I get a lot of questions from readers who ask for a lot of answers to basic questions. I had been intending for a while to add a Beginner Guide tab to the menu so each of the Back to the Basics will find their way into the tab. If you have basic questions that you would like answered, feel free to ask so they can be included here!

Back to the Basics – Earning Miles and Points

I have racked up over 1 million miles and points over the last year (that is, my wife and I have). When people ask me how many points I have or how many points it took to make a particular trip, my reply is normally met with either disbelief, headshaking, expressions of never being able to do that, etc. The next question normally has to do with how they can earn miles and points themselves (to learn about the difference between miles and points, check this previous Back to the Basics post). I hope this will help you learn how you too can earn miles and points.

Credit Card Bonuses

Credit card bonuses are definitely the most lucrative of ways to earn miles and points. Bonuses range from 25,000 points – 100,000 points with different cards! It would take a lot of spending to rack up as many points as you can get in one credit card bonus. These bonuses are awarded to customers who open a credit card account through a particular advertisement or link (not all links for the same card give the exact same bonus).

Credit card bonuses are definitely the most lucrative of ways to earn miles and points. Bonuses range from 25,000 points – 100,000 points with different cards! It would take a lot of spending to rack up as many points as you can get in one credit card bonus. These bonuses are awarded to customers who open a credit card account through a particular advertisement or link (not all links for the same card give the exact same bonus).

Once you are approved for that particular card, you will receive the card in the mail within 7-10 days. You have a set amount of time (normally 90 days, can be more or less) from the day that the account was opened (it is not the day you receive the card) to meet the spending requirement for the bonus. This means that the offer for that particular card is contingent on you meeting a set amount of spending within that specific timeframe. So, for example, (one of the most lucrative credit cards on the market at this time) the Chase Sapphire Preferred card offers 40,000 Ultimate Reward points after spending $3,000 in the first 90 days. In order to receive those 40,000 points, you will need to spend $3,000 on qualifying purchases (almost any spending counts with the exception of things like – credit card fees, transaction fees, balance transfers, finance charges) within 90 days from the day you were approved for the card (which is normally the day that you applied if you received an approval message at the time). These are credit card bonuses and one of the easiest ways to rack up miles and points.

