Apple has an event going on right now and, say what you want about Apple, their marketing machine has done a good job. Thanks to Apple Pay, they have learned a lot about their customers and how the system is used all over the world. Today, they have announced their next step – the Apple Card.

Details on the Just Announced Apple Card

Apple is not positioning this card to take on the great reward credit cards from banks like American Express, Chase, and Citi.

The Apple Card – No Fees

Instead, they are going after them in a different way – fees. Apple is positioning this new Apple Card as a card that lessens or gets rid of many fees altogether. Here is how that part is working.

Apple is promising lower interest rates and they are also promising that the Apple Card will have none of these fees:

- Annual Fees

- Late Fees

- Over-limit Fees

- International Fees

With many of our favorite credit cards not having international fees, that is not a piece of great interest. But, the fact that this card will have no late fees and no penalty increase on interest is something that is not present on those cards that we love.

Apple Card Details

This card is being issued with Goldman Sachs as the issuing bank. Furthermore, it will be in the MasterCard network.

In Apple fashion, you will actually be able to sign-up for this card right from your Apple device and it will automatically be added upon approval.

If you want a physical card, you can get that but it will be like no card that you have. There will be no numbers on the card at all and no signature. Just the white Apple Card and chip.

Apple is going for the privacy angle with this as well by promising that your information will never be sold and all purchase information will be kept on device, not with Apple. So, Apple will never know what you are buying (this would be a great thing if they offered bonus points on those merchants that have gift cards to purchase!).

If you need to change something with your account, a simple iMessage to Apple will get that done.

As far as purchase history and tracking for yourself, Apple will use their own Apple Maps to help give details on each transaction so you know exactly what it was and where and they will give you all the graphics so you know where your money has been going.

The card will be available for applicants this summer

Apple Card Rewards

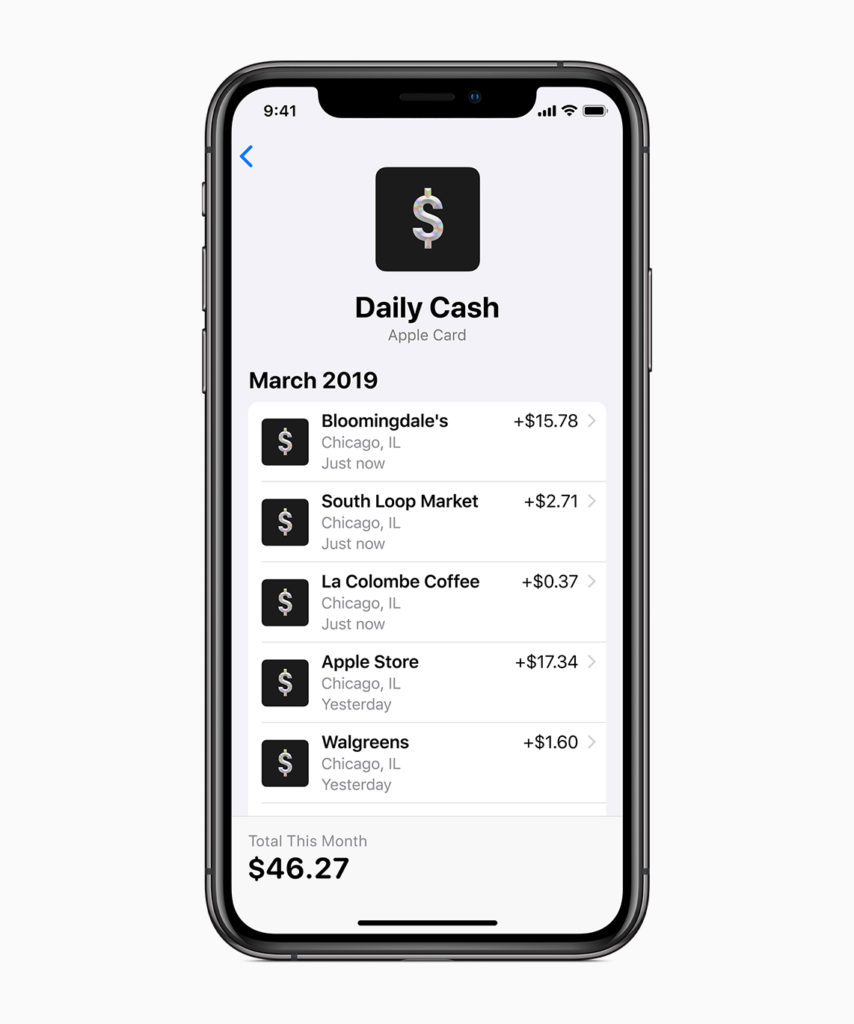

Daily Rewards from Apple Card

This will not be a rewards card that many of us will want for travel but it does have some decent rewards, especially how they will be rewarded.

For purchases made from Apple, you will get 3%. All purchases made through Apple Pay will earn you 2% in Daily Cash and all purchases made with the physical card will give you just 1%.

This reward structure is called Daily Cash and it means just that. Each day you will receive your cash amount in your Apple Pay Cash account. Yep, every single day! No waiting for rewards!

That means that this could, essentially, be a 2% cash back card everywhere since Apple Pay is being accepted in so many places now. Yes, the US Bank Altitude Reserve gives 3 points per dollar for Apple Pay purchases but that card comes with a high annual fee.

Summary

It will be interesting to see how this all works in the real world. I am interested in getting it for non-category bonus purchases and it should just work since that is Apple’s mode of operation.

no cash advance or fx fees means this would be great for getting cash out of ATM when abroad