The Hilton co-branded credit cards definitely give interested travelers the best options for maximizing point earning for hotel redemptions. While with other hotel cards you may only have one or two options, Hilton gives you four different credit card products! Not only that, but they give it to you through two separate banks making it easier to accrue the Hilton points.

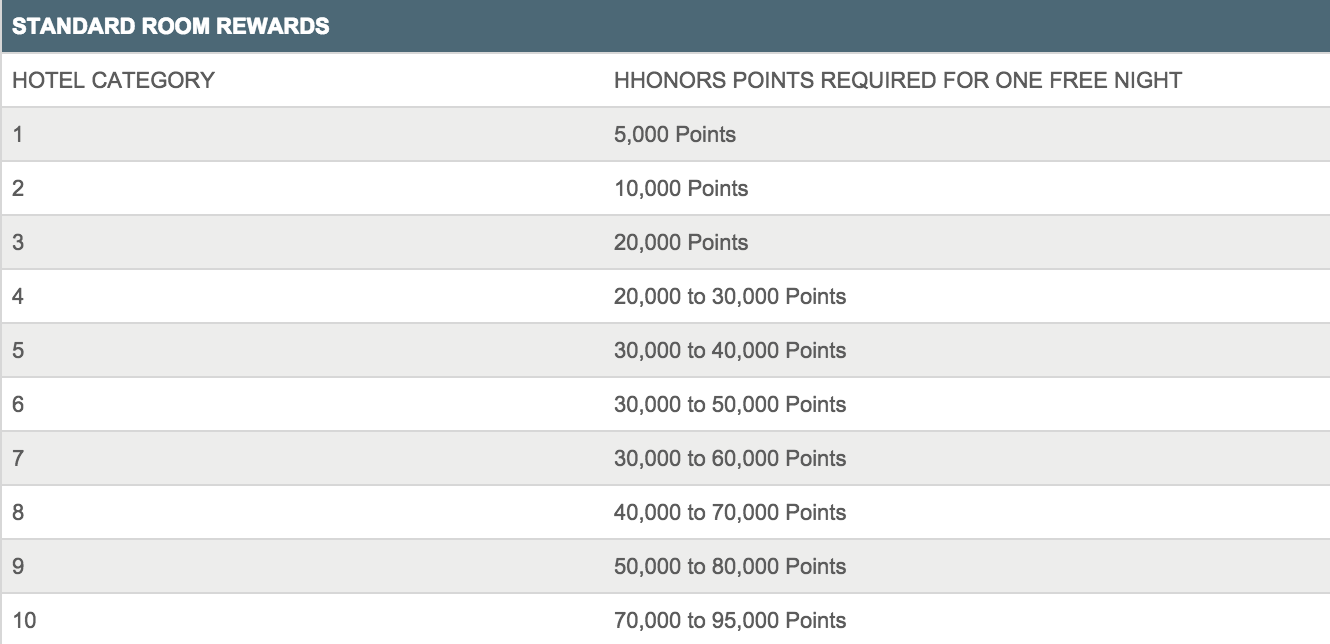

And it is a good thing that they do give out so many points because Hilton points have some of the lowest valued hotel points around. With a 10 category award listing for Hilton hotels, redemption levels range from 5,000 per night to a jaw-dropping 95,000 points per night at certain hotels during peak season. But, there is still some tremendous value to be had in the middle category listings so these cards are worth serious consideration, especially now with their increased sign-up bonuses.

Roundup Of Hilton Credit Cards

*Disclosure: I do NOT receive a commission for any of the cards in this post.

Amongst the four credit cards for Hilton, we have two no-fee cards as well as two cards with each American Express and Citi. That helps to give just about everyone options when it comes to earning Hilton points. Before we look at each card individually, here is a chart to explain the earnings to be had with each card.

[table “” not found /]*At this time, there is a limited-time bonus increase on the three cards that earn points as a bonus. For the American Express cards, that limited-time offer is through May 5. The offer on the Hilton Citi Visa Signature card is through April 30.

