This month, the Apple Card will hit the streets (or, rather, the iPhones) for the masses. From reading the forums and news stories since this new credit card was first announced, there is a ton of excitement about this credit card and there will likely be an enormous amount of applicants when open registration begins. Why?

How the Apple Card is Going to Be Huge – Without a Sign-Up Bonus or Huge Rewards

Link: The Apple Card

apple card huge

On the rewards front, the Apple Card is truly a somewhat mediocre card. Not only is there no sign-up bonus but the earnings are not even that impressive. There are several credit cards that will give you 2% earnings on spending and the Apple Card will only give you that through using Apple Pay. There are even better cards to use for actually purchasing from Apple (the American Express Business Gold card, for example) where the Apple Card gives you 3% back.

If you are going to use the actual titanium Apple Card for purchases, that will only earn you 1% cash back. So, the rewards are pretty average to be sure. So, why is this card going to be so huge and likely be one of the top credit cards in terms of early applications?

The Apple Brand and Method

Walk through New York City and you will see little white Apple AirPods sticking out of peoples’ ears – or at least the corded earbud version. Get on a subway in any major international city and you will likely see many iPhones, iPods, or iPads being used. Go to an office and you will probably see more Apple Watch devices on peoples’ wrists that any other watch.

This is a demonstration of how the Apple company became one of the richest in history – it has been very well adopted over the years. The Apple brand is huge! The method that caused such widespread adoption in the first place of Apple devices can be found in one word –simplicity. Or, as Apple has put it, it just works.

People like to turn on a device with some power and just have things work without a ton of customization or setup. Apple is king in that regard and it is part of what has caused the brand to grow like it has. For example, I can just have a hard drive plugged into my MacBook and it will do regular Time Machine backups so if I ever need to restore it or move to a new computer, I just have to plug that drive in and wait a few hours and the new computer will look exactly like the old one (even applications will work without having to reinstall them!).

Simplicity is What Will Make the Apple Card a Huge Hit

Apple starts the whole process out with that simplicity. Simply open up the Apple Wallet on an iPhone and you will (eventually) have the option to apply for the Apple Card. In just a few minutes (and if you are approved), you will have your new Apple Card loaded onto your iPhone in your Apple Wallet to be used across your devices with the full credit limit at your disposal. This lets you get started with the card right away – and you did not even have to go to a regular bank website.

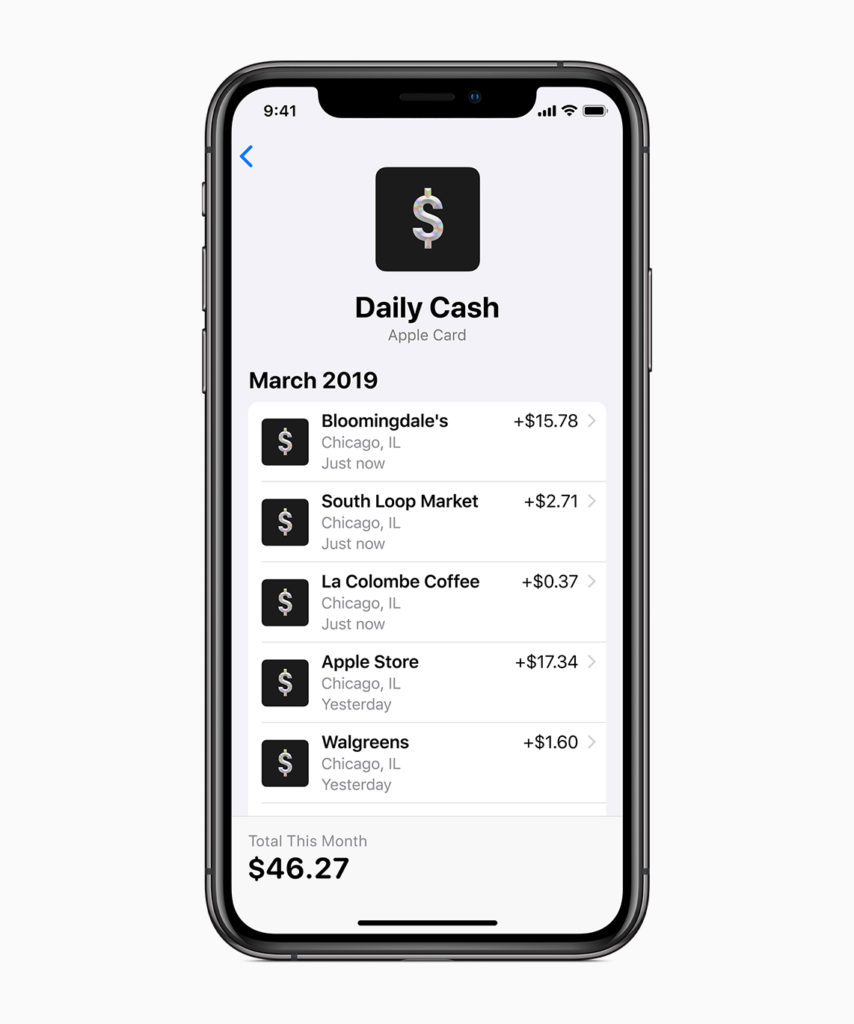

When it comes to earning rewards, that will also be simple. Earn 3% on Apple purchases, 2% on purchases made through Apple Pay, and 1% everywhere else. Combine that with the fact that this cash back will be available in your account the very next day and you again have a simple solution – no waiting 4-6 weeks for your rewards to show up in your account (though CapitalOne does this quick availability as well).

