As ticket prices fall and programs change, so do I. Currently I am earning points (since the bonuses are high), but I’ve always had a love affair with cash back. Although points are still be the better option currently (only due to bonuses, IMO), I consistently gravitate towards cash back.

I do believe cash back will be the better currency for travel soon enough. When looking at cash back options, I like earning 5%, who doesn’t right? This leads me to an undervalued 5% card, the US Bank Cash Plus.

Credit Card Review: US Bank Cash Plus

Credit Score Needed:

When looking through Credit Board Pulls, the lowest score approved was 682. Most of the people who listed their information were in the mid 700’s. I have always told people who are interested in this game to wait until they are at least a score of 700.

If you take a look at the scores, you’ll see there are some scores of approval with people who have scores less than 700, but apply at your own risk. Chances are much higher when your score is greater than 700.

Sign Up Bonus:

Currently the sign up bonus is $100 cash bonus after spending $500 in the first 90 days. On top of that, if you redeem $100 or more, you will receive an extra $25 bonus. This will occur only once per account.

In total, you are looking at $125 bonus for spending $500. This is a solid 25% return while earning your bonus. Not to mention the cash back you’d earn for your spend as well

Annual Fee:

This card comes with no annual fee, so there is no reason to cancel this card if you have it. This will help extend the age of your credit history. Plus long term, you can earn a lot of cash back for no fee.

Earning Rate:

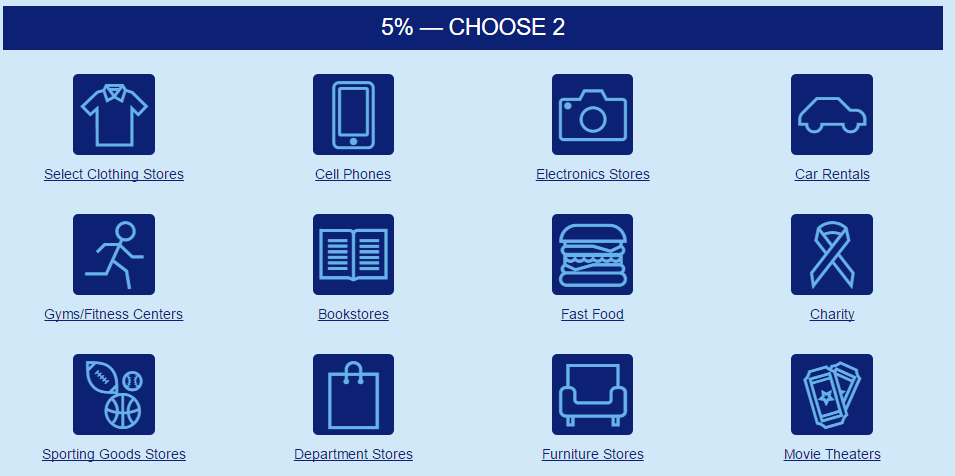

This is probably one of the more underrated cards when it comes it’s ability to change the bonus spend categories. Last week, I told you how I think how personalizing your credit card could really change the credit card game. The US Bank Cash Plus allows you to change which categories you would like to earn 5% cash back quarterly.

This is a great perk, since it allows you to control more of your earning. Cards like the Chase Freedom or Discover It are great, but you are stuck using the bonus categories they select. If you take a trip every summer and rent a car, you can select that category to make sure you are earning 5% back. Or if you give to charity every year around the holiday season, you can earn 5% back for your donations.

The US Bank Cash Plus card allows you to pick 2 categories where you earn 5% cash back, on the first $2,000 spent per quarter. You will also pick a 2% cash back category. The real draw here is the ability to pick your 5% categories every quarter. The 2% category is less appealing since 2% cash back (possibly 2.5%) is the minimum amount you should be earning.

Categories that earn 5%:

The options of 5% categories here is actually quite impressive, especially if you can select the right type of gift cards at certain retailers.