American Express Hilton Surpass

This is the American Express Hilton card that does have an annual fee as well as holding the distinction of requiring the most spending to receive the bonus.

This is the American Express Hilton card that does have an annual fee as well as holding the distinction of requiring the most spending to receive the bonus.

American Express Hilton Surpass Application Link – Spend $3,000 in 3 months to receive 80,000 points

But, that spending comes with 80,000 Hilton HHonor points. While that is not enough to get you a single night at the highest category hotel during peak season, it is still a nice haul. Hilton has a fantastic footprint worldwide and there are a lot of middle category hotels all over. Being able to snag two or three of them with these points, and save hundreds of dollars in the process, is a great way to maximize points.

Points By Spending

As for an actual spending card, this card does a good job of giving some nice points. Here is the spending breakdown:

- 12 points per dollar on Hilton spending

- 6 points per dollar at US restaurants, US supermarkets, and US gas stations

- 3 points per dollar everywhere else

Elite Status – Gold

One of this card’s strengths is the fact that the holder will have Hilton Gold status for as long as they hold the card. Having this mid-tier status is no simple thing. Hilton has the best middle tier status in the hotel industry since Gold members receive free breakfast! That is a strong benefit and if you plan on staying even a couple of nights at Hiltons per year with your family, that $75 annual fee could pay for itself.

The Amex Twist

Since this is a personal card offered by American Express, you cannot receive this bonus if you have ever held the card before. So, if you had the card 5 years ago, you are stuck – no 80,000 points for you.

However, there is a workaround with that and it has worked for many people. See this post about upgrading to the Hilton Surpass card.

Citi Hilton Reserve

This is the Citi version of the above card in that it charges an annual fee and it to is not waived for first year customers. The spending is slightly less than the Surpass, and you have 4 months instead of 3 months to meet it.

This is the Citi version of the above card in that it charges an annual fee and it to is not waived for first year customers. The spending is slightly less than the Surpass, and you have 4 months instead of 3 months to meet it.

Citi Hilton Reserve Application Link – Spend $2,500 in 4 months to receive 2 weekend nights.

There is a better offer that will give you a $100 statement credit after a stay at a Hilton hotel, in addition to the free nights. Read this post to learn more.

This is the card in the Hilton credit card family that has a different sign-up bonus – instead of points, you will receive 2 free weekend nights at almost any Hilton in the world. That has the potential to be equal to 180,000 points (if redeemed at a category 10 hotel during peak pricing) but it is also limited somewhat in its flexibility since you can only use these nights on weekends.

Points By Spending

This card also presents some nice options for earning points by spending and in different categories:

- 10 points per dollar on Hilton spending

- 5 points per dollar on airline and car rental purchases

- 3 points per dollar everywhere else

Elite Status – Gold

One of this card’s strengths is the fact that the holder will have Hilton Gold status for as long as they hold the card. Having this mid-tier status is no simple thing. Hilton has the best middle tier status in the hotel industry since Gold members receive free breakfast! That is a strong benefit and if you plan on staying even a couple of nights at Hiltons per year with your family, that $75 annual fee could pay for itself.

The Annual Bonus

This is the only card in the Hilton family that gives you the ability to pick up another free night each year. This does not come for just holding the card but does require that you spend $10,000 in a cardmember year to receive the free weekend night.

Even thought the spending is a little high for that, it is not all bad. If you spent that amount on non-bonus spending, you would receive an additional 30,000 Hilton points which can get you anywhere from 6 nights at a category 1 to 1 night at a category 7 during off-peak times. That is good earning and incentive!

The Citi Angle

Citi has a much friendlier policy when it comes to earning the sign-up bonus again. As long as it has been 18 months or more since you last opened or closed this card, you can get it again and the free nights.

