There is no question – credit card sign-up bonuses are the easiest, fastest way to earn all of our valuable miles and points. However, after the bonus is earned, credit card companies then try to pack the cards with enough perks to encourage you to continue using the card. As a result, we continue to use certain cards throughout the year. Then, we have to face the anniversary of our credit card bonus (or when we signed up for the card) and with that comes the annual fee. Most cards waive that annual fee for the first year but it comes down hard at the start of year two and then forces us to examine our benefits and spending habits with the card to determine if it is worth the fee for us to keep it.

But, what if some of our favorite cards came without a bonus? Would they still exist as our “favorite” cards? Let’s look at some cards that may be worth applying for even if they did not provide us with a sign-up bonus. From that, it can help us determine which card may be valuable to keep in spite of the annual fee.

Which cards are good even without the bonus?

There are a few different categories of rewards/travel credit cards:

- Co-branded credit cards These are cards like the Delta American Express cards or the Hyatt Chase card – cards that are offered as a joint effort by both an airline/hotel and the bank. They offer perks from the airline/hotel side of things while giving you a card that can be used anywhere

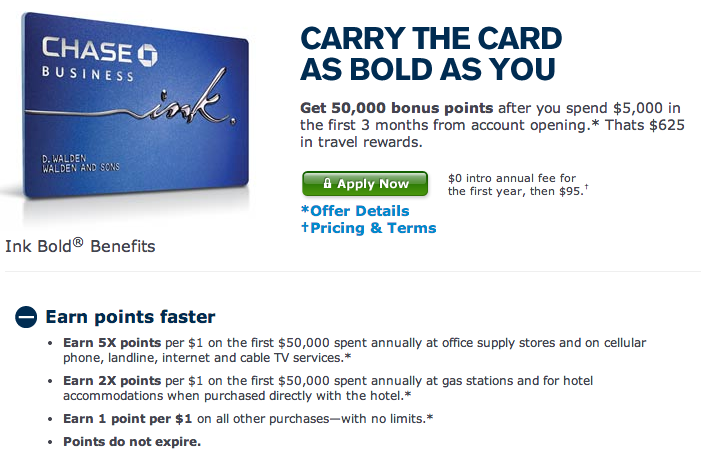

- Flexible reward cards These are cards like the Chase Sapphire Preferred and Chase Ink cards (which feed into the Chase Ultimate Reward program) and the American Express Platinum card and Premier Rewards Gold card (which feed into the Membership Rewards program). The perks from these cards and programs is that they normally carry some type of membership benefits as well as category bonuses. These points can be transferred into a variety of travel programs as well as merchandise awards.

- Cash Back cards These are cards that give traditional cash back on purchases (like the American Express Simply Cash business card) and those that give cash back for/towards travel, like the Capital One Venture card, US Bank FlexPerks card, and the Barclay Arrival card. These cards typically allow you to earn around a 2% cash back rebate when redeemed towards travel.

Each of those category of cards possess their own strengths for positioning as a “keeper”.

With the co-branded credit cards, the airline cards will offer benefits that are similar to their lowest level of elite status while the hotel cards offer actual elite status. If you use either the hotel or airline around 4 times or more in a year, you may find the card to be valuable for you because of the benefits. As a daily use card? Not so much. If you are just looking for a card to rack up points with, most airline and hotel credit cards are not the ones to use. That is because they are normally transfer partners with a flexible reward program (Ultimate Rewards or Membership Rewards) that can earn points at a greater rate and be transferred into your preferred airline/hotel program. So, the bonus is the huge lure to get you to sign-up and without it, there may not be enough value to keeping the card if you do not use that particular brand a couple of times a year.

With the flexible reward cards, they offer various categories for bonus point earning. For example, the Chase Ink Bold and Plus cards offer 5x points at office supply stores and telecommunication bills. That is a minimum of a 5% rebate – it can be of greater value when transferred to a travel program and used on expensive flights or hotels. Another example is the American Express Premier Rewards Gold card that offers 3x points on airline purchases from the airline. This is far better than what the different airline credit cards offer – they offer only 2% when used to book travel at their own airline. In addition to the point bonuses, there are also card perks that work to keep the customer satisfied. With the American Express Platinum card, it carries a wide-array of benefits that can help an individual in several areas of life and work. A card like that can be valuable even if it never leaves the drawer. A card like the Chase Sapphire Preferred is valuable for use – it really does the cardholder no good sitting in the drawer. With all of these cards, the bonus is to give you a taste of what can be done with the points, but the cards continue to be valuable after the bonus is gone because of the category bonuses. If you use the Chase Ink Bold or Plus, you can earn the amount of points that were offered as the sign-up bonus (50,000 points) by spending $10,000 at office supply stores.

Then we have the cash back cards. With respect to the cards that give cash back/cash off travel, these cards have programs that will give you right around a fixed redemption rate of 2% (the Capital One Venture gives 2 points per dollar spent, the Barclay Arrival card gives 2 points per dollar spent and a 10% rebate on pointed redeemed, and the US Bank FlexPerks card gives 1 point per dollar but can be redeemed for up to 2 cents per point). There may be small category bonuses but the real strength of these card is in the every day spending. You cannot transfer these points to travel programs but you can spend them on any travel so you are not locked into a particular airline/hotel or flexible rewards program. These cards offer sign-up bonuses that are worth between $200 to $440 or more depending on promotions. These bonuses are great, but the everyday point earning is also great. Again, these are not cards that are going to sit in your drawer. These are the cards you use for medical bills, bookstores, sport stores, malls, etc. These cards are very valuable even without the sign-up bonus.

Card List

So what are some of the cards that I think are worth having even if they did not offer a sign-up bonus?

[table “” not found /]

There is a lot more to each of those cards then I listed, but those are the general reasons why I would consider getting the cards even without a bonus. Why is this important? With Chase, you are technically allowed one bonus per card per lifetime. What if you were to cancel the card but were interested in getting it again later? Some have reported success getting another bonus, but many have not. Would you apply for it again even if you did not receive the bonus? For the cards above, I would. How about when the time comes around for the renewal? I know many banks are very good about offering retention bonuses to encourage you to keep the card, but what if nothing was offered? Would any of the reasons above be enough to keep the card? What are some of your reasons and do you think I might have missed some key cards? Add them in the comments!