I have come to take expiring credit card offers with a grain of salt. Sure, they all expire at some point, but the truth is that they (almost) all come back to that level at some point and sometimes, the issuer even extends the limited-time offer. So, I mention that this card’s increased offer expires soon, but that does not necessarily mean you should rush to apply for it. Let’s see what it does have to offer and then whether you should get it or not.

Lufthansa 50,000 Mile Offer From Barclays

Disclosure: I receive a commission if you are approved for this card using my links. Thank you for your support!

application link – Barclay’s Premier Miles and More World Mastercard – 20,000 miles after first purchase and additional 30,000 miles after spending $5,000 in 90 days

This card is typically at 20,000 miles but it has its moments when it pops up to 50,000 miles. For most people, the intended purpose of these miles will actually not be the best use for them. However, for people that seeking to travel domestically and may have already burned through the United cards, this card can be a compelling choice at the current offering. Here are some of the highpoints of the card:

- Earn 20,000 award miles after your first purchase or balance transfer

- Earn an additional 30,000 award miles when you spend $5,000 in purchases within the first 90 days of account opening

- Cardholders receive a companion ticket after first use of the account and annually after each account anniversary

- No foreign transaction fees on purchases made outside the U.S.

- Redeem miles for flight awards and upgrades on Lufthansa, Austrian Airlines, Brussels Airlines, SWISS, Star Alliance member airlines and other partners

- $79 Annual Fee

Value

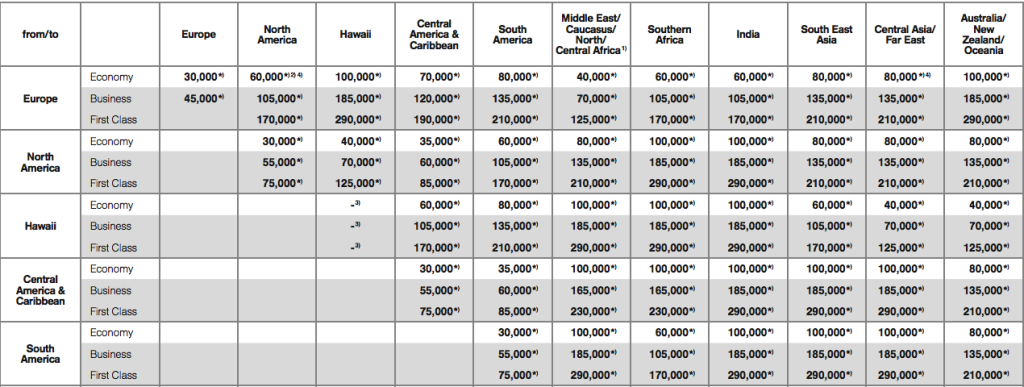

Contrary to what you may think, you do not need to use these miles on just Lufthansa or the airlines in the Miles and More family. You can use them on any Star Alliance partner! The problem comes that the Miles and More program will leverage fuel surcharges on your award ticket unless you fly on a partner that does not have fuel surcharges. There are not many of them, but if you are interested in traveling to Europe, you can do it on LOT Polish (via Warsaw) or United. If you reside in and depart from the US, economy to Europe is only 50,000 miles (10,000 fewer miles than United charges). here is the miles and more award chart.

When it comes to domestic travel, this card can be a big help as well. You can fly anywhere that United flies, on United, with these miles. It will cost 25,000 miles round-trip to travel on United within the US in economy and 35,000 miles to travel on United in First Class (within the US). The price for first class (business class) is actually quite a bit lower than United would charge you for those same flights, plus, you can keep your United miles for other destinations.

I would put the value on this offer (if only used in the above examples) at a decent amount – worth at least more $600 depending on the flights you choose. That makes this a fairly good offer and one you should consider! However, if you plan on applying for one of the other Barclay cards, I would think long about which one will serve you the best right now. Barclay tends to be more stingy now with their approvals and may not approve you if you apply for too many of their cards within a short amount of time.

What I Like

This card has a healthy sign-up bonus. I like that you get some of the miles after your first purchase. Given that it is Barclay, you should see those first 20,000 miles appear in your account within 4-5 days after making your purchase.

