Recently, US Bank started allowing you to redeem your Flexperk points for any travel. You would no longer need to use their specific portal, which is great to have extra options. While there was excitement for this option, there have always been real time rewards.

Real Time Rewards

To get some details of this change, read the article Doctor of Credit wrote about it when it happened.

Why This is Good:

Anytime there is a change that benefits consumers, it is good. There seem to be more negatives than positives over time in this game, so we’ll take what we can get.

I have found the bank specific travel portals can have different prices than compared to other 3rd party travel sites, or even the airline/hotel directly. This will stop the price issues as you can now book with the best priced site.

On top of that, you’ll be able to stack with portals to earn extra rewards. I am a huge fan of shopping portals and think everyone needs to use them!

Hopefully, this change also makes it’s way to the Chase Sapphire Reserve. If it does, then Chase just increases the value of that card.

Why This isn’t as Good as it Seems:

The Real Time Mobile Reward option for the US Bank Altitude and the US Bank Visa Flexperk, not the American Express version (at least at this time).

Looking at those options:

The US Bank Altitude earns 3x on travel and mobile payments, which is great, but mobiles payments are accepted everywhere. Also, when you consider the Chase Freedom is currency offering a 5% return (minimum) on mobile payments, it reduces the value at least for this quarter. The return on these points is 4.5%, since these points are worth 1.5 cents per point.

The US Bank Visa FlexPerk earns 2 points per dollar on grocery, gas, or airlines (on which ever category you spend the most on, the others earn 1 point per dollar), 2 points per dollar on cell phone services and 2 points per dollar on charity. At most you earn 3% back for rewards.

Once you blow through the bonus, there is no reason to keep using these cards (exception could be the Altitudes mobile payments option), because the earning rate is too low!

If you’re a fan of using these real time rewards, you can easily out earn 3% on these options, with a mix of different CASH BACK credit cards. Plus, it is known that US Bank does not like people to MS on their cards, so that isn’t really an option on these cards.

The Trend is Changing:

When the Chase Sapphire Reserve was released, I think it changed how people wanted to redeem their points.

The Chase Sapphire Reserve 1.5 cent per point redemption has been a favorite of many who have the card. By using your points this way, you are using them as cash back.

Once this benefit came out, more people people began to recommend it. It became even better once you combined the points from your Freedom/Freedom Unlimited/Ink cards.

Then American Express followed along with their 50% rebate (now 35%), although this isn’t as good as the Chase Sapphire 1.5 cent per point. It was still a great way to use your points for about 2 cents per point.

Why use that options?

Redeeming your points for 1.5 cents per point is easier (and still provide good value), because there weren’t restrictions on award seats. You could find the ticket you wanted without messing around with partner airlines, earn miles for your flight, and work your way towards elite status.

Only a couple of hotels offer a greater value than 1.5 cents per point (SPG and Hyatt). Beyond those, award charts are inflated and if you could use those points for 1 cent per point, most were happy. With the Sapphire Reserve, you could redeem at 1.5 cents per point.

Increasing Cash Equivalents:

The fares across Europe, Asia, and other destinations have been quite cheap (for coach), because of that we are seeing more value from using the flexible currency as a cash equivalent vs transferring points.

It’s a terrible idea to transfer 60,000 miles plus pay taxes for a ticket that cost $450. But redeeming 30,000 to 36,000 (redeemed at 1.25 to 1.5 cents per point), sounds much better.

The value to transfer for coach tickets is shrinking, because the tickets have been so cheap. Add in the fact Premium Economy is expanding and Business class award availability is becoming more difficult to find as well as well.

There is still value to be had by using transfer partners, but they are shrinking and costing more points each year.

I’m a firm believer that the majority of people don’t use their points for business/first class tickets. They want to see the world in an affordable way. Maybe I’m wrong, but I know I prefer more trips than fewer, more lavish ones.

Build Yourself a Solid Rotation:

If you are using your flexible currency as a cash equivalent, or are excited for US Bank Real Time Mobile Rewards, then you should consider building yourself a true “Real Time Reward” in cash back currency.

That doesn’t mean neglect points! You should definitely diversify your travel currency.

The bonuses on those point credit cards are much higher than cash back credit cards. Plus, who doesn’t love a good bonus? Banks keep tightening, so you need to be more selective on the bonuses you apply for. Build your long term strategy while looking for those bonuses as well.

If you prefer flexibility, then how much more “real time” can you get than cash back?

Found yourself a cheap fare? Book it. There’s a promo for buying points to saves you thousands? Redeem your cash back to buy the points.

Banks are definitely trying to one up each other with a top category for rewards, so use that to your advantage.

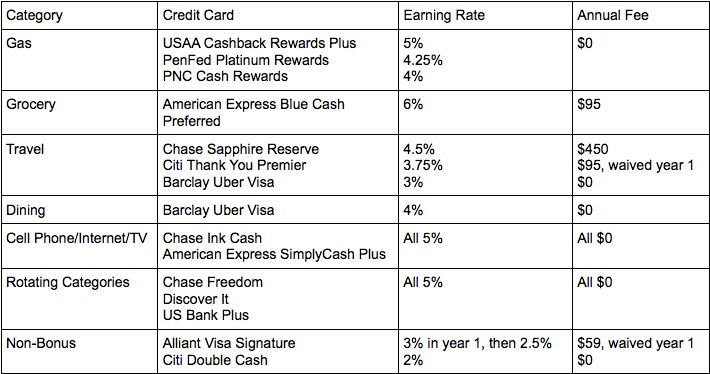

Let’s take a look at some options:

You can see with the right combination of cards, you can earn pretty close to 5% back on all purchases.

Why the Push Back?

Let’s be honest, cash back isn’t the sexiest option, everyone wants those Ultimate Rewards, right?

I get the idea of earning points, I like to earn a lot of them myself. It looks like the best way to get yourself “free travel.” And it sounds really cool to tell your friends I redeemed my points for this trip, instead of my cash back.

But if you’re using your points as a form of cash, then you potentially missing out. Once you can accept the fact you are using your points as cash and can maximize your earnings, it will be easier.

Trust me, it is boring to use my Limitless earning 2.5% cash back on all non-bonus spending, but earning 2.5% on all non-bonus spend is pretty fantastic.

I’ve just accepted the fact that cash back, in today’s travel world is the better option for my travel goals.

Conclusion:

Real Time Mobile Rewards from US Bank is a great improvement for their rewards. Hopefully others follow along. But let’s not fool ourselves to think this new, there have always been “real time rewards.”

If you prefer the real time rewards, you should probably consider cash back as your daily earning currency.

Are you happy with US Banks changes? Do you agree or disagree with me?

Consider Subscribing to my YouTube Channel, Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!