After the demotion of many SPG cards to the sock drawer, I thought it was time we took a look at a few options to start handling your non-bonus spending. There are plenty of other cards that could contend for your non-bonus spend. So, let’s take a look at some options!

Top Cards For Non-Bonus Spend

While we tend to focus on the 5x or 5% categories of our credit cards, it is important that we find ourselves a card that earns well on the “other” categories.

Not all purchases fall into a bonus category and there should be no reason to earn only 1 point or 1% cash back. You’ll be missing out on a lot of extra rewards.

This list is not in any particular order, it is just a list.

American Express Blue Business Plus

For a points card, this has to rank towards the top for non-bonus spend! It is pretty hard to argue against the earning rates on this card.

This card earns 2 Membership Reward points all on all purchases, up to $50,000 per year. Toss in the American Express offers and you have yourself a top card for your spending. If you can top it out, you’ll earn 100,000 Membership Reward points, which is a lot of travel!

The bonus is a bit underwhelming, but I’d gladly take the 10,000 (or if you can find it, 20,000) Membership Reward points after $3,000 spend.

The fact it has no annual fee and these points can transfer to airlines is a great way to keep your Membership Reward points alive is great.

Alliant Visa Signature:

This is probably the top cash back card for non-bonus spend. Some people might even consider this card if they don’t want to deal with rotating category cards.

If anything were to change with my USAA Limitless, this card would be added to my wallet almost immediately.

Earning 3% cash back on all purchases in your first year is a great return. After your first year, earning 2.5% cash back is the best you’ll find for non bonus spend. An exception I can think of would be if you were receiving the 75% banking bonus from Bank of America.

Probably one of the largest negatives about this card is the fact it has no sign up bonus. But for a solid daily earning, some people might be willing to look beyond the lack of a bonus.

This card does come with a $59 annual fee starting in year 2, so if you don’t spend at least $11,800 on this card in a year, a different card on this list might actually be better for you.

Chase Freedom Unlimited:

For you Ultimate Reward lovers out there, this card should be in your wallet.

The Freedom Unlimited earns a solid 1.5 Ultimate Reward points on all purchases. Which is 50% more points than the uncategorized offering on the other Ultimate Reward cards.

By itself, this card isn’t actually the impressive, because that would equate to 1.5% cash back.

The bonus on this card isn’t huge, but at 15,000 points it is pretty standard for tier of credit card it falls into.

This card only becomes valuable when you stack it with one of the premium Chase cards. Ideally you would stack it with the Chase Sapphire Reserve, so you would redeem for no less than 2.25% on your travel purchases.

If you are new to the credit card game, Chase cards should probably be the bank you focus on first, since their 5/24 rule is pretty rough.

Citi Double Cash:

There should be no reason anyone is earning less than 2% on any purchase. While I have the Alliant Visa Signature card on this list, the Citi Double Cash is on here for the smaller spenders.

If you are spending less than $11,800 per year on categories where you aren’t spending in bonus categories, then the Citi Double Cash is your best option.

While earning higher cash back return on the Alliant Visa Signature card might look better on paper, you’d actually earn less due to the $59 annual fee.

Also, Citi recently increased it’s bonus offer not this credit card. You’ll earn a $150 cash back bonus when you spend $500 in the first 90 day.

American Express Everyday Preferred:

Not everyone is comfortable opening a business card, so this would be another solid option from American Express.

For non-bonus spend, once you hit the 30 transaction per month requirement you’ll earn 1.5 Membership Reward points on your non-bonus spend. This is a very solid amount of Membership Reward points.

If you were to go incognito you can find higher offers than the public offer. Everyone should be using this method for their sign up bonuses. One negative to this card, is the fact it comes with a $95 annual fee.

Chase World Of Hyatt Credit Card:

This might not be an option for most people, but for some putting your non-bonus spend on a hotel credit card might make sense.

The World of Hyatt card will earn a “free night” at a hotel category 1 through 4 when you spend $15,000 each card member year.

You’ll also earn 15,000 points since you will earn 1 point per dollar. This will be good enough for another category 4 hotel.

This isn’t a bad option, especially if you are a Hyatt fan.

