The Chase Sapphire Reserve is currently at its highest public bonus in 6 years – and that bonus will be gone next week! This card is definitely worth it, even with the high annual fee and here is why!

The Chase Sapphire Reserve with 80,000 points

Link: Chase Sapphire Reserve 80,000 point offer (this is a personal referral link that helps me earn points as well – thank you!)

When the Chase Sapphire Reserve was introduced over 6 years ago, it launched at 100,000 points and then eventually went down to its 50,000 or 60,000 point amounts. With an annual fee at $550, it has been much easier to recommend the Chase Sapphire Preferred with its own 60,000 point bonus since you only pay a $95 fee. But, for a limited time, you can use points to pay the annual fee and still get a ton of value!

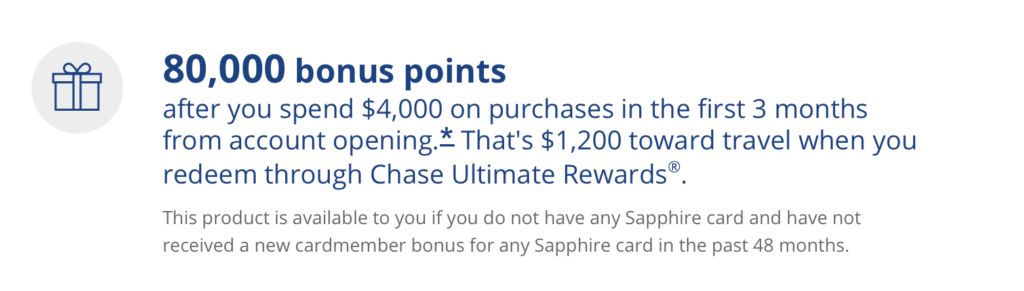

The Sign-Up Bonus

At 80,000 Ultimate Reward points, you are looking at a big value! If you redeemed those points for the Pay Yourself Back categories (which include the annual fee!) or you use the points to pay for travel directly, you are getting a solid 1.5 cents per point. That turns this sign-up bonus into an easy $1,200 value, if you only use the points that way.

You will need to spend $4,000 in the first 3 months to get that bonus.

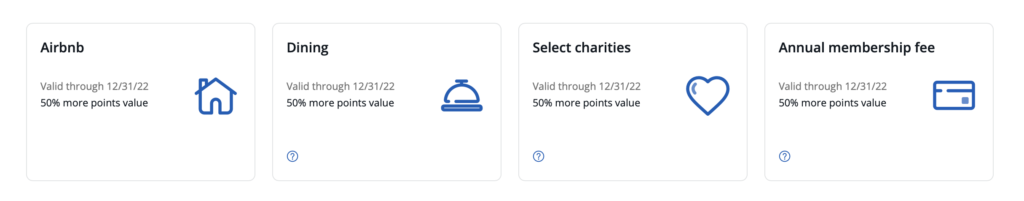

This means you could use 37,000 points to pay the annual fee and still have 43,000 points to use for travel! Great deal! Plus, you are still getting the big perks on the card that can help you get more points and save more money.

Of course, if you transfer to partners, you can get even more points!

The Chase Sapphire Reserve Travel Credit

The card still comes with a $300 annual travel credit. This works much more broadly than the American Express Platinum travel reimbursement credit. For the Chase Sapphire Reserve, anything that codes as travel activates the travel credit and you will see that credit hit your account within days of the charge posting.

This means no pre-planning about what airline to pick (like with Amex) because you get the credit on all travel! It also means you don’t even need to think about it – it is all automatic, whether you want to use it for airplane tickets, car rentals, hotels, or even toll payments and metro fares.

Primary Rental Car Insurance

There are other cards that offer this as well but since I like to use my Chase Sapphire Reserve for all things travel, this is the card I use when renting cars. That means that I don’t have to worry about any damage that may happen to the car that is my fault. With primary insurance, Chase picks up the whole thing instead of serving as a backup for a regular insurance policy.

Plus, you are earning the bonus points for having booked the rental car with the Reserve, which helps you get a few more points than you otherwise would with something like the Preferred.

Lounge Access

Again, there are other cards that offer Priority Pass memberships at various levels. But, it is easy and unlimited (for the cardholder and up to 2 guests) and it applies to the authorized card users as well.

I have Star Alliance Gold status so since I mostly fly Star Alliance carriers, I have lounges at every airport. My wife, however, doesn’t have elite status. So, when she travels, it is nice that she can use lounges for free with her card. Or, if our family is traveling, we can get everyone in between the two of us.

Point Earning

At the risk of sounding like a broken record, there are other cards that offer the same or better than the Chase Sapphire Reserve with dining and travel, when you just use the card directly with travel providers. However, it is just so easy with the CSR!

For example, unlike some other cards, I can buy airline tickets through Kayak, pay for award fees, buy from the airline – and earn 3 Ultimate Reward points per dollar. With something like the American Express Platinum card, you need to spend at the airline’s website to get the 5X points.

If you order takeout or make a prepaid reservation through Chase Dining, your Reserve card will get you 10X points on that dining! That is fantastic!

You get the same wen you book prepaid hotels or rental cars through Chase Travel (remember that you will not get elite credit or benefits if you do this!) – 10X total points per dollar!

If you do want to book your air travel directly through Chase Travel (like the Amex Platinum does) you will get an extra 2X points for a total of 5x points per dollar.

Instacart

A lot of people are into getting everything delivered. If this you, you may like the 1 year complimentary Instacart+ membership. In addition, you will get $15 per month in statement credits when you use your Reserve card to pay for the purchase. This will last through July, 2024.

Bottom Line

It is a big annual fee – nothing little about it! At $550, you are really investing in this card’s offers and bonus. Yes, the Chase Sapphire Preferred is the better bet when it is at 80,000 points. Even at 60,000 points, you are still saving on the annual fee ($95 with the Preferred vs $550 with the Reserve). But, if you can take advantage of the travel credit and the other features of the card (like the lounge access and increased point value), the Chase Sapphire Reserve at 80,000 points is a good deal – especially since you can use 37,000 points to wipe that fee out.