Daily Rewards from Apple Card

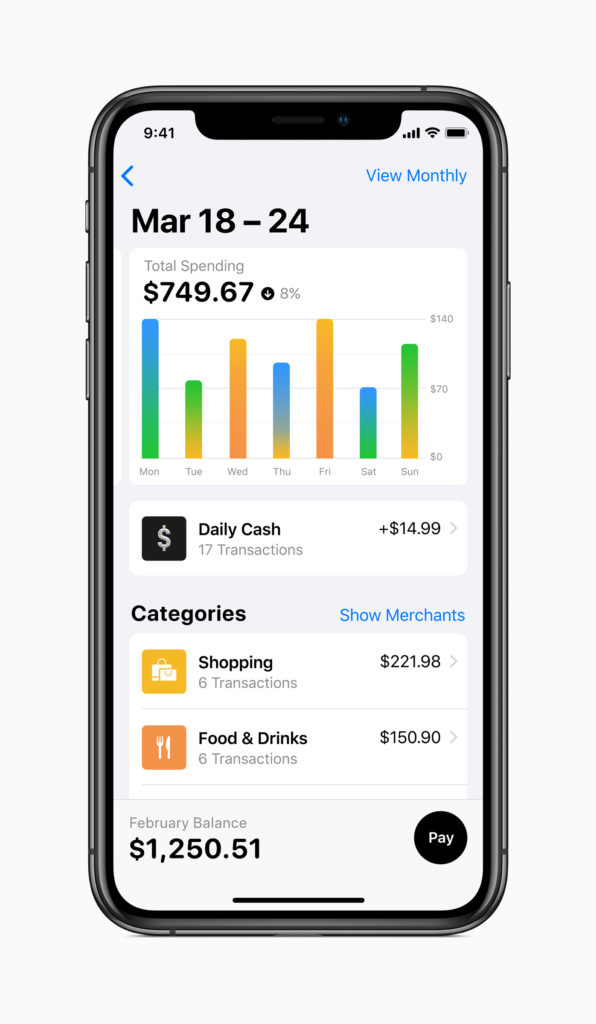

If you want to see more details at a glance, your spending summary and details can be quickly spotted through a simple graph and color wheel. Plus, you can dig down to see more about where the spending was done and categories. While other bank apps have some similar things, they really don’t operate like this.

Simplifying spending with the new Apple Card

Do you need to make an account update? Just send a quick iMessage and you can change things like your address, phone number, or get assistance. That is also just something so simple.

Oh, and then look at the simplicity of the fee structure:

- No Annual Fees

- No Late Fees

- No Over-limit Fees

- No International Fees

Summary

Is the Apple Card one that should replace any card in the serious reward earner’s wallet? No – there are better cards in each area of rewards. Still, even reward seekers may still consider it for just having that simplicity when traveling – kind of like a backup card in case anything else goes wrong with other cards or accounts.

What will make the Apple Card insanely popular with possibly millions of customers is the simplicity it will have. Hopefully, issuers like Chase, American Express, Citi, and Bank of America will try to catch up a bit in some of these areas so that we are not still living in the rewards world of circa-2000 when it comes to how things are processed.

I’m a big Apple fan and own dozens of Apple products. I use Apple Pay with my Apple Watch whenever I can. But my choices are pathetically slim. I can’t use Apple Pay for my groceries, my gas any hardy any restaurant. Aldi can’t use it at Home Depot, Lowe’s, Ace Hardware xnxx can’t use at Target without forgoing my 5% Red Card discount. So until Apple expands where we can use Some Pay and their new credit card, I don’t believe this will be the success the fan boys are touting.

OMG, Apple invented credit???? Let me get it now!

Can u use it to withdraw cash from foreign ATM without fees?

Initial reports suggested this might work. If yes, it’s a huge deal

[…] This month, the Apple Card will hit the streets (or, reasonably, the iPhones) for the tons of. From studying the boards and information tales since this novel credit score rating card was once first provided, there’s a ton of enjoyment about this credit score rating card and there’ll seemingly be an … Be taught Extra […]

[…] Source link […]

[…] NirmalaYadav comment on Role of Social Media for Marketing and Business – An unknown side […]

[…] card will likely appeal to Apple fans. You bet my wife and daughter will not get one though lol. How the Apple Card Is Going to Be Huge – Without a Sign-Up Bonus or Huge Rewards. Watch the big commercial credit card sales blogs sell this baby like hotcakes if a juicy affiliate […]

With respect, might I enquire as to whether your home is stuffed with Apple devices? If so, this review is pointless, it will be covered in internal bias. You yourself explain the card is rubbish. So what exactly is it about the card apart from the name? The only reason about half of the people who have iPhones continue to buy them is because Apple has deliberately trapped them. You cannot buy anything from the app store, it effectively stays the property of apple (try to take your iTunes with you if you move to android). You are in the other half, who would still buy an iPhone if they changed the outward design, gave it a new number but changed nothing else. Even if the better alternative was half the price. As I said, style over substance (especially since Jobs died). The card will be huge because people are stupid and a fool and their money are easily parted (not saying you are, as I assume you wouldn’t be daft enough to actually spend on this card).