A couple of years ago, Kristin and I both received our Chase Ink business cards. I couldn’t pass up the huge bonuses and the fact I’d earn 5x on transactions I was going to make anyway. When I started to dig a little more on how I could save/earn even more with these cards, I stumbled upon Visa SavingsEdge. It was free, could save me more money, and it only took a few minutes to link my business card to it.

Saving More with Your Business Credit Cards with Visa SavingsEdge

What is Visa SavingsEdge:

This program is run by Visa for business owners (or anyone with a qualifying Visa Business Card 🙂 ). You are rewarded when you shop with certain retail stores. When you spend money at the participating retail locations, Visa credits your account in the form of a credit statement. The amount credited is equal to the percentage for that retail location.

What types of cards can you use?

In order to enroll your credit cards, it must be a business card (how sweet would it be to use a personal card though!). The criteria according to Visa is:

- Visa Business credit cards

- Visa Business Platinum credit cards

- Visa Business check cards

- Visa Business Platinum check cards

- Visa Business Signature cards.

These include cards like the Chase Ink Plus, Chase Ink Cash, Capital One Spark cards, and Visa’s that meet the criteria (which seems pretty wide open). You are able to register up to 10 Visa Business Cards to your account.

Statement Credits:

In my experience, the credit usually post 3 to 5 business days after the transaction post and the credit statements do not take away any potential points you earn from the transactions! The discounts even include the taxes and shipping cost (if your transaction had either one). They tell you the percentage you will receive back and I’ve never had an issue with it.

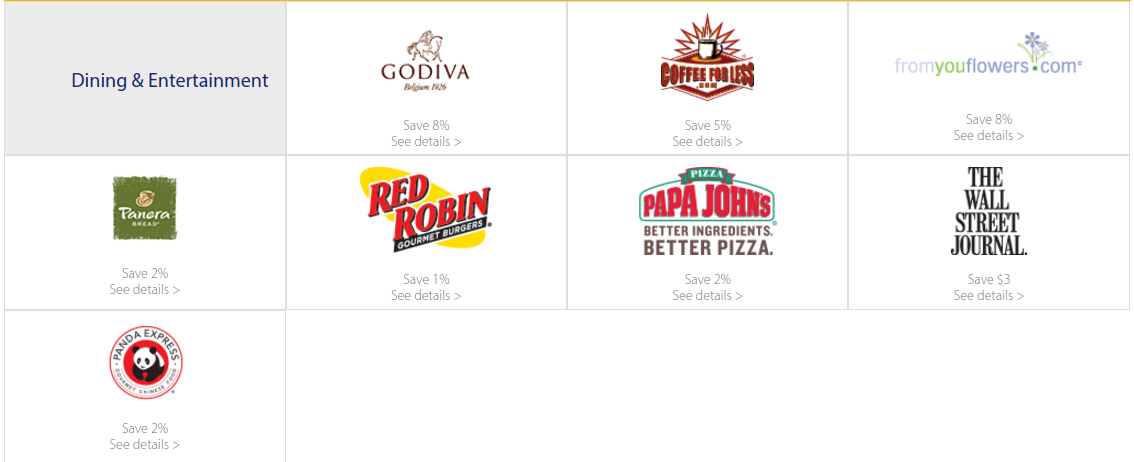

Types of Retail Stores:

Visa SavingsEdge currently has 56 different retailer, which include 29 travel retailers. They do add and remove retailers, so you will want to look at the stores participating.

If you notice, there are car rental companies and many Wyndham hotels on the list. Although some of these aren’t “luxury” hotels, they still can bring about great savings. This will stack with the 2x on hotels with your Ink Plus. There can be even more savings to stack with this, I’ll explain that soon.

Although these might not seem super exciting, I like that Panera Bread is on this list. When I am not earning 5x with my Chase Freedom, I would like to earn 2x Ultimate Reward points plus 2% back with my Chase Ink Cash.

The other interesting retailer on this list is the Wall Street Journal. A couple of weeks ago, they had an increased offer of 1,000 United miles for $1 (this is no longer available). The terms say you will receive $3 credit after first transaction, which should be after the $1 trial period. So, not only should you earn extra miles, when they have this promotion again, you will also pocket $2.

