The Chase Sapphire Reserve is definitely the most popular card in the last couple of years. Not only did it have a fantastic sign-up bonus (100,000 points – now 50,000 points) but it also has a rich $300 travel credit that really helps to offset the $450 annual fee. Now, the way that Chase dates that credit will be changing.

The Chase Sapphire Reserve $300 Travel Credit Is Facing A Change

When the card launched, the $300 travel credit was an annual credit based on a calendar year. That meant that all of us who received the card last year were able to double dip and get the $300 in 2016 and hit it again in early 2017 if we wanted for a total of $600 in travel reimbursement.

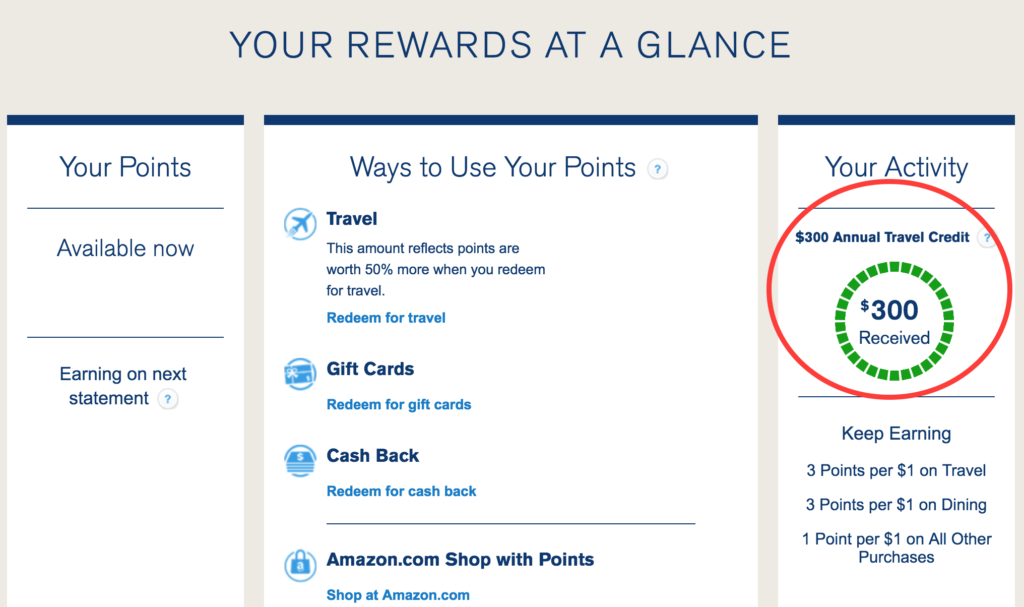

How to track your $300 Travel Credit with the Chase Sapphire Reserve

Change from Calendar Year to Cardmember Year

However, starting May 21, that will change from a calendar year to a cardmember year for new applicants. That means that it will be $300 each year, based on when you received the card. For all of us who already have the card, that is not that big of a deal.

But, for people that are considering the card, it is a big deal as you will no longer be able to double dip and get $600 in the first year. Definitely a downgrade for any future applicants and something to think about if you have not yet applied for this card.

On the landing page for your Chase Sapphire Reserve on the UR site, you can see how much of the travel credit you used.

Should You Apply for the Chase Sapphire Reserve Now?

Since the Chase Sapphire Reserve is under the 5/24 protection, chances are you would have already gotten this card if you could. But, if you recently cleared 5/24 and are just waiting for the 100,000 bonus to come back, this may be a really good time to think about getting the card.

Personally, I do not see the 100K bonus coming back as a public offer until at least this fall, maybe longer. If you are able to get this card now, I would definitely consider doing so as you will be able to get $300 in travel credit this year and early next year while only paying one annual fee ($450) – and also getting the 50,000 Ultimate Reward points.

Since the Chase Sapphire Reserve turns those Ultimate Reward points into a more valuable currency for direct travel redemption (1.5 cents per point instead of 1.25 cents with the other UR cards), you would be guaranteed a minimum of $1,350 in travel “money” in exchange for paying $450. Not bad to get a net minimum of $900 in a credit card bonus!

HT: Doctor of Credit