Shopping Portals

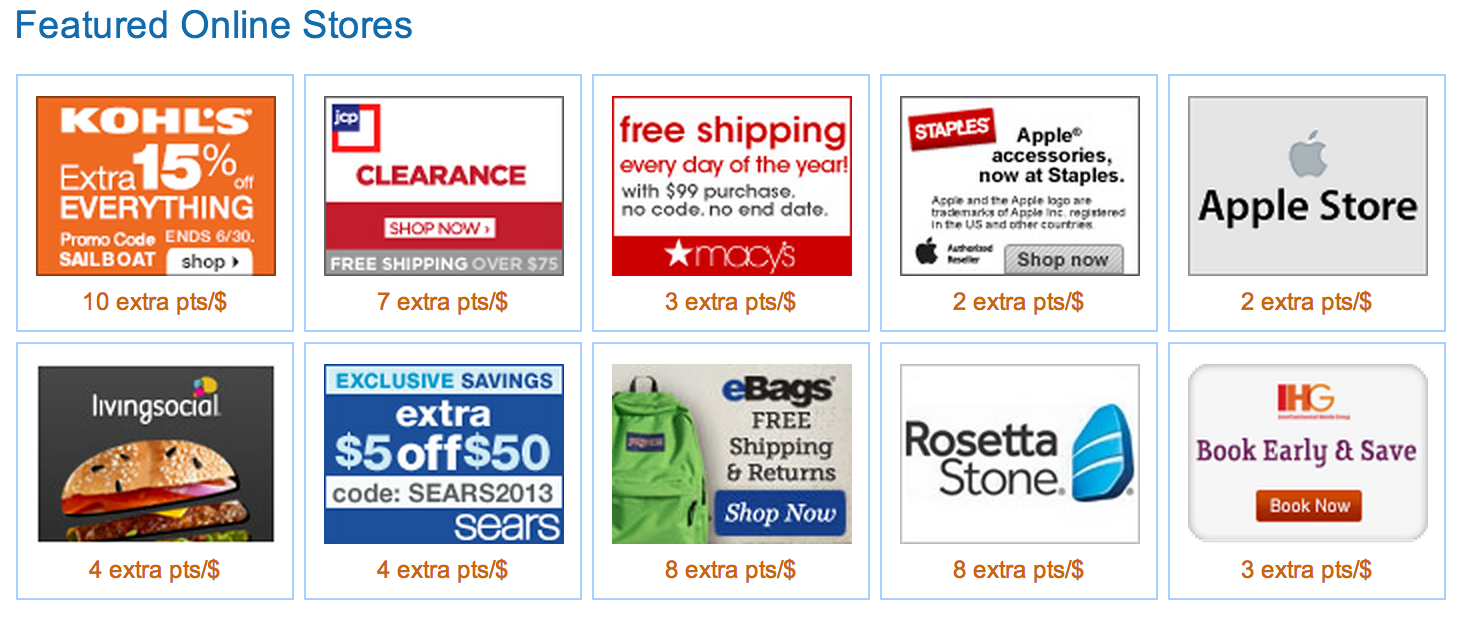

Another way to earn miles and points is to utilize shopping portals. Everyone buys things. More and more people every day are moving a majority of their spending to the internet. If you shop online, you should be utilizing shopping portals to maximize your point earning!

Shopping portals work like this – there are websites (portals) that negotiate with online stores/retailers to send customers to them. Part of the negotiation is the website (portal) offers you miles/points to visit the online store/retailer through their site before you shop at the store/retailer. All prices stay the same. Everything looks the same. The only difference is that you do not type in the name of the store directly but follow the link through the portal to get there. In the process, you will earn miles/points for doing so and the portal gets a commission from the store/retailer.

Here is an example: you might be shopping for a running watch. To purchase, you start with a shopping portal (something like the Ultimate Rewards Mall) and search for your store or product within the portal. When you find the best place/bargain/point earning, you click on that store and it will take you there. When you make your purchase, you will earn points corresponding to the offer that you utilized (normally within a timeframe that allows for the fact that you might return it, sometimes they may post within a week).

Here is an example: you might be shopping for a running watch. To purchase, you start with a shopping portal (something like the Ultimate Rewards Mall) and search for your store or product within the portal. When you find the best place/bargain/point earning, you click on that store and it will take you there. When you make your purchase, you will earn points corresponding to the offer that you utilized (normally within a timeframe that allows for the fact that you might return it, sometimes they may post within a week).

To learn more about mile and point earnings with shopping portals, check out my series on Best Point Earning for the Runner for some places where you can maximize your shopping for running items. To learn about a great site that shows many of the shopping portal earnings, check out this post.

There is the potential to earn a lot of miles/points with portals. One of my recent favorites was Rosetta Stone – 8 points per dollar! If you are purchasing a $400 Rosetta Stone package, you can earn 3,200 points! This is when you want to start doing all the shopping for your friend! Christmas time is another great time to do online shopping as the point offerings typically rise to attract your business (one year, Best Buy was offering 10 points per dollar through the Ultimate Rewards!).

Flying and Staying

Believe it or not, people still earn a lot of miles and points by flying airlines and staying at hotels! One time, I earned over 100,000 miles flying to Australia because of my elite status bonus, route bonus, city promo, and base miles! On a typical flight to Australia from the East Coast for someone who has no elite status will net that person around 20,000 miles! That is a good chunk of miles that is almost enough for an award trip anywhere in the US. The same goes for hotel stays. Points are earned based on base points for staying, elite status, promo points, etc. If you are flying or staying at hotels, sign-up for the loyalty program of the carrier/hotel that you are using and begin to accrue miles/points in those accounts (a possible exception might be if you want easy Star Alliance status).

Believe it or not, people still earn a lot of miles and points by flying airlines and staying at hotels! One time, I earned over 100,000 miles flying to Australia because of my elite status bonus, route bonus, city promo, and base miles! On a typical flight to Australia from the East Coast for someone who has no elite status will net that person around 20,000 miles! That is a good chunk of miles that is almost enough for an award trip anywhere in the US. The same goes for hotel stays. Points are earned based on base points for staying, elite status, promo points, etc. If you are flying or staying at hotels, sign-up for the loyalty program of the carrier/hotel that you are using and begin to accrue miles/points in those accounts (a possible exception might be if you want easy Star Alliance status).

