Over the last year, I have been pretty active earning American Airline miles from bonuses. I opened the Barclay Aviator Red, Citi Business Aadvantage Platinum Select, and the Citi Aadvantage Platinum Select. The fee just posted and I decided to give Citi a ring to see my options for a retention offer.

Citi Aadvantage Platinum Select Retention Offer

Anytime I have a credit card, I usually go through the same steps to decide if I want to keep the card or not. This usually ends up with a call to the bank seeing if there are any retention offers on my account.

My process for the Citi Aadvantage Platinum Select was no different. I had very little plans on keeping this card, since the fee outweighed the benefits for me. I opened all of these American Airline cards for the points, since the bonuses were so high.

I’ve pretty much just burning my American Airline miles this year because I had plenty.

Making My Call:

I didn’t put much for spending on this card outside of the minimum spend requirement, so my expectations were set accordingly.

After a few minutes of verifying information and mentioning some of the benefits I enjoy, like free checked bag. The representative said he’d be right back as he looked up my offers.

When he returned he sounded quite happy to inform me I did have an offer on my account. He said, I had an offer for 1.99% interest blah blah blah. I really stopped listening once he said my offer was for a reduced interest rate.

I did ask if there were any other offers and there were not.

Now, I had a few options:

- Keep the card and pay the annual fee- Nope

- Downgrade to fee free version – Meh

- Try to product change to another card- Possible

- Flat out cancel- Possible

My Realistic Options:

Since there weren’t any offers I’d actually take for my Citi card, I was very close to just canceling the card. When I asked if I convert my American Airline card to the Citi Dividend card.

I thought I had read I could convert to this, but honestly, I couldn’t remember and I’ve never tried. I typically just cancel my Citi cards since there usually aren’t alternatives that work for me.

When I asked if I could convert to the Citi Dividend, the representative took a look and said I could do that if I wanted. Although he pushed pretty hard for me to convert to the Double Cash, which I already have.

With the option of converting to the Citi Dividend available, this took top option for me.

Why The Citi Dividend?

If you remember, I earn cash back as my day to day currency and open point cards for their bonuses. This works really well for me and my travel habits/goals.

The application for the Citi Dividend is long available. The only way to get the card is through product conversion.

The Earning Rates:

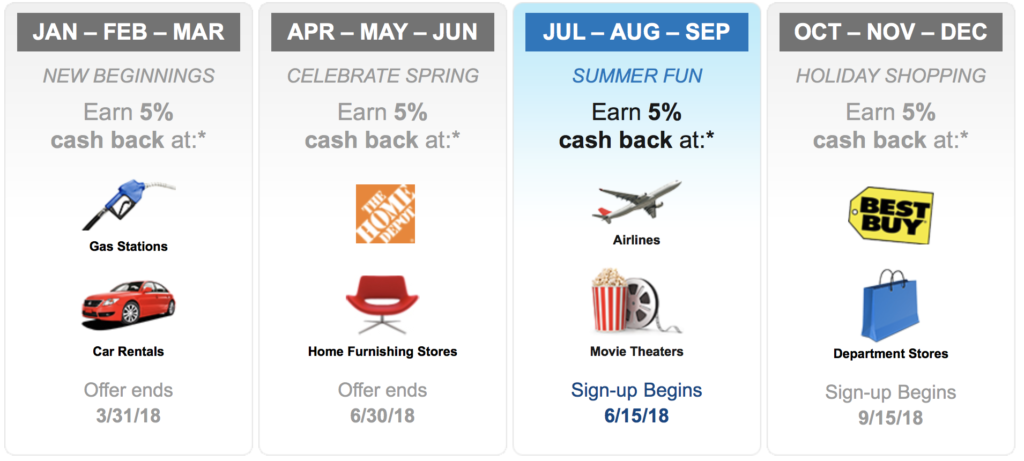

The Citi Dividend is another 5% rotating category card, which I’ll add to my Chase Freedom and Discover It credit card mix.

The quarterly categories for 2018 look like this:

I actually have a few trips coming up that I haven’t booked yet, but I’ll most likely put my taxes and fees on the Citi Dividend since I’ll earn 5% back.

Other Reasons for Dividend:

There is one benefit the Citi Dividend has that I like over the other rotating 5% category credit cards. The $300 of cash back of 5% rewards is not split between each quarter.

You have the option to spread it out, or if you knew you had home renovations (for example), you could have spent $6,000 in quarter 2 and earned your $300 cash back rewards.

While these categories are set for the year, you can plan how you plan to take full advantage of the 5% categories.

Citi Bonus Cash Center:

I and a HUGE fan of shopping portals and I use them every chance I can get. Now that I have a Citi Dividend this gives me access to the Citi Bonus Cash Center.

Will this be the best portal to use? Maybe, maybe not. This portal does show up on cashbackmonitor.com, so I’ll be sure to check there before I make my purchase.

This just gives me another portal I can use and potentially score a higher return on my purchases.

The Negatives Of Converting:

While I think this conversion is great for me, there were a few negatives.

Conversion Time:

This one really threw me off when I was being told this information. Anytime I have converted a card from any other bank, I was set to go from that moment on. The conversion was complete once the representative made the update in my profile and away I went.

Converting my Aadvantage Platinum Select to the Dividend card is going to take a month! I won’t be receiving my card until August, which I thought was pretty crazy.

I have no idea why it takes so long to convert a card within Citi’s portfolio, but it does. It’d be great to see Citi reduce this time to be instant like other banks.

Resets My Clock:

There was a slight moment of hope that when I would convert my Aadvantage Platinum Select to the Citi Dividend card, my account numbers would stay the same.

Why is this important?

If my account number changes, this will reset my clock and I will need to wait another 24 months to get another American Airline bonus from Citi.

When the representative read over the product conversions information, it was stated I will be receiving a new account number. Dang!

This means I won’t be eligible for another American Airline bonus until 2020, unless I find an offer with no bonus restriction language. I have other currencies I can use, but the bonuses make it so easy to earn a lot of American Airline miles.

Conclusion:

I had every intention on canceling my Aadvantage Platinum Select credit card, but being able to convert this to a card that will actually get some use is a win for me. The yearly $300 cash back limit (on 5% categories) isn’t bad since I can spend this all in one quarter if I needed too.

Have you converted your Citi cards to another product? If so, what did you convert to?

Consider Subscribing to my YouTube Channel, Like me on Facebook, or Follow me on Twitter. If you have questions, comments or would like a topic, leave a comment. Thank you for reading!