It is has been a rough year for credit card churners. First we had the gradual move on Chase’s part to go with what has been called the 5/24 rule – no new card applications if you have 5 new accounts (with any bank) in the last 24 months. Then we saw Amex institute their once-in-a-lifetime rule for business cards. Now, Citi has made a change.

Citi Changes Timetable For Churners

Citi used to have language on their credit card applications that said “_____ offer is not available if you have had a Citi® _____ Card account that was opened or closed in the past 18 months.” As I said earlier this year when applying for my new Citi AAdvantage cards, that is great for people who have had the card for a while as they can still apply and earn the points while holding the card already (as long as it had been for 18 months or more). The biggest issue was if you closed the card to open the new card. Then the 18 month clock reset.

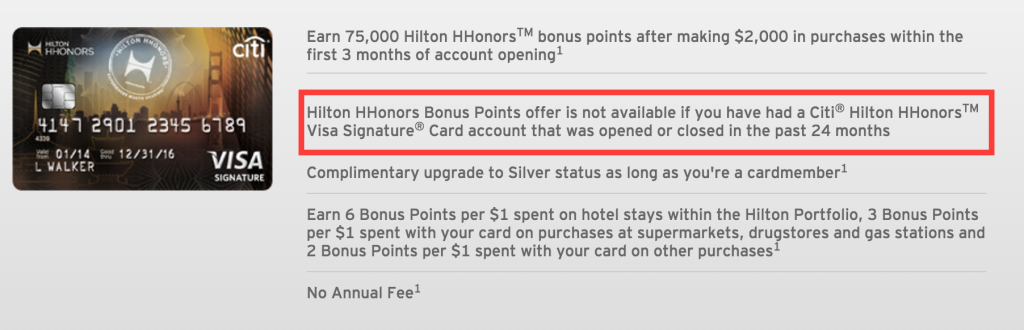

The New Language

Today, Citi has changed the language on many of their cards to this – “__________ offer is not available if you have had a Citi® ________ Card account that was opened or closed in the past 24 months.” They went from 18 months to 24 months for the period of time for opening and closing the card.

Is this a big deal? Not really since it is only adding on 6 months to the card membership. Plus, it will put it in line with when the annual fee is due and you can cancel that older card after you apply and receive the new card. The big deal is that you are aware of it. If you are used to applying for cards on a 18 month cycle, you will need to know next time going in that it is now at 24 months.

Still Better Than Chase & Amex!

Even with this change, Citi is still more churner-friendly than Chase & Amex! Citi did not say it had to be 24 months since you received the points and you cannot currently hold the card (Chase) and they did not say you are not eligible for the points if you ever held the card before (Amex). It is simply a waiting issue of an extra 6 months.

Summary

If this is Citi’s big move for churners this year, then I think we could all be happy about it. Citi still has some great cards and offers and I know many of us will be concentrating some of our efforts on them as time goes on. Thankfully, they are still churner-friendly over all – at least more than Chase and Amex.

HT: Doctor of Credit

Is there a way to check when a Citi account was opened? I’ve done product changes to my cards when then annual fees come due so I don’t have a clue how long it’s been.

You can call and ask. Otherwise, check previous statements online to see which product it was referencing.