I wrote before about how United was complaining/frustrated that they thought Chase was taking away their customers on their co-branded cards because Chase cards were just too good. Or maybe it is that United cards are really not good, hmm?

United Should Bring This Old Perk to Their Credit Card to Earn Loyal Customers

Apparently, it is a foreign concept to United that a loyalty program should do something to earn that loyalty. Check out this post from Ed at Pizza in Motion – a Premier 1K United customer – to see an example of this from the airline loyalty side.

With airlines earning so much money from actual credit card customers now (to the point that it rivals flying customers), United needs to do something to earn the loyalty there as well instead of blaming Chase for customers wanting to use the inferior Chase cards over the co-branded Chase/United cards.

So, go ahead and read that post to get more of the context about this whole situation.

A Perk That Could Help United

The Current Perk’s on the United Club Card Don’t Inspire

So, since United was talking about the Chase Sapphire Reserve, we will look at its “competitor” on the United side (not fair to even call it that as it doesn’t even compete at all, really). That is the $450 United Club card.

I have maintained before that this card is a good card for a frequent United flyer since it gives them United Club membership. The problem is that some of the other benefits are ones that someone that actually was flying United enough to get value out of the club likely already has through elite status.

That is referring to the priority access you gain with the card (United elites already have that) as well as the close-in booking fee on awards (Silvers pay $50, Golds pay $25 and Platinum and 1K members pay nothing) which is normally $75 for non-elite customers.

The elite benefit that Chase United Club cardholders currently get

So, the card isn’t that great of a value for someone who flies United like 12 times a year because the card’s club membership isn’t really paying for itself quite yet, given how easy it is to get Club passes.

The Ability to Earn Flex Elite Miles = Spending More

The real perk that would actually benefit elite members is one that existed on the now-discontinued (as in no longer issued) Continental Presidential Plus card. That was the ability to earn Flex EQMs (elite miles) with spending. This is nothing novel as both Delta and American already have this for some of their credit cards.

How the Flex Elite Miles Benefit Worked

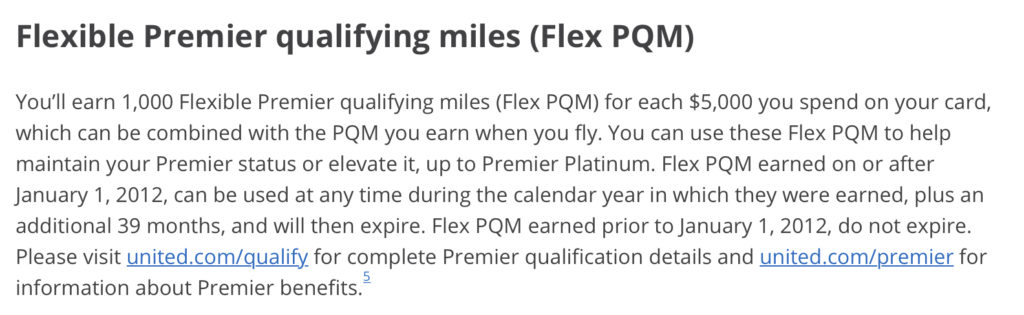

In the old days, you would earn 1,000 elite miles for every $5,000 in spending. I actually liked that system because it gave you the ability to hit that threshold in smaller increments than AA (like 10K with $40K in spend on one card) and Delta (like 15K with $30K spend on one card). If you were using the United Club card to hit the elite spending waiver (you have to spend $25,000 in a calendar year to avoid having to spend a certain amount on tickets for elite status), that would give you 5,000 elite miles.

Here Is How this Perk Works on Grandfathers Cards

This card is still out there, but you can no longer apply for it.

This Would Reward the Loyalty United Thinks It Deserves Now

I think this would be a fantastic way to encourage more spending on that United card by elite members. Also, it doesn’t really cost United that much in the long end anyway since not that many people are using the card for spending anyway. Also, you were not able to use those elite miles earned by spending to reach Premier 1K status either so they could still protect their top tier status.

For me, I think one of my favorite parts about the perk (pre-2012) was that these were flexible elite miles. You could assign them to any year you wanted – as in the year you are in or the next year. Or, you could just sit on them until you need them! Check out how long I have had mine!

Summary

Do I think United will bring back this great perk from the old Continental days? Probably not. But, this kind of perk is exactly what the United Club card needs to gain loyalty in the wallet for spending. With something like this, United wouldn’t need to beg the bank or customers to use their card, they would just be rewarding the loyalty they are demanding.

You’re completely right. That said, Scott Kirby has zero interest in providing value to either flyers or cardholders. For him, loyalty should strictly be given -to- United, not the reverse.

[…] United Should Bring This “Old” Perk to Their Credit Card to Earn Loyal Customers by Running With Miles. […]