Banks have been working hard to making earning bonuses more difficult. Citi’s rule is frustrating because the clock resets when you either open or close a card. For many, this means it could be 3 years between earning a bonus from Citi. When I saw the Citi Thank You Premier bonus increased to 50,000 points, I felt it was worth applying. I had the card a couple of years ago, but my calculation was off. Did my error prevent me from earning another Citi bonus?

Earning Another Citi Bonus Within 24 Months

Citi Thank You Premier Offer:

I won’t go into all the details of this card, but what peaked my interest to apply for this card again was the 50,000 point bonus. That is a lot of points and they have some crossover for with my Membership Rewards, which is always a great.

The offer of 50,000 points comes after spending $4,000 in the first 90 days of opening the card. Also, based on Citi’s rules, you are ineligible for this bonus if you have opened or closed any Thank You Point earning card in the last 24 months.

Applying for the Card:

I actually applied for this card in the car ( I was passenger 🙂 ) while driving to a wedding. I had this card before and thought it had been 2 years since I closed this card.

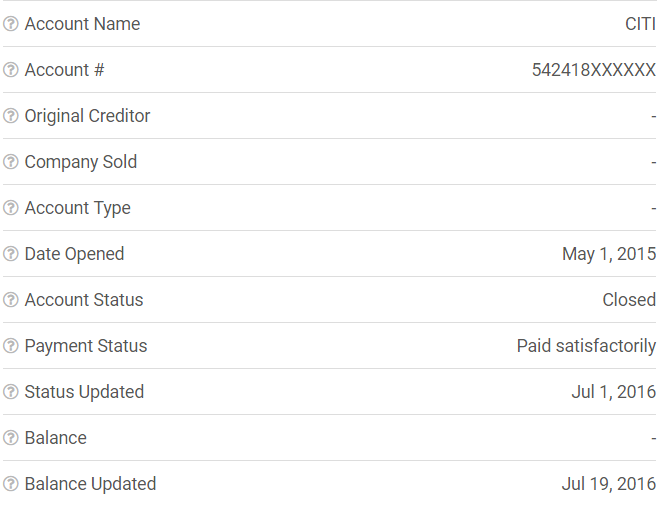

After quickly checking my Experian App to see if I would be eligible for this bonus again. It looked like I was eligible, so I applied. If I wasn’t eligible, it wouldn’t be worth my time to apply.

After, I clicked submit, I went to close the app and realized I was looking at the WRONG DATE! I saw I opened the card on May 1st, 2015, not closed it. I closed this card July of 2016, right before Citi’s new rules took effect. UGH!

Based on Citi’s rules I wouldn’t be eligible for this bonus since it has been about 12 months since I closed the card. I wouldn’t be eligible for another Citi Thank You bonus until July of 2018.

Now I was mad at myself for not reading this carefully, but after I hit submit I was asked to call Citi for more information. I called, since I already took the hard pull hit.

After answering a few questions I was told I was approved. Well that was great, but it didn’t matter at this point. Until…

Out of nowhere the representative gave me the details about the bonus categories and I would receive 50,000 points after spending $4,000 in the first 90 days. I perked up hearing this and asked her again about the bonus. She repeated I would receive 50,000 points after spending $4,000 in the first 90 days.

I wrote down the time and date of the call as “All calls may be recorded for quality assurance.”

Now, I doubt the word of one customer service representative would actually hold up if I weren’t to receive the bonus. Either way, I felt I was going to try for this bonus.

Receiving my Card:

When I received my card, there wasn’t any information about my welcome offer. This type of information doesn’t always come, but in this case I was unsure if I was actually going to receive my bonus.

I decided to call Citi to activate my card and ask about the welcome offer.

After activating my card, I mentioned there wasn’t any information about my welcome offer. The representative asked me which offer I was referring too. I mentioned the 50,000 points after $4,000 spend.