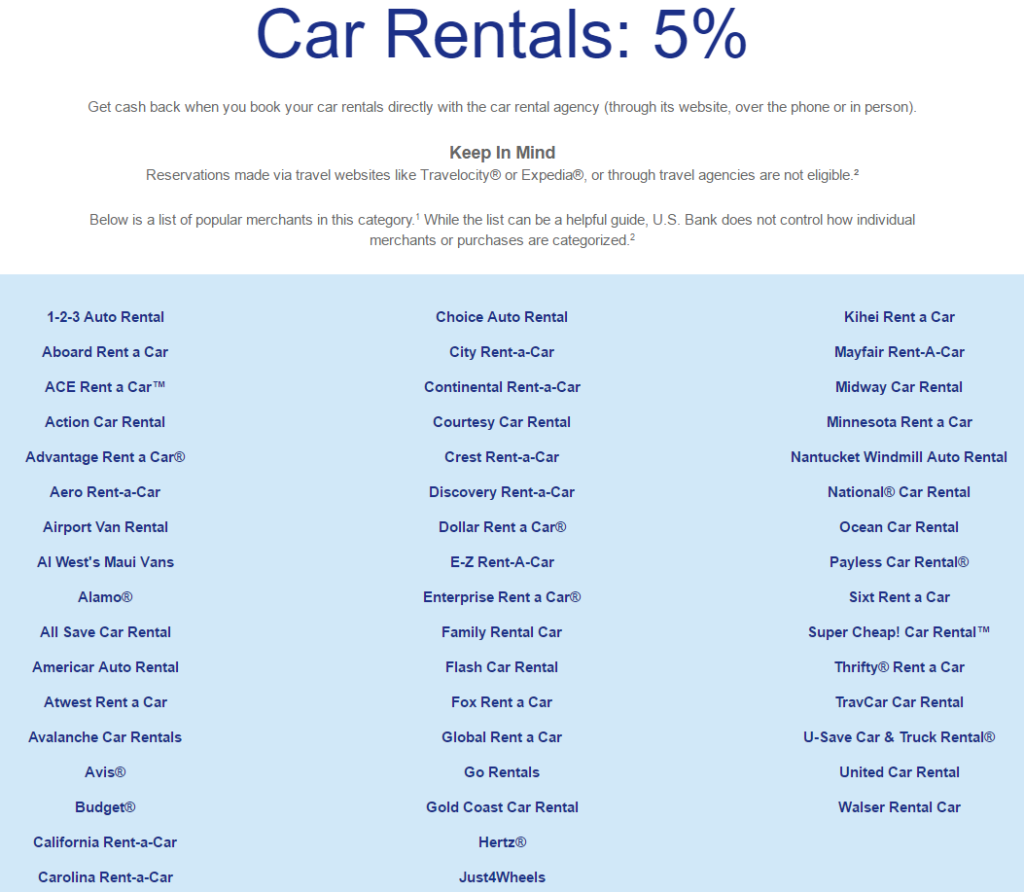

This is all depending on your goals, but 5% cash back is pretty hard to beat. There is a long list of car rental agencies and you can stack these with other promotions. Not to mention if you have a credit card that gives you status on car rentals, you can earn 5% back while using those benefits.

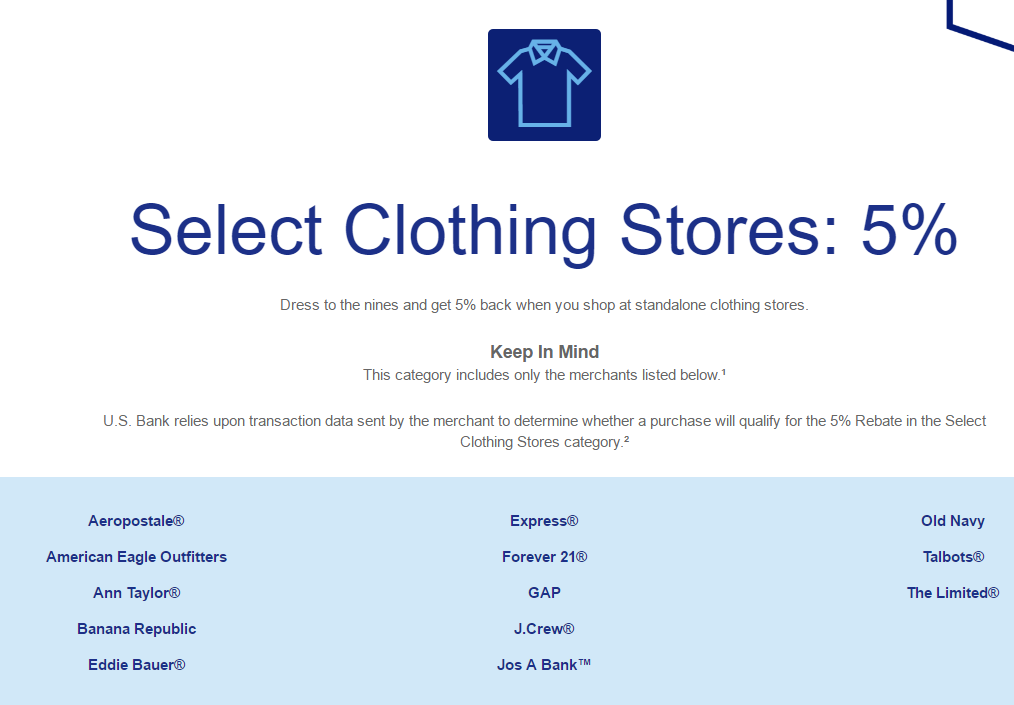

Although this isn’t a long list of clothing stores, some of these stores offer great discounts on their products. There could be cards better for this, but having the option for 5% back during back to school shopping, for example, could be a nice way to add some money back to your account

