Just the other day, the US dollar and the Euro hit parity for the first time in 20 years. Now, we have a US dollar that is actually stronger than the Euro.

The Dollar is Now STRONGER Than the Euro

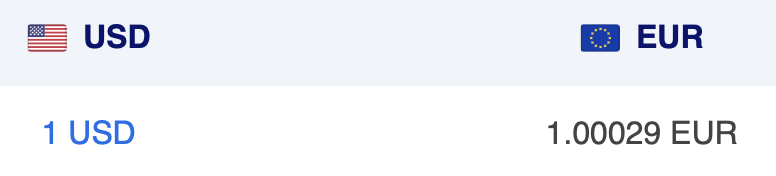

This was taken at the time of this post being written – xe.com

It is currently not by much but $1 is now worth a smidgen more than €1. There is no sign of this halting, either. This means that as Europe continues to fill with American tourists, Americans are going to find that their US dollar is going to go further than it did last month.

However, inflation continues to be a major problem. The stronger dollar means that you will be getting a better deal in Europe than you would have before but things may still cost a bit more than they did last summer (even though last summer it was €1 = $1.21).

If you booked any reservation where you were already charged, this is a great time to cancel that reservation and rebook – if you are able and if the price has stayed the same. One instance is something like paying points and cash with Hyatt. If the cash component part has stayed the same, you could rebook and save a bit if it has been more than a month since you booked.

As someone who is able to take advantage of this stronger dollar, I am pretty excited about it! It makes the cost of gas in Greece about $8.75 a gallon when it was just $10.10 a gallon early last month!

If you want to stay up to date, head over to XE.com and put in an alert for a certain conversion rate. Remember that they are using mid-market rates for their conversion rates.

By the way, if you wanted to get a long-term resident permit/visa in some European countries (called a “Golden Visa”) and you have the money to swing that, this could be a great time to start looking. For Greece, it is a property investment of €250,000 and it gets you a 10 year Golden Visa.

While certain property values in the cities have gone up, there are plenty of properties in more rural areas, on islands, or in the north have really come down so you could get a property on the cheap (from what it was 2 years ago). People from Qatar, UAE, and China have really been taking advantage of this so the time to lock in a good deal on property could be sooner rather than later.

Fun fact – the last timeframe that the US dollar was stronger than Euro, the Euro had just started being use beyond electronic means and it was only then becoming mandatory for countries using it to convert the currency to it.

What’s missing here is that inflation in Europe is also crazy high so compared to a year ago you are actually worse off, even with the parity. Drinks, coffee, taxi and hotels are up by 20% or more across most tourist spots in Europe. We were there in June and can attest.

I currently live here and can tell you that there are plenty of things that are cheaper than they were last year. I mentioned the inflation (currently over 12% in Greece) but the Euro last year to the dollar was $1.21 to €1 so this really balances a lot of things out. In some places, it puts things even with last year or even a little better.

Also, many tourist hotspots like Southern Europe have had some really good deals for tourists this year to draw them back so this helps as well.

But, you are absolutely right that the inflation is a problem for sure.