The Apple Card opened for public applications yesterday and many people jumped on it. It is far from the most exciting card with benefits or rewards but it is Apple’s foray into the financial world and Apple fans like it.

The New Apple Card Will Offer 3% Cash Back with More Merchants

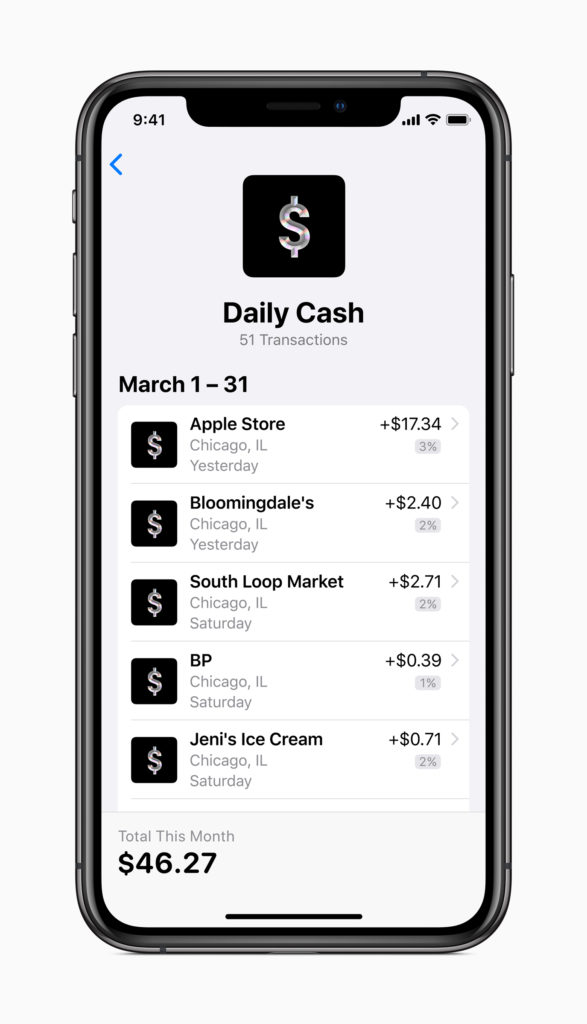

One of its key features is the cash back rewards – 3% when spent on Apple, 2% through Apple Pay, and 1% when using the actual credit card. The unique thing (except for CapitalOne who does this also) is that the rewards are available the next day. No more waiting until after the statement closes.

But, the cash back amount is pretty lame, especially for a giant like Apple which has the negotiating power to do better. As I wrote yesterday, there are other cards that are much better.

Apple Will Add More Merchants and Apps to the 3% Daily Cash Rewards

However, Apple’s announcement yesterday included the news that Uber and Uber Eats will also earn 3% cash back (when using Apple Pay). In addition to that addition, Apple had this to say:

“More Merchants to Offer 3 Percent Daily Cash

Apple Card’s compelling rewards program, Daily Cash, gives back a percentage of every purchase as cash on customers’ Apple Cash card each day. Customers will receive 2 percent Daily Cash every time they use Apple Card with Apple Pay, and 3 percent Daily Cash on all purchases made directly with Apple, including at Apple Stores, apple.com, the App Store, the iTunes Store and for Apple services.

Apple Card is extending 3 percent Daily Cash to more merchants and apps.”

Notice the title and the last sentence – Apple will be offering 3% cash back with more merchants and apps. Uber was just the first and Apple will be using that bargaining power to bring more merchants into the 3% category family.

Does This Make the Apple Card More Valuable?

Depending on the additions, this could definitely increase the value of the Apple Card for some. For instance, in keeping with kind of the “thing” of Apple, I could see them adding some dining merchants (or maybe dining as a whole) as well as subscription services. My guess is that they may even include cellular service in with that 3% eventually as well.

Will this make the Apple Card a card to get? No – not for most of us. Cards like the US Bank Altitude offer 3% on all purchases through Apple Pay (although with a hefty annual fee) so if you are into digital wallets, the US Bank Altitude card is better – especially since you can redeem those points for travel at 1.5 cents per point.

Still, it will increase the Apple Card’s value to those who have it and make it be more of a focus card for certain spending that the typical Apple customer may already be doing. Wallet placement (even digital wallets) is a very lucrative game and card issuers are constantly looking for ways to be at the top of the heap. Is the Apple Card a top dog card? No – but with Apple’s branding and bargaining power, it could become more so over time.

It is interesting to see Apple’s strategy – rather than go all out to lure customers in and then cut benefits over time, Apple is apparently starting low and then adding features as time goes on. Let’s see how that works!