For example:

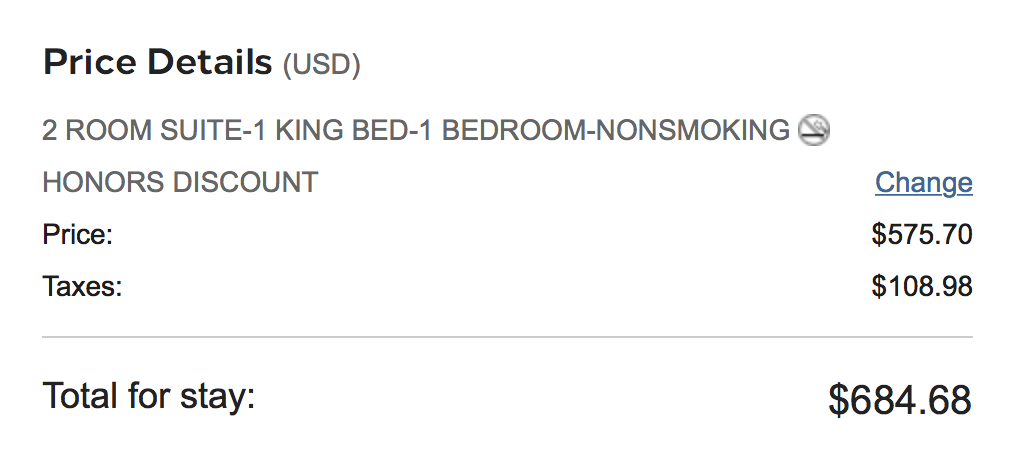

If you stayed at the Hyatt in New Orleans, you would have received 4.4% in value from your spend.

- 667.48/15,000 = 0.044

That is a very sold return on your non-bonus spend! Of course this is just one example, but you can see the potential value here.

Hiltons Ascend:

This follows the same lines as the World of Hyatt credit card. You will receive a free weekend night after you spend $15,000 each card member year.

This card earns 3 points per dollar on non-bonus spend, which will give you an extra 45,000 points.

For example:

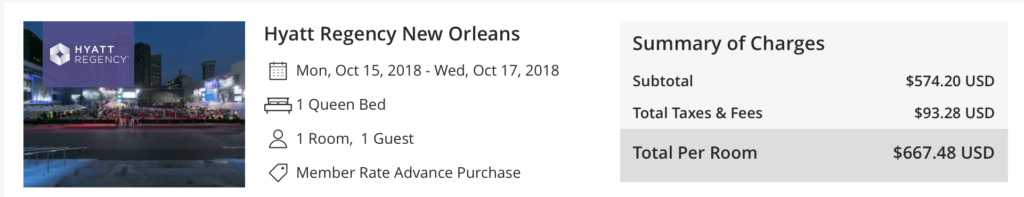

This room is at the Embassy Suite in St Louis and cost 40,000 points per night.

This particular hotel would have yielded a 4.6% return on your spend.

- $684.68/$15,000 = 0.0456

This again is a stellar return on this example.

The amount of rewards return is based on the room cost. But it seems fairly to receive a solid return on your money.

Conclusion:

Finding a card for your non-bonus spend is quite important. These can help you earn cash back, extra points, or even a few free nights at hotels.

These are just a few options that I think are worth a spot in your wallet.

Your Hyatt example isn’t right. The $667 is for two nights. Hyatt doesn’t sell rooms for 7500K/night, so I assume that Hyatt is 15K/night, which means only 2.x%.

Hey A,

Correct, but when you spend $15k on your card for non-bonus. You’ll earn 15k Hyatt points in addition to the category 1-4 certificate (up to 15k). So it would only take $15k in spend to have 2 nights.

Thanks for reading! I appreciate it!

Dustin

If you’re counting the “free night” as really FREE, you shouldn’t, and you should calculate the annual fee of the card-what, $95?- into that calculation.

Oh, nevermind. You get the 15K points for spending, and then the bonus night for 15K spend, and then the “free” night for the annual fee. Almost enough to make me apply, but Hyatts don’t have a big enough footprint.

Yeah, their lack of a larger footprint kills me! I love Hyatt, but they really need to increase their footprint!

Dustin

I guess you could, if you wanted too. But this isn’t the free night benefit you receive when you pay the annual fee on this card. That I would count as the $95 annual fee. This “free night” is a benefit after you spend $15k. You don’t spend it, you don’t get it. But you will still receive 1 “free night” when you pay your $95 annual fee.

And I mean if you really want to get nitty gritty, wouldn’t it be $20 since the other Hyatt card has a $75 fee (if I remember correctly) and comes with a category 1-4? You would be paying $20 for the opportunity to earn a “free night” after spending $15k?

Dustin