Citi Visa Signature

Now we get to the no-fee variety. This card and the next one are ones that everyone should consider getting since there is no annual fee and the required spending is low. Not only that, but now with the 50% increase on the sign-up bonus, it makes for an even better time to get the card.

Now we get to the no-fee variety. This card and the next one are ones that everyone should consider getting since there is no annual fee and the required spending is low. Not only that, but now with the 50% increase on the sign-up bonus, it makes for an even better time to get the card.

Citi Visa Signature Application Link – Spend $1,000 in 4 months to earn 60,000 points

Points By Spending

Since this is a lower-tiered card than the Citi Reserve, the earnings are not as good:

- 6 points per dollar on Hilton spending

- 3 points per dollar at supermarkets, restaurants, and gas stations

- 2 points per dollar everywhere else

Elite Status – Silver

Silver status within the Hilton chain is really nothing, but it is better than nothing! The card does give you the chance to fast track to Hilton Gold, however. If you stay at Hiltons 4 times during the first 90 days of having the card or you spend $20,000 in a calendar year, you will receive Hilton Gold.

The Citi Angle

Citi has a much friendlier policy when it comes to earning the sign-up bonus again. As long as it has been 18 months or more since you last opened or closed this card, you can get it again and the points.

American Express Hilton HHonors

This is the little Amex brother to the Surpass card. Like the Citi card above, this card does not have an annual fee and has a decent sign-up bonus.

This is the little Amex brother to the Surpass card. Like the Citi card above, this card does not have an annual fee and has a decent sign-up bonus.

American Express Hilton HHonors Application Link – Spend $1,000 in 3 months to receive 60,000 points

Points By Spending

Since this is a lower-tiered card than the Amex Surpass, the earnings are not as good:

- 7 points per dollar on Hilton spending

- 5 points per dollar at US supermarkets, US restaurants, and US gas stations

- 3 points per dollar everywhere else

Elite Status – Silver

Silver status within the Hilton chain is really nothing, but it is better than nothing! The card does give you the chance to fast track to Hilton Gold, however. If you spend $20,000 in a calendar year, you will receive Hilton Gold.

The Amex Twist

Since this is a personal card offered by American Express, you cannot receive this bonus if you have ever held the card before. So, if you had the card 5 years ago, you are stuck – no 80,000 points for you.

However, there is a workaround with that and it has worked for many people. See this post about using this card to upgrade to the Hilton Surpass card.

Summary

Having options is good and we have several good options for the Hilton hotel chains. If you were to get all 4 cards, you would have 200,000 points and 2 free weekend nights. That is a nice total and nicer still if your stays are at mid-tier hotels.

If you wanted to get the most Hilton points possible, here is what I would do:

- Apply for the Hilton Surpass and Hilton Visa Signature now

- Apply for the Amex Hilton HHonors card next month

- Apply for the Hilton Reserve card next year

There is no rush on the Hilton Reserve as it is not a limited-time offer. If you take advantage of the other offers now, you will end up with 200,000 points over the next few months! One of my favorite redemptions will then be available to you – four nights at an all-inclusive resort!

Could you sign up for Surpass and get the 80k, and then upgrade your Amex Hhonors in, say, a year and get another 50k?

If you signed up for the Surpass and then closed it (moving credit to another card first), you could upgrade the Amex card (even Delta or SPG cards) to the surpass. If the offer is there, you can do it. As of right now, there is no language excluding you from getting the bonus on an upgrade.

So , regarding the citi hilton reserve card,” As long as it has been 18 months or more since you last opened or closed this card”.In an example, if I opened the card let’s say 24 months ago and I still have the card opened, if I close it now, do I have to wait another 18months for it to be closed in order to get the bonus?Or the first part of the fine print is suffice, at least 18months since you last opened?

Thank you

Weekend Night Certificates offer is not available if you have had a Citi Hilton HHonors Reserve Card account that was opened or closed in the past 18 months.That s what I saw on their terms.I understand that you have to wait 18 months after the account was closed