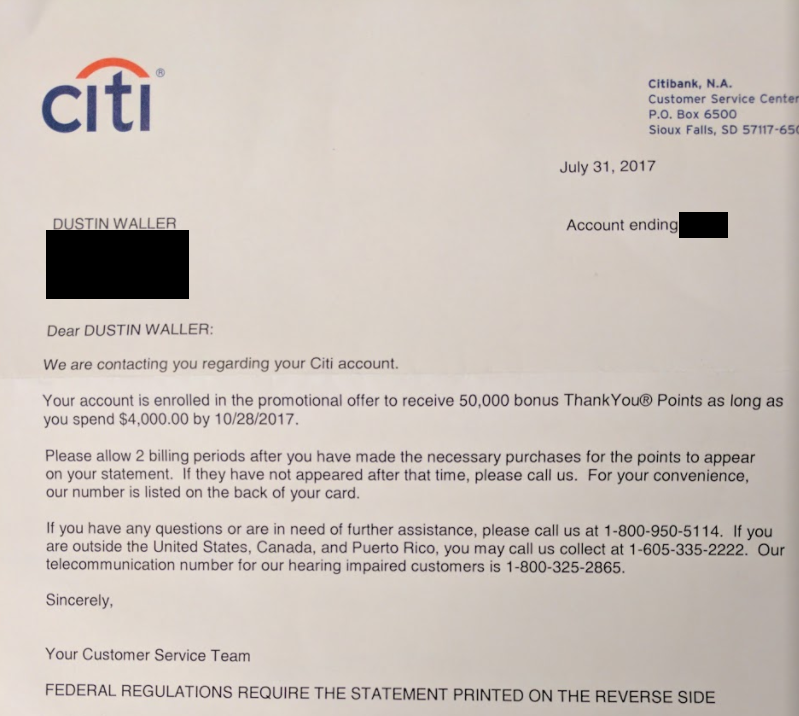

After a few more comments and questions, she was able to confirm that the 50,000 offer and $4,000 spend was on my account. She did even better by asking me if I wanted a letter sent out to me telling me about my welcome offer.

Absolutely, I did! The representative told me it would be delivered in 7 to 10 days.

Sure enough, in the next week this letter was delivered to me.

With 2 phone calls and this letter I was feeling very confident that the points would end up in my account, one way or another.

Did the Bonus Post?

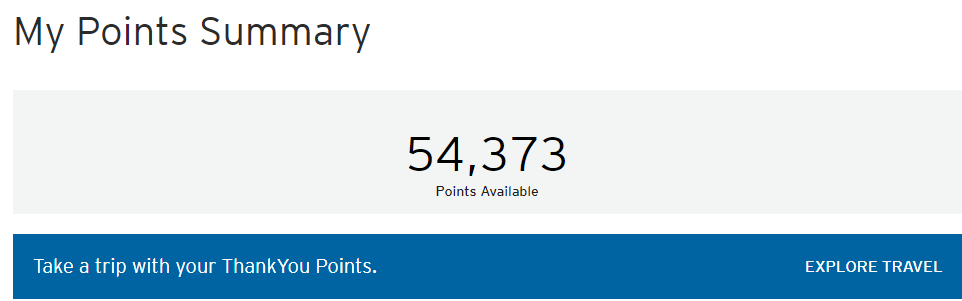

I had some bills to pay which I paid via Plastiq. This caused me to hit my minimum spend before the first statement close, so it was just a waiting game. My statement closed just the other day and when I logged on to my account, this is what I saw…

The points posted the day after the statement closed!

If the bonus didn’t post, I was fully prepared to call/message and see why I didn’t receive the bonus. Thankfully, I didn’t have too.

Playing with Fire:

I have no problem taking some risk in this game, but this was not a risk I would have taken had I read the right date. This was a miscalculation on my part, which could have not only cost me a bonus, but a hard pull. Not to mention reset my clock again for another Citi bonus.

In making this mistake and seeing the bonus post anyways, you can guess I am quite happy.

I am not sure I would push your luck, but this did make me think about Citi’s 24 month rule. There seems to be a lot of information out there about it, but also plenty of confusion.

I closed all my Thank You Earning cards before the new 24 month rule went into effect. Did I just happen to get lucky or did Citi not enforce this new condition on cards closed before the new language went into effect around August of 2016?

I am just one person, so it would be good to hear others experiences on this issue. Since many have held off to not be denied a bonus, I’m not sure if others who closed their cards before the roll out of this new language would/have received the bonus or not.

After my experience, I have started to wonder if someone who closed all of their Thank You Point earning cards before the new 24 month rule could receive a bonus.

Conclusion:

Fortunately, I received the bonus after closing my card a year prior. I received verbal confirmation twice and even received it in writing, just to be safe. It’s always a good idea to document these conversations, just to be safe.

If you have closed a card after Citi’s new 24 month rule went into place, I would definitely not try your luck. Someone who closed all their cards before the new rule, like myself, you might be eligible for the bonus again. There’s no guarantee you would earn the bonus again, but my gut says it is possible.

Have you received a Citi bonus after the new rule? Are you considering trying for a bonus, if you closed all your Thank You cards before the new rule took place?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!

Does AT&T arrival plus also comes in the category of TYP earning cards. I closed this one two months ago so not sure if I can apply for Citi prestige card

Hey Caveman,

Everything I have seen/read says the AT&T cards are considered different products from the other Citi TYP earning cards. I’d feel comfortable saying you are good for the Prestige personally. The T&C only mention Preferred, Premier, and Prestige in that category.

Thanks for reading! I appreciate it!

Dustin

[…] Earning Another Citi Bonus Within 24 Months by Running With Miles. Very interesting… […]

One of my readers was able to get the bonus on Citi AA card (twice!) despite the fact that she wasn’t eligible for it. I think it’s YMMV type deal. Personally, I wouldn’t chance it. Either way, congrats!

Hey Leana,

That’s great! I agree it probably a YMMV deal. It’s always good to hear stories of people who somehow get around banks for a bonus :-).

Thanks for reading! I appreciate it!

Dustin

The problem is if u don’t receive the bonus again, then the clock resets by opening the card again. So, back in the line again..

Hey ff_lover,

I agree, I had even made a comment in my post about that. Nobody wants to wait another 24 months to get another bonus, so I can completely understand the reservation about applying for Citi cards.

Thanks for reading! I appreciate it!

Dustin