Yesterday, there was an update made to the SPG airline transfer program with the addition of Korean Air. That has added yet another airline to the list of 1:1 transfer partners that SPG has. While not the most exciting addition, it may have prompted some people’s curiosity over whether they should use this transfer opportunity for Skyteam redemptions.

The problem is that, while additional flexibility is nice, it is not big news since Korean Air already has a strong transfer partner with Chase’s Ultimate Rewards program. It joins several other airlines that have Ultimate Rewards and SPG as transfer partners. Here is a look at which program you should use to transfer to airlines that these transfer programs have in common. Keep in mind that you can use other programs like Citi’s Thank You program or Amex’s Membership Rewards to transfer to Singapore Airlines or British Airways (not from Citi, though). The point of this is to examine what is best with these programs because of the addition of Korean Air to SPG.

Transfer SPG Starpoints Or Chase Ultimate Rewards To Airlines?

The airlines that these two programs have in common are:

- British Airways [oneworld alliance]

- Korean Air [Skyteam Alliance]

- Singapore Airlines [Star Alliance]

As you can see, the three major alliances are represented between both programs by these airlines that they share. So any of these airlines would make good options for traveling on the various alliances. The question is – should you transfer your SPG Starpoints or Chase Ultimate Reward points to one of those airlines for your redemptions?

The easiest answer is to use whichever program you have more points in. If that is you, use whichever program you have a ton of points in as your transfer partner.

However, that is not going to be most people. So, here are some things to consider before initiating a transfer for the pros and cons of each transfer program.

Chase Ultimate Rewards -> Airlines

Chase points transfer at a ratio of 1:1 in increments of 1,000. To initiate a transfer to an airline, you will need to have those points in an account tied to a Chase Sapphire Preferred, Chase Ink Bold, or Chase Ink Plus.

Multiple Point Earning Cards – Up To 5

That’s right – any of those three cards earn points that can be transferred to an airline. Not only that, but if you have one of them and a Chase Freedom or Chase Ink Cash, you can transfer points earned from those cards to an airline as well. That makes a total of 5 different Chase cards that have the potential to transfer to the partner airlines at 1:1.

Multiple Bonuses

With each of those cards above, you can earn a very healthy sign-up bonus. The minimum card will earn you a 10,000 point bonus (Chase Freedom, but that has a special offer of 20,000 points quite often) with the other cards earning 30,000 points, 40,000 points, and 50,000 points. That allows for a big point balance that can be transferred to airlines!

Bonus Spending Categories

Chase has many bonus categories that can earn extra points on each purchase. If you have a Chase Ink Cash, Ink Bold, or Ink Plus, you will earn 5X points on purchases at office supply stores or on telecommunication bills. Not only that, but you can earn 2X points on gas and hotels with those cards as well.

The Chase Sapphire Preferred will earn you 2X points on travel as well as dining. The Chase Freedom card has rotating categories that earn you 5X points each quarter (up to $1,500 in spending each quarter).

All of that totals a lot of points that can be transferred to airlines or other partners!

Shopping Portal

The Shop through Chase portal can earn even more points on purchases at retailers when you go through the portal first. With nice bumps every so often, this portal gives you the opportunity to earn even more points to transfer.

SPG Starpoints -> Airlines

When it comes to SPG Starpoints for transfer to airlines, it is pretty easy to breakdown the earning potential with their cards.

Multiple Point Earning Cards – 2

There is a personal card and a small business card. Both of them can earn points that can be transferred to an airline.

