Doctor of Credit first started talking about the Chase 5/24 rule a long time ago and has done a lot of coverage of it since then. It was never really something that Chase officially acknowledged though they did decline new accounts for having too many new accounts in the last 24 months.

The Official Language for the Chase 5/24 Rule

When the Chase Sapphire Reserve poked its head out into the public for a short hour or so, many people were able to get approved despite being on the wrong side of the 5/24 rule. But when it officially launched, the Chase Sapphire Reserve seemed to hold the 5/24 rule line pretty hard.

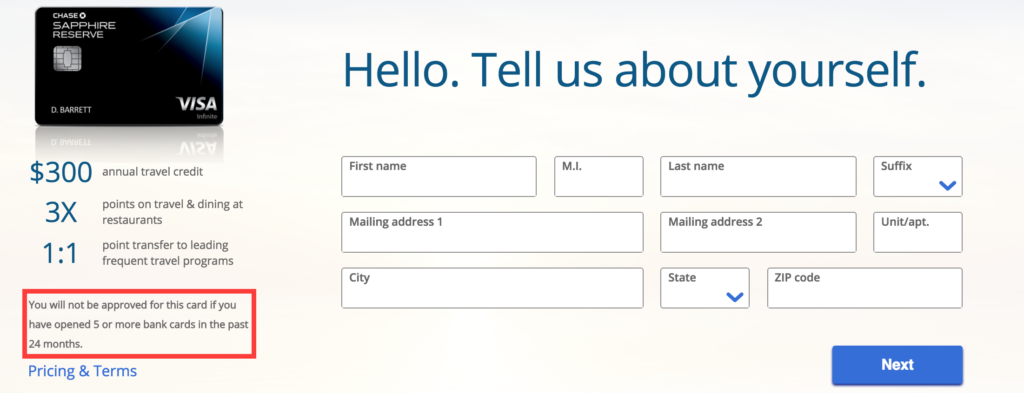

The Chase 5/24 Rule Language on the Chase Sapphire Reserve

Now, after all of these months, Chase has finally put official language to the 5/24 rule and they did so on the application of the Chase Sapphire Reserve. We knew it was here but it is nice to see Chase publicly acknowledge it, even if they only did it on one of the cards it applies to. I suspect that they did it on the Chase Sapphire Reserve because of the massive amount of internet noise that the Chase Sapphire Reserve has had since its launch.

So, here is the official Chase 5/24 rule language:

You will not be approved for this card if you have opened 5 or more bank cards in the past 24 months.

You can see this language on the application page of the Chase Sapphire Reserve. To see a complete list of what cards are under the Chase 5/24 rule and which cards are not, check out this post by Doctor of Credit. At this time, the language does not appear on other Chase card applications but we know that it does apply to many Chase cards.

Summary

Now you know – if you have opened 5 or more new cards (across any bank) in the last 24 months, you will not be approved for the Chase Sapphire Reserve. Given the huge 100,000 point bonus, if you will fall under that 5/24 number in the next few months, I would certainly hold off from applying for any other cards until you get under that number. It should be worth it!

HT: reddit / user LimitedReactant