This is the category that really caught my eye. Stores like Apple don’t come along too often with other 5% cash back cards (or can be excluded), but with the US Bank Cash Plus card you can select it each quarter. Not to mention stores like Newegg and Best Buy are on this list.

The list on US Bank does seem to do be slightly outdated though. From the best of my knowledge, Cowboom closed and moved to Best Buy Outlet. It would be nice if they were to update this list as well.

This list is not all inclusive of all the Sporting Good Stores that earn 5% cash back. The one store on this list that catch my attention especially for my running gear/shoes needs is Road Runner Sports. Typically, Road Runner Sports has some pretty solid portal payouts as well, plus of you are a VIP member, your discount is even greater.

Overall:

I think having many 5% cash back options is great to choose from. The freedom and flexibility to change (or keep) your categories is quite nice. If you are one of the people who can max out the $8,000 in spend per year at 5% cash back, you’re looking at a cool $400 cash back.

Foreign Transaction Fees:

This is definitely a card to leave at home if you travel abroad. I don’t think I have seen this before, but US Bank list foreign transaction fees as:

- 2% of each foreign purchase transaction or foreign ATM advance transaction in U.S. Dollars

- 3% of each foreign purchase transaction or foreign ATM advance transaction in a Foreign Currency

Now, I did say above to leave this card at home, since there are plenty of cards that offer no fees internationally. That being said, I have always paid in the currency of the country I am in. I have kept an eye on the USD amount it would have been had I let the merchant convert for me. It was always higher.

Another consideration using this card abroad, is the fact Visa exchange rate is higher than that of Mastercard, and in my own experience American Express.

Again leave this card at home,but if you must use this card, you should try to weigh the 1% difference between paying in USD or the currency of the country you are currently in.

Redemption:

The redemption options are straight forward. This is one of the largest draws to cash back,in my opinion. Less hassle of award charts and rules. You’re also not restricted to a handful of partners, but you could give up some “potential value” to earn cash back.

When redeeming your cash back, you can:

- Deposit into US Bank account

- Use as statement credit

- US Bank Rewards Card- which is a gift card

If you are redeeming for a US Bank Rewards card, there is a $20 minimum and must be done in $5 increments from that point.

If you were looking to redeem your cash into your US Bank account or as a statement credit, you have no minimum redemption amount.

When you make your first redemption of $100 or more (remember the sign up bonus is $100 after $500 spend), you will receive a one time $25 bonus. That’s a nice little boost to your cash back account

I wish there was an option to redeem your cash back into your non-US Bank account. The cash back I earn, I typically cash out and put into my “travel fund.” It lets me keep an eye on the money I have for travel. I am also not a big fan of credit statements since I can’t directly move the money into one central location.

I have found away around this with other banks though. When you redeem your amount for a statement credit, you’ll want to make sure you have a $0 balance. Once the statement credit post to your account, you will have a negative balance. Once you see this, you can call/chat/message the bank and let them know you have a credit on your account. You just need to tell them to mail you a check for your credit.

I have yet to run into an issue this way.

Other Perks:

The US Bank Cash Plus is a Visa Signature card, so you receive all the standard benefits of a Visa Signature.

Outside of the standard Visa benefits, this card doesn’t offer much for “extras.” I guess you can’t blame US Bank for this, since the card comes with no fee. Overall the benefits are “boring,” but it if are looking for extra perks and benefits this card probably isn’t on your radar to begin with

Conclusion:

The card doesn’t get much exposure, but I think it is actually underrated. Especially when you factor in the fact it is 5% on the first $2000 spent per quarter in the 2 categories you select. As the game changes, we must be looking at all options to make sure we can make the most from our earnings.

Being able to select your bonus categories allows for more flexibility compared to the other 5% cards on the market. That said, this would be a solid compliment to those cards to really boost your 5% earnings.

If cash back is what you like to earn, this would be a great card to add into the rotation.

Do you have the US Bank Cash Plus? What is your favorite cash back rotation?

Don’t forget to Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!