This month, the very popular premium travel card, the Chase Sapphire Reserve, added a $100 price hike to its annual fee. That annual fee not sits at just over half of a thousand dollars, $550 to be exact. With meager new perks (for Lyft and DoorDash), many customers have been closing their accounts or downgrading their cards. Here are 3 things that Chase could do to stop that from happening.

3 Things That the Chase Sapphire Reserve Could Do to Keep Customers

Link: Chase Sapphire Reserve (affiliate link)

First of all, I am being serious and realistic here so that means no 100,000 point sign-up bonus. 🙂 While there may be a 75,000 point offer at some point in the future, I don’t think we will ever see a public offer for 100K points on this card again (I really hope I am wrong!).

But, there are some things that American Express does that Chase could implement on this card. These work very well for Amex and these are things that help customers keep their Amex cards year after year.

Better Chase Offers on the Chase Sapphire Reserve Accounts

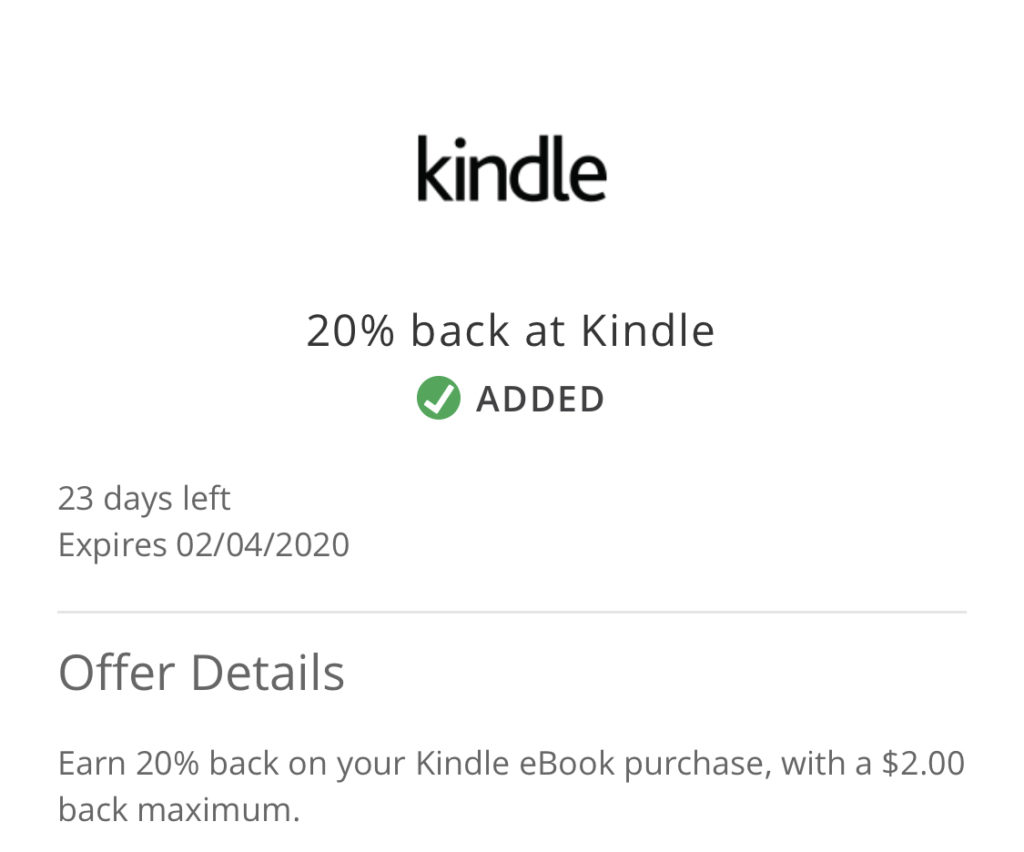

A while ago, Chase started offering their Chase Offers, similar to Amex Offers where you get some money back on purchases made with certain retailers. But, while it is possible to save the same offer to multiple cards (and Amex doesn’t allow that any more), many of these offers are pretty pathetic in terms of actual money back.

A total of $2 back on a 20% offer?! Do better, Chase!

I understand it costs Chase money but I also think that their most premium public travel card could be one that would offer better offers than on other cards. For example,

Not only would this make the Chase Sapphire Reserve more attractive to some cardholders but it would also encourage them to use it for more spending.

Personal Referral Offers on the Chase Sapphire Reserve

Most Chase cards have referral offers on them – meaning that current cardholders can refer other people to that particular card and the one that refers it gets some points if the new customer is approved. The Chase Sapphire Preferred has a 15,000 point referral offer with a cap of 75,000 points in a year.

The Chase Sapphire Reserve used to have personal referral offers but that ended over a year ago. With the increased annual fee, it would be a huge help for current cardmembers to have this as an incentive both to keep the card and to refer it to others. It will be a harder sell on its own now since it has a lower sign-up bonus than the Sapphire Preferred and costs so much more and anything Chase could do to encourage current cardholders would certainly help.

Transfer Bonus Offers

American Express frequently runs promotions where points transfer to partners at a better rate. Chase did this one time with a bonus transfer offer to British Airways but that is certainly not the norm.

Instead, they allow transfers to partners at 1:1. It would make the Chase Sapphire Reserve much more valuable to any fans of travel points if Chase Sapphire Reserve accounts would get transfer bonus offers from Ultimate Rewards to partners. Even something like a 20% transfer offer to United or Southwest would be a huge way to make holding the Chase Sapphire Reserve more valuable to customers.

This would be something that Amex does not even do as their transfer offers are sometimes targeted but not to their premium cards. It would certainly be a good move for Chase to copy Amex but take it a step further for their premium card.

Bottom Line

Whether Chase realizes it or not yet, the Chase Sapphire Reserve is going to need some help to retain the customer base it has had since the card’s introduction. DoorDash and Lyft are certainly not enough for most customers! I think the 3 things I listed here may just be something that could help keep those customers while keeping Chase happy as well.

I know these things would keep me a happy cardholder!

Yup, if things stay like they are I’ll cancel my card in Sept…I’ll have had the card 4 years at that point. I certainly didn’t expect to cancel the card.

They could reduce the fees in conjunction with a banking account, or allow interest payments in points. That’s a win-win for them.