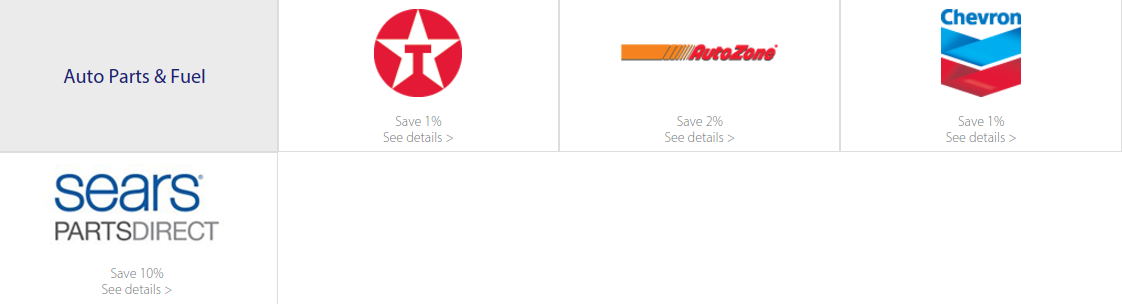

I am always a big fan when I can save more money/ earn more rewards on my gas purchases. It may not seem like a lot, but for business that do a lot of driving, saving 1% on top of earning 2x Ultimate Reward points or 2% cash back can be a nice way to save a little more.

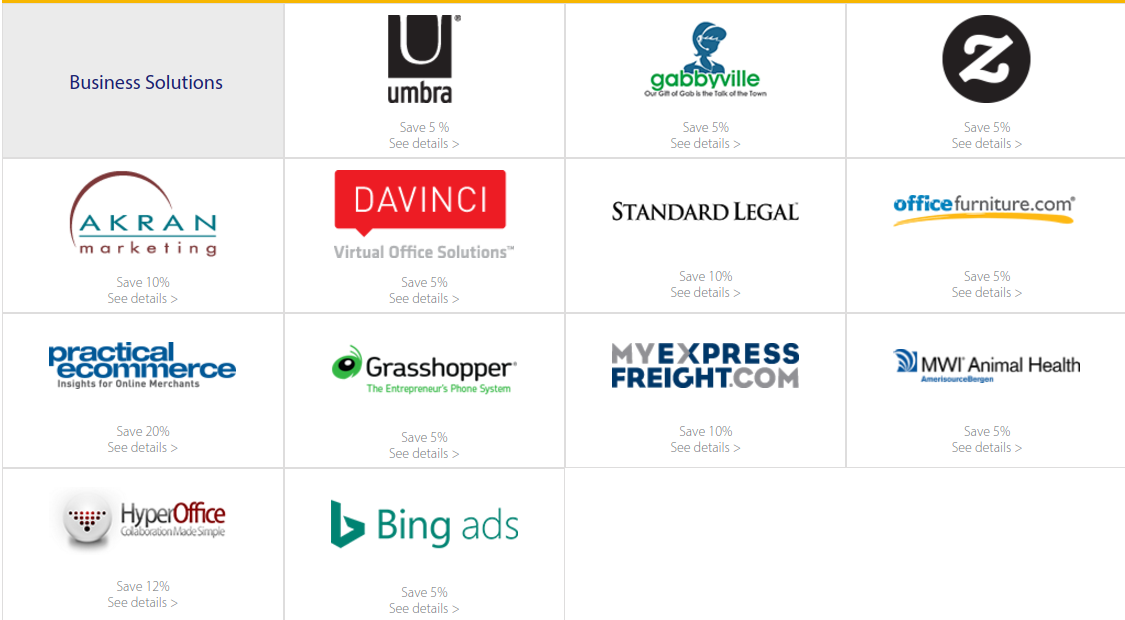

I haven’t used any of these but, anytime you can save 5% or more on business expenses, plus earn points in the process, I’d consider that a great deal.

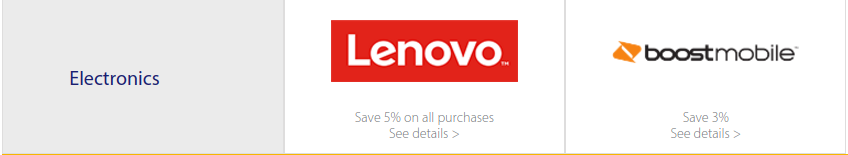

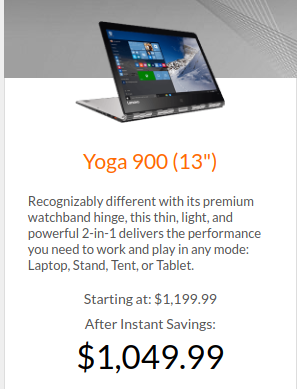

I know plenty of people who like to use Levovo for their computers, and even my employer has Lenovo computers. Saving 5% on your purchase, plus the points you’ll earn, this could be a huge savings for some

Using the App:

The mobile app could use some work. It doesn’t always find my location correctly and even entering the location by zip code, it doesn’t always bring up the right location. The app is a bit slow and not very responsive. If you can deal with that, it can help show you participating stores in your area. I would really like to see Visa improve on this, because this could be a great app.