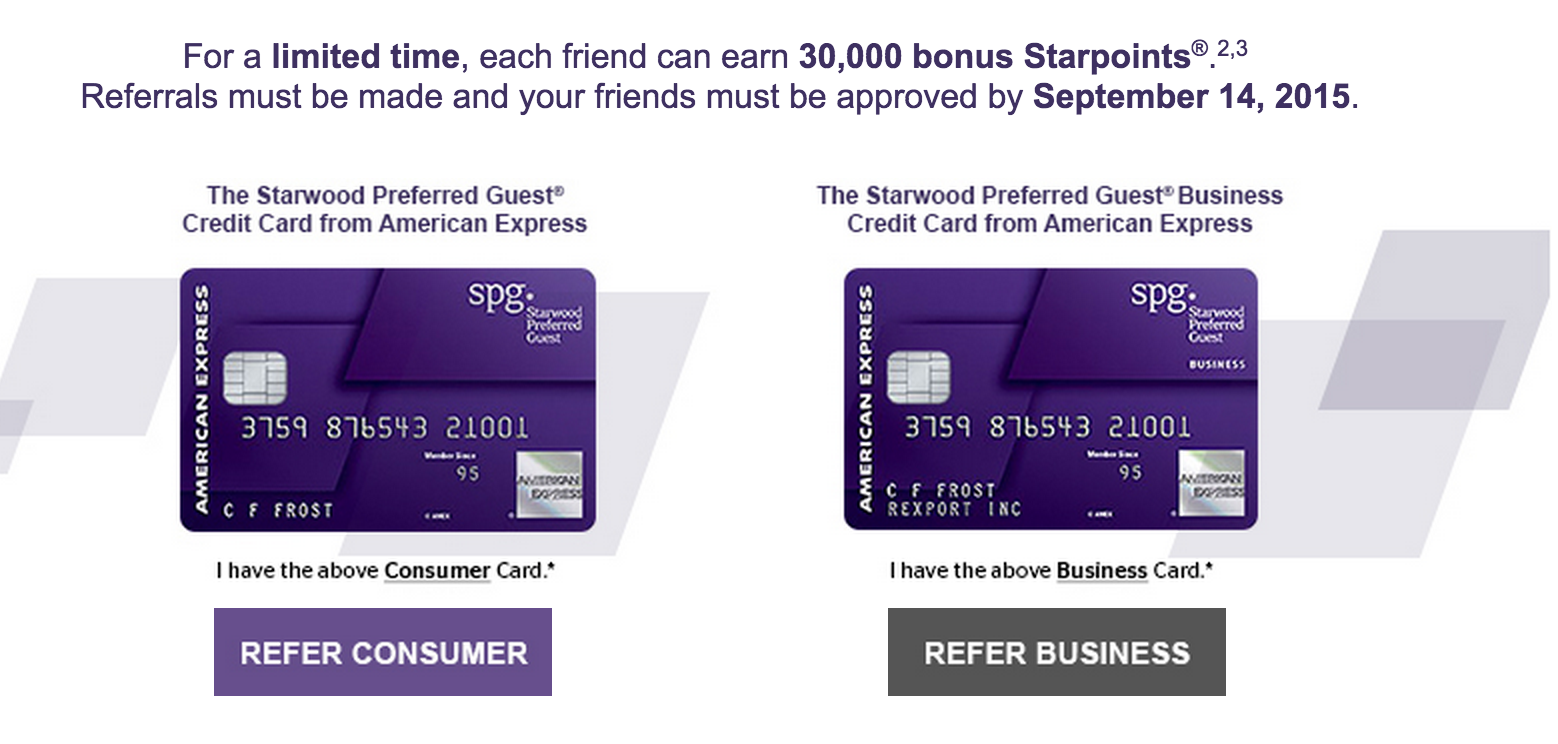

Multiple Bonuses

Sign-up bonuses can be earned on both SPG cards. The downside is that you can only earn the sign-up bonus on the personal SPG card once in a lifetime. So, if you have ever received the card before, forget about getting the bonus now.

The standard offer on both cards is 25,000 Starpoints. There is a bump each year that brings the bonuses up to 30,000 Starpoints (going on now). That is the peak offer and the most you can expect to get.

Bonus Spending Categories

This is easy – there are no bonus earning categories on these cards other than the bonus that is earned with spending at SPG hotels. That’s right, every $1 spent (other than at SPG properties) earns 1 point. Definitely not a way to earn a lot of points!

There is one nice perk that could be counted as bonus earning and that is with the Crossover program with Delta (for elites) that helps you to earn points when you fly with Delta and match your accounts. The same is true for spending with Uber where you can earn bonus points on that spend as well

Transfer Bonus

There is no SPG portal to earn bonus points but they do give bonus miles on the transfer. If you transfer to an airline in a block of 20,000 points, you will pick up a 5,000 mile bonus on the transfer. If you are always transferring in blocks of 20,000 points, that means that you are earning 1.25 miles per dollar. That is certainly a nice perk and bonus to have!

So, Which Program Is Best For The Common Airline Transfers?

Unless you are a major SPG loyalist that stays at a lot of SPG properties and earns a lot of points, transferring SPG points to airlines that are common with the Ultimate Rewards program is not the best choice. Not only is the earning not as plentiful with SPG as it is with the Ultimate Reward earning cards, but the transfer time is not good either. With Chase, the transfers happen immediately. With SPG, they can take up to a week for the transferred points to appear in your mileage account.

Of course, there are other ways to earn those miles with those airlines besides even these two. British Airways has its own credit card for US card applicants and British Airways and Singapore Airlines are also transfer partners of Amex’s Membership Rewards program. Singapore is also a partner of Citi’s Thank You program

To sum up, unless you have a boatload of SPG points and very few Chase Ultimate Reward points, Ultimate Reward points will be the winner for transferring to these shared airlines every time.