Another think I like about this offer is that it will allow you to use these miles for domestic awards on United which can keep your United miles free for the international destinations. If you redeem your miles from this card for travel to Europe on Lufthansa or one of the Miles and More family members, you will find yourself paying large surcharges. If you use United miles to book those same flights, you will find that you pay a lot less. So, this is another example of using a European mileage program for travel within America and the American program for travel to Europe!

What I Don’t Like

That this card is from Barclay is good and bad. Good because it will not take a valuable application and open account from American Express or Chase which has better offers. Bad because Barclay has been tightening the belt when it comes to approving applications. So, as I mentioned above, if you were thinking of applying for a different Barclay card – like the Barclaycard Arrival – you may want to consider which card will give you more of the immediate value.

I also do not like that Miles and More leverages such high fuel surcharges. However, that is a function of that program and not the card, so it is really not a negative against this bonus offer. Just figure out which uses you could have for this card that would give you the best bang for your buck.

Why You Should Get It

The obvious reason is that it gives you an additional 30,000 miles over the regular offer. Another great reason is because it allows you to redeem for Star Alliance flights (especially domestically and in the Caribbean) without burning up your more valuable United/Ultimate Reward points. And yet another reason is that it is not a card that is issued by Chase or American Express – in other words, it gives you the opportunity to get a great offer without burning an application with a bank for which you may have better offers.

Why You Should NOT Get It

As I mentioned at the top, limited-time offers rarely leave and never come back. Unless you have a use for these miles in the next 3-9 months, I would not consider this card a must have right now. There is no reason to get this just because it sounds great and then let the miles sit there until they devalue because you have no use for them.

Another reason is the spend. Having to spend $5,000 in 90 days is quite an asking on a personal card, especially when that is the same amount required by cards like the Chase Ink Bold and Plus that offer quite a bit more value for the points. If you can handle the spend without a problem, then do not let that stop you.

In addition, this card is issued by Barclays. I know I said that was a good thing but it is also becoming a very bad thing. Where Barclays used to be super generous in their approval process they have become quite stingy – especially with applicants who have had a lot of credit inquiries. Gone are the days of getting multiple Barclay cards in the same day (Dan from Dans Deals has actually spoken of getting 4 or 5 US Airways cards on the same day).

So, unless you have a specific need for these miles (such as using them as alternates to your United miles while still redeeming for United flights), I would pass on this offer. There are so many other offers from Barclays that are great deals that could service you now. The top one is the Barclaycard Arrival Plus* with its 40,000 miles. Another good one is the soon-to-disappear US Airways card*. On top of those, they also have several others like the newly acquired Hawaiian Airline cards*. In light of those offerings, again, I would pass unless you have a need for the Lufthansa miles at this time.

Of course, should you decide that this card is right for you, I would be more than honored if you used my application links (which do pay me a commission). 🙂 The asterisk above marks cards that I receive a commission for.

Unfortunately, the bonus miles for this card do not post a few days after purchase, but rather a day or two after your statement closes.

Really? This has changed since the last Barclay card I had – they were the fastest with posting within a few days. I will change that. Thanks for the update!

Maybe it depends on the type of Barclay card?? Or, maybe I was just unlucky!

Thanks so much for the break down! Having picked up the USAirways MC in mid May and now with a few other new cards (4 total) then yesterday I picked up the Citi Exec card. I wonder if I could manage to pick up the Miles & More card and not take a big hit on my credit score?

[…] (adsbygoogle = window.adsbygoogle || []).push({});(adsbygoogle = window.adsbygoogle || []).push({}); I have come to take expiring credit card offers with a grain of salt. Sure, they all expire at some point, but the truth is that they (almost) all come back to that level at some point and sometimes, the issuer even extends the limited-time offer. So, I mention that this card’s increased offer expires soon, but that does not necessarily mean you should rush to apply for it. Let’s see what it does have to offer and then whether you should get it or not. Read full article […]

Your bullet points include a Companion ticket, but you give no details about that ticket. An annual companion ticket on a $79 annual fee could make the card a keeper, depending on the rules for that ticket. Lufthansa only, or any Miles & More carrier? Germany only, one country only, euro only? Fuel surcharges on companion ticket?

This offer is from 5 years ago and that is no longer applicable to the offer.