Ways to Stack Savings:

I am a BIG fan of shopping portals, they are one of the easiest ways to earn extra points just for doing normal shopping.

Utilizing these deals from Visa SavingsEdge can be stacked with shopping portals to earn either more cash back or extra points!

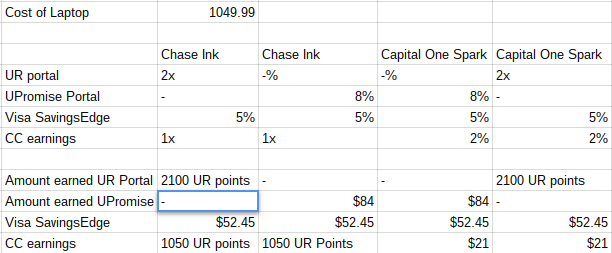

Let’s use Lenovo as an example and we are puchasing a Yoga 900 laptop:

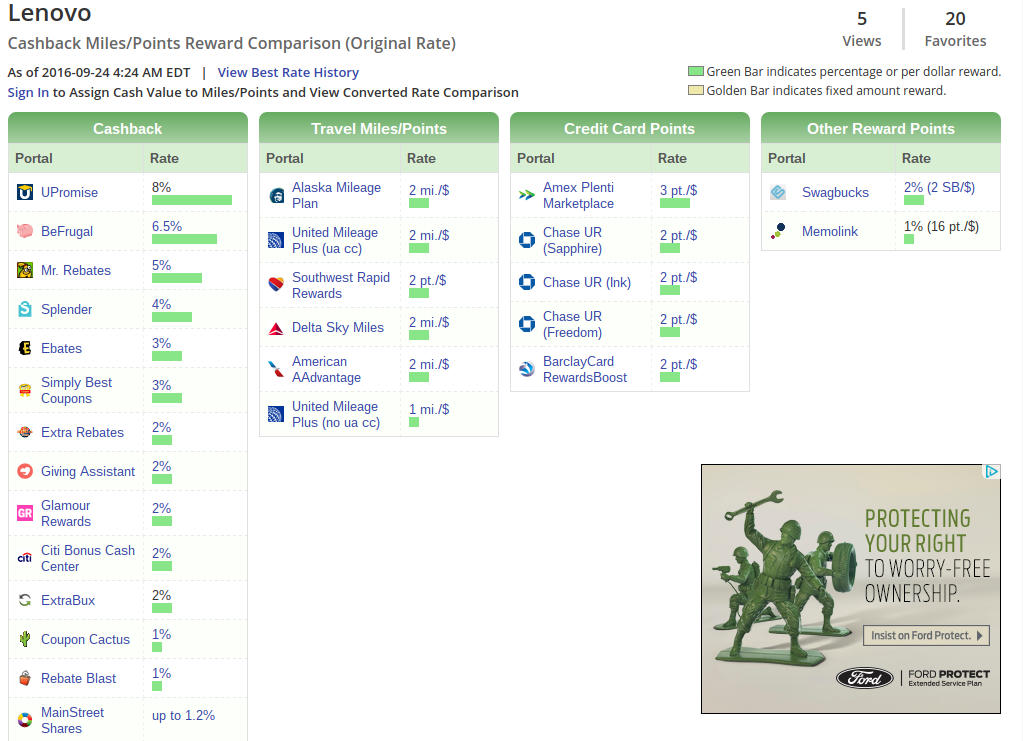

Once I find out the price of my products, I then head over to cashbackmonitor.com to search for the best portal to use (your portal preference might be different than mine), then continue on with my purchase.

Since I value Ultimate Reward points at 1.8 cents each, using that portal would mean I’d earn about 3.6% return on my purchase. This will depend on my redemption, but I can earn 8% through UPromise. That is more than double what I would value my Ultimate Reward points.

After selecting UPromise, I would just make my purchase with my card registered with Visa SavingsEdge.

When you start looking at the total savings, you can see how stacking these savings can yield some really good savings.

When looking at the Wydhman hotels for savings, you can also use the same approach as the Lenovo example. Another way is to stack your 5% savings with Points and Cash reservations. Will it lead to a massive savings? It all depend on how much your cash portion would be, but every little bit helps!

Conclusion:

Overall the Visa SavingsEdge program is a very straighforward way to save money. This program is similar to dining reward programs, where you’ll earn something if you shop at participating retailers.

I am guilty to have forgotten about this program and after looking at some of the offers, realize I have left some money on the table :-/ ! Registering your credit cards takes just a few minutes and when stacking it with portals, it can yield some great savings.

Have you heard of Visa SavingsEdge? How often do you use it?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!