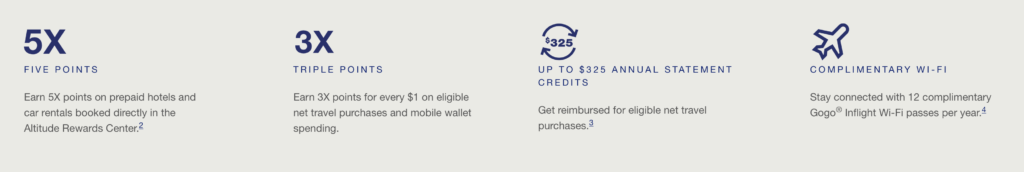

While there are no transfer partners for Altitude Reserve points, you can redeem them for travel at a rate of 1.5 cents per point. Over the years, they have made it easier than ever to redeem with instant notifications coming to you on such a purchase that will let you use points to cover a purchase with just texting back an affirmative answer.

It also has a nice earning niche where you earn 3 points per dollar on all digital wallet spending (like Apple Pay or Samsung Pay). This means that if you use this card for just digital payments and redeem for travel, you are getting a return of 4.5% on your spending. Not bad!

Keep, Cancel, or Downgrade – the US Bank Altitude Reserve

But, will this card be one that survives in many early adopters wallets after the next couple of weeks? Sure, there will still be travel but will customers feel good about paying an annual fee of $400 next month for the $325 travel credit that may take a while use? If you have to work to make that travel credit work for you, this is not the card for you. So, will you need to work at it?

There are likely many, many people that will face that annual fee next month. What will US Bank do about this? I would bet that they will offer some nice retention bonuses to keep customers, but they better not tie those bonuses to a lot of spending as people are not doing a lot of spending right now.

Keep – with retention offer

So, what are your options? Even if you plan to keep it, you should definitely still give them a call to talk about the annual fee. This is an unprecedented time in the world and having that travel and economic uncertainty is reason enough to ask for some kind of retention bonus. Last year, there were data points of them giving 10,000 points (worth $150 towards travel) for keeping the card. I would guess you can get much more this year.

Downgrade – may be possible

If you want to keep the credit line and the relationship with US Bank, you could always inquire about downgrading. According to some (like DoC in this post), US Bank does not offer a downgrade path for the Altitude Reserve. However, there could be such a path now but not to a co-branded card. It is likely that they may allow a downgrade now to keep you as a customer. Banks will be hurting for customers in the near future so it may be worth while to them to keep you. The US Bank Cash+ may be an option and it has no annual fee.

Cancel – don’t lean on the travel credit

Canceling the card could end up being where you head with this card. If you feel that you will not get the value out of it this year and you have another premium travel card (like the Chase Sapphire Reserve) that offers things like lounge access, you may feel it is time to let it go. Do not just keep the card for its travel credit. By canceling it, you will actually end up $75 in the black over paying the annual fee and using the travel credit. If the card does not make sense for your future travel habits, cancel it.

Just remember that you do get 30 days from the time the annual fee posts to cancel the card and get it back.

Bottom Line

There is going to be a bit of a cancelation rush on premium travel cards this year. On one side, the traveling customer is going to try and be careful with their travel strategy in the year to come and paying around 1/2 a thousand dollars may not fit in that strategy. On the bank side, they are going to be desperate for business so we may see some very good retention bonuses. Who knows – we may even see the Chase 5/24 and Amex once-per-lifetime rules relax this year!

What will you do with the US Bank Altitude Reserve this year?

No way! The world is moving to moving to mobile payments, and this card offers 3x on nearly every brick and mortar purchase. Even gas stations are putting in mobile readers. I’m keeping mine. The travel credit is a cinch to use.

Good to hear! The card has definitely improved since it was first offered, especially in regards to redeeming the points for travel!