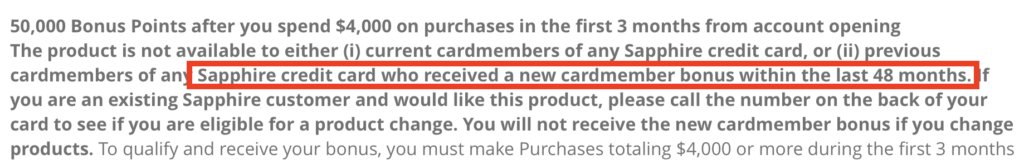

In case you missed it earlier, all referral/public/affiliate links for the Chase Sapphire Preferred and Chase Sapphire Reserve now contain language barring applicants from getting those cards if they had the bonus from either one in the last 48 months – that’s right, 4 whole years since the last bonus on one of those cards (and the Sapphire Reserve was not even around then!).

Two Ways the New Chase 48 Month Policy Is Worse Than the Amex Lifetime Policy

The Amex Lifetime Policy

While pretty limiting to anyone that wants Chase cards like that, the Amex policy of one bonus per lifetime (or at least as long as they keep your information – maybe after 7 years or so) is quite a bit more devastating for reward seekers! That policy means that if you took an inferior offer marketed by Amex or one of their marketing websites of, say, 30,000 Delta miles, you would be unable to get an offer like the 70,000 mile offers we see sometimes. That means you have missed out on earning up to an extra 40,000 miles! At least the Chase cards don’t see bonus offers swing that much!

So, what two ways is the Chase policy worse than the Amex one?

The Chase Policy Limits You From More Than Just the Card You Had

For example, if you received a bonus on the Chase Sapphire Preferred 3 years ago, you would be ineligible to get the Chase Sapphire Reserve card now. That is a completely different product but you are still excluded from it since it is in the same product family.

With Amex, the lifetime limit is per card. So, if you had received a bonus on a Platinum card, you wouldn’t be excluded from getting the Premier Rewards Gold card and bonus. So, the Amex policy gives you more cards you can turn to in racking up points.

The Chase Policy Prevents You From Getting the Card – Not Just the Bonus

This is the one that really hurts. Say you got the Chase Sapphire Preferred 3 years ago and closed it out last year or earlier this year in preparation to get it again or get the Chase Sapphire Reserve card. Now, you are ineligible to even get either card now – not just ineligible for the bonus. With the Chase Sapphire Reserve being an awesome card with benefits like $300 in travel reimbursement, great Priority Pass lounge membership, higher point redemption values when booking with Chase, etc., it can help to make it worth getting and paying the $450 annual fee for – even if you do not get any points as a bonus.

The new 48 month restrictive language that is in effect for Chase Sapphire cards

If you were going to redeem your Chase Ultimate Reward points for some of the awesome economy or business tickets we see go on sale sometimes, a redemption amount of 120,000 Ultimate Reward points could be worth $1,800 when redeemed out of the Chase Sapphire Reserve account, as opposed to $1,500 when redeemed from the Chase Ink Business Preferred card. That difference alone would help wipe out the annual fee of the Sapphire Reserve.

But, if you have held either the Sapphire Preferred or the Sapphire Reserve and had a bonus from them in the last 47 months, you would not be able to even get one of those cards. This means the best thing to do is to make sure you always hold a card that will let you product change to one of them (like one of those two cards or a Freedom card).

With Amex, you can freely apply for any card you want – again and again – and take advantage of any benefits the card offers. The only thing is that you won’t get the bonus if you had received the bonus before. But, for cards like the Platinum card, it can be a big help to take advantage of some of those perks (especially if you apply for the Ameriprise Amex Platinum card with no annual fee for the first year) and you would’t need to have the bonus to make it worthwhile.

This is a big way the Chase policy is worse than the Amex policy since it prevents you from even getting the card, not just denying you the bonus. With the Chase cards having some nice benefits and perks, this can make that 48 months seem like a really long time if you don’t have an upgrade path to the Sapphire cards.

Two Ways to Get Around That for the Card Benefits

As I mentioned, if you have a Chase card that can be product changed to a Chase Sapphire Preferred or the Sapphire Reserve, you can always upgrade to one of those cards when you need to (as long as it has been 12 months since you had first applied or paid the first annual fee). This way, you can avoid the high annual fee of the Reserve and just upgrade when you have a bundle of Chase points to redeem through Chase or you want the lounge benefits, etc.

The other way is to be an authorized user on someone else’s Chase Sapphire Preferred or Reserve account. This costs $75 per year for the Reserve and it gives you the opportunity to redeem points at the 1.5 cents per point, gives you the free Priority Pass lounge membership, and the car elite status levels. You will need to make sure it is with someone you trust as any points you transfer to that account from one of your other accounts (like the Chase Ink business cards) will go to the main account holders point balance. Of course, I would assume you both are ok with each other anyway if they are giving you a credit card they are responsible for. 🙂

Takeaway

Personally, I understand why Chase is limiting people from two of their top cards (because it costs them a lot of money in customer acquisition and it can be wasted if the person cancels after just a year or two), but I still think this is going to end up hurting Chase more. You have a lot of people that got the Chase Sapphire Preferred as their first rewards credit card that closed it after the first year or so because they were not used to paying annual fees. Now, they may know more about this game and want the Reserve for its benefits – but they are unable to get it until that 48 month period has passed. This will force a lot of these potential customers to other banks.

I think Chase should adopt a similar policy to Amex – let the customer get the card but not the bonus. There are just too many cards in the Chase portfolio that can be valuable to have and use – even without the sign-up bonus. Look at the new World of Hyatt card – it helps bridge the elite gap and has potential for free nights without even counting a reward bonus. Fortunately, that is a new card and pretty much any valid applicant can get it. But, I think there could be problems for many down the road when it joins the “product family” ban for those that had received the old Hyatt card and closed it out.

I love the Chase card benefits and the Ultimate Rewards system, but I think that Chase is going down an iffy road with some of their cost-cutting measures that could hurt both them and some good customers.

Does the 4 year policy apply to the SWA cards?

Thanks

No, not yet! 🙂

There is another way the Chase rule is worse than American Express’s. The American Express online application warns the applicant if they may not be eligible for the sign up bonus. Chase makes everything a mystery.

You are right – I had intended on inserting the link to that post in here as well but forgot.