It seems that every credit card issuer has a couple of different bonuses one the same exact card – at least a couple! With the basic Citi Hilton HHonors card, that is the case as well.

I use the word basic in the sense that this card carries no annual fee and is not marketed as one of the premium hotel cards as with other cards. Not only that, but it does not come with an anniversary bonus. However, the bonus it offers is not basic at all!

Two Great Offers For The Citi Hilton HHonors Card

Disclaimer: I do not receive a commission for any links in this post

The Citi Hilton HHonors Visa Signature card offers several different items for cardholders and these offerings are the same regardless of the offer you choose:

- 6x Hilton points for every $1 spent at Hilton properties

- 3x Hilton points for every $1 spent at supermarkets, drugstores, and gas stations

- 2x Hilton points for every $1 spent everywhere else

- Hilton HHonors Silver status as long as you hold the card (while not worth much, some status is better than no status – especially free)

- Fast Track to Hilton Gold – complete 4 stays at Hiltons within the first 90 days of holding the card or spend $20,000 in a calendar year

- No annual fee

60,000 Point Offer

– Citi Hilton HHonors 60,000 Point Link (must spend $1,000 in 4 months)

What would likely be the top choice for most people, the Citi Hilton HHonors card has a promo going from now through April 30th and is offer 10,000 more Hilton points than normal – for a total of 60,000 points! I saw this offer mentioned over at Doctor of Credit.

While 60,000 points does not get you what it used to, for a card with no annual fee and a very small spend ($1,000 in the first 4 months), this should be a no-brainer for the person who likes free hotel stays. Citi is quite generous when it comes to bonuses on their cards for repeat customers (many people getting this same card over and over for the 50,000 point bonus) so it is fairly east to rack up some Hilton points with no annual fee.

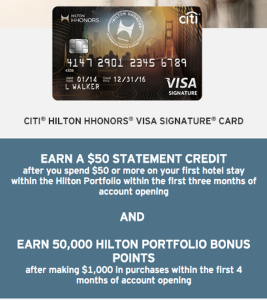

50,000 Point Offer + $50 Statement Credit

– Citi Hilton HHonors 50,000 Point and $50 Statement Credit Link (must spend $1,000 in 4 months)

While most people would probably opt for the 60,000 point offer above, there may be some people that would look at the $50 statement credit as worth more. Now, this statement credit only kicks in when you complete a stay at Hilton and charge more than $50 to this card. While that may sound like a dealbreaker, if you are staying in Hilton hotels anyway, this is a nice way to get some money back.

It could also be helpful if you stay in cheaper Hiltons – it may make more sense to pay for a room than redeem for a room. Finally, it could also make sense if you are doing a points and cash mix for a room and want to pay for the cash part with the card. In that way, you may end up getting more value out of the $50 than the 10,000 points from the offer above.

This offer is available on the checkout page. This is the application page for this offer, but it does not mention the statement credit on it. You should get it since it came right from the landing page. But, if you want to be safe, go through the booking process (you will not have to reserve a room to get the offer) and follow the clicks there. This offer only appears when you click on the link for the Citi Hilton Reserve during the room reservation. Once there, you can select the Citi Hilton Visa Signature card.

Summary

Which offer is better? Both are strong offers for a card with no annual fee and I think more people would opt for the offer with additional points over the offer for the statement credit. But, there may be some that would find more value in the statement credit offer. The best part is that you can select whichever works best for your particular situation!

@Charles

i was recently approved for the 40k offer.

think citi upgrade me to the 60k?

thanks

Citi is not normally that good about matching offers. Unfortunately, the terms do state that it must be 18 months since you applied to get the bonus again. However, people have reported being able to get it again.

Personally, I would give them a call and ask them about matching the offer. Nothing to lose and let them know it is important to you as a card customer.