Last year, the new Aeroplan (Air Canada’s loyalty program) launched and with it came some good news and bad news. Part of the new launch meant that Chase and Aeroplan would eventually team up in a transfer partnership as well as a new credit card. Well, that time is now!

Transfer Chase Ultimate Reward Points to Aeroplan

Link: Chase Ultimate Reward to Air Canada Aeroplan

So, why is this good news? Air Canada’s Aeroplan is already a transfer partner of another very popular points program – American Express Membership Rewards. Not only that, but there have been some nice transfer bonuses over the years as well, up to 40% as of most recently. That has always been a solid use of American Express Membership Reward points for flying on Star Alliance flights – especially in premium cabins. But, it always helps to have another transfer partner!

That is why this is good news for all Chase Ultimate Reward fans. Chase has a popular Star Alliance partner with United Airlines but there is some nice value in having a transfer partnership with Aeroplan as well. For example, here are some perks of using Aeroplan miles over United miles on a simple NYC – Germany business class flight:

- United charges 77,000 miles one way for this flight

- Air Canada charges 60,000 miles one way for this flight

- Air Canada also offers a capped rate of $25 (CAD) for lap infant fares

- United charges 10% of the cash fare for lap infants

If you are traveling with a lap child (which is totally doable in business class for sure) Aeroplan is a instant winner. Not only that, but you will pay far less in terms of miles for such a flight above. Not every flight will be that much of a savings over United but some routes certainly are.

Air Canada will also let you add a stopover on one-way flights for just 5,000 miles each. This is a great perk that is better than United if you plan on doing such trips.

Now, on the United side, if you are flying any segments that are on United flights, having a United credit card or United elite status could open up award space on those flights – flights which might otherwise show no availability. This is something I have struggled with quite a bit over the years when I want to redeem with Aeroplan but a segment would be with United.

Lastly, as just a short list of differences, you can actually use Aeroplan miles to redeem for Etihad Airways flights as well as Air Serbia flights. Not sure if Air Serbia is at the top of your list (I will be trying out their new business class cabin in just a few weeks between the US and Belgrade) but the good thing is that there is typically consistent award space available on the JFK-BEG route so that is a nice way to get into Europe. Of course, with Etihad, you get a great airline experience also.

Like the other airline partners of Chase, the transfer ratio from Chase to Air Canada is 1:1 and the transfers take place in 1,000 point increments. Like I mentioned, Amex has had transfer bonuses but Chase almost never has had those so it still may be good to use Amex points for that – if a transfer bonus pops up.

Is There a Somewhat Fixed Value on These Points?

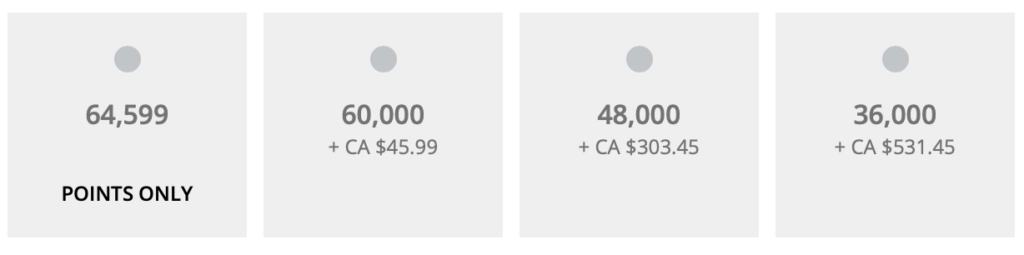

Lastly, this certainly is good news because it gives more value but remember that there is somewhat of a fixed value with your Chase points when redeeming with Air Canada. For example, our NYC-Frankfurt example above would cost 60,000 miles plus $45.99 in taxes/fees (CAD). But, you can actually choose to use even fewer miles if you are willing to supplement cash. Here is what that looks like on this particular itinerary.

In this example, if you wanted to save 12,000 Chase points, that would cost you $205.55 (USD as of the time of this post). That translates to paying 1.7 cents per point to keep those 12,000 points with Chase. If you want to save even more Chase points from being transferred to Air Canada, you could opt to pay $387.51 (USD at the time of this post) and save 24,000 points. That works out to a nice 1.6 cents per point.

I don’t know about you, but I value my Chase points at more than 1.6 cents per point for outright travel redemptions. The reason is that I can get a consistent 1.5 cents per point when redeeming those points out of my Chase Sapphire Reserve account for things like dining/grocery/home improvement purchases or using them to pay travel directly through Chase.

So, that is something to think about as there is somewhat of a fixed value of the Chase points to Air Canada if you are willing to pay that rate to keep the Chase points. Of course, you still need at least 36,000 miles in the example above so it is still beneficial to transfer something!

New Credit Card Coming – Get a 10,000 Mile Bonus Now

Link: New Chase Aeroplan Information

Lastly, there is a new Chase Aeroplan credit card coming out. Air Canada wants you to get excited about that so if you sign-up through this link to be notified (not an affiliate link), you will receive 10,000 bonus miles on top of the regular bonus offer when it comes out.

My guess is that you would need to apply through that link they will send you to get that bonus so this is a smart move on their part. This means that you cannot apply through an affiliate link (like the ones I have and other bloggers have) to get that bonus – Chase is basically trading the affiliate payout for extra miles for you. I’m sure you like that math! 🙂 So, sign-up – it costs nothing to be notified!

Chase Sapphire Preferred – 100,000 Point Bonus Offer, worth $1,250 for Groceries, Dining , Travel & More!

The popular Chase Sapphire Preferred card is having a special bonus offer – 100,000 points! This makes this offer worth at least $1,250 in travel, groceries, dining, or home improvement!

- Earn 100,000 points after spending $4,000 in three months

- Transfer the points to popular airlines and hotels for maximum value!

- Use the points with Pay Yourself Back feature to pay for groceries, home improvement, and dining purchases

- Earn 2x points on all travel and dining!

- Annual fee of $95

- Application Link (this is a referral link that gives me points also)

[…] they come up with, any guesses? My guess is 75,000 Aeroplan miles. For more about this development, see this post at Running With […]