Promotions and Contests

Many credit card companies, airlines, and hotels will run different promotions and contests that will give you miles/points for entering your information. Some of them are small (like 100 points) while some might be more lucrative. 100 points is 100 points! A lot of people might scorn such a small number but you cannot believe how many points you will give up if you do not sign up for the small promos/contests. They run them quite often and you can continue signing up for each and everyone! Last year, Netflix and United ran a promo that gave you 2,000 United miles for signing up for Netflix. If you paid with your United credit card, you would get another 2,000 miles. You did need to sign-up and pay the $7.99 monthly fee but you could cancel right after receiving the bonus (which took about 1 week). So, for $7.99, you earned 4,000 United miles. Those 4,000 miles have a conservative travel value of $70! Not bad for only paying $7.99!

Many credit card companies, airlines, and hotels will run different promotions and contests that will give you miles/points for entering your information. Some of them are small (like 100 points) while some might be more lucrative. 100 points is 100 points! A lot of people might scorn such a small number but you cannot believe how many points you will give up if you do not sign up for the small promos/contests. They run them quite often and you can continue signing up for each and everyone! Last year, Netflix and United ran a promo that gave you 2,000 United miles for signing up for Netflix. If you paid with your United credit card, you would get another 2,000 miles. You did need to sign-up and pay the $7.99 monthly fee but you could cancel right after receiving the bonus (which took about 1 week). So, for $7.99, you earned 4,000 United miles. Those 4,000 miles have a conservative travel value of $70! Not bad for only paying $7.99!

Dining

Every airline and hotel offers dining programs that give you miles based on your spending at various restaurants. One of the great things about dining programs is that these programs track your spending by your credit card usage. This means that you can use your best restaurant bonus credit card (something like the Chase Sapphire Preferred which offers 2 points per dollar on spending at restaurants) to earn points on your card and then the dining program tracks that credit card spending at the particular restaurant to give you points in the program that you signed up with. This is a classic method of double-dipping (earning miles/points in one program while earning miles/points in another program at the same time) and can be very lucrative if you dine out a lot.

Every airline and hotel offers dining programs that give you miles based on your spending at various restaurants. One of the great things about dining programs is that these programs track your spending by your credit card usage. This means that you can use your best restaurant bonus credit card (something like the Chase Sapphire Preferred which offers 2 points per dollar on spending at restaurants) to earn points on your card and then the dining program tracks that credit card spending at the particular restaurant to give you points in the program that you signed up with. This is a classic method of double-dipping (earning miles/points in one program while earning miles/points in another program at the same time) and can be very lucrative if you dine out a lot.

Credit Card Category Bonuses

Most credit cards offer category bonuses as a way to encourage you to use their card at stores in particular categories. For example, the Chase Ink Bold/Plus cards offer bonuses of 5 points per dollar at all office supply stores. The American Express Premier Rewards Gold card offers 3 points per dollar on all airfare purchases and 2 points per dollar on grocery store purchases. These are just a couple of the examples of the many cards and category bonuses out there. It is very helpful to learn these different bonuses so that you can maximize your point totals. To see how you can use these categories to take advantage of things like shopping at Amazon, check out this post.

Most credit cards offer category bonuses as a way to encourage you to use their card at stores in particular categories. For example, the Chase Ink Bold/Plus cards offer bonuses of 5 points per dollar at all office supply stores. The American Express Premier Rewards Gold card offers 3 points per dollar on all airfare purchases and 2 points per dollar on grocery store purchases. These are just a couple of the examples of the many cards and category bonuses out there. It is very helpful to learn these different bonuses so that you can maximize your point totals. To see how you can use these categories to take advantage of things like shopping at Amazon, check out this post.

Everyday Spending

And then of course, we have just everyday spending. I use my credit cards for everything. I use it to buy postage stamps, packs of gum – anything! Every single dollar I spend using my credit card goes into racking up my point totals. It always amazes me to see people using cash for large purchases. I have been in line many times and will see people pull out $3000 to pay for a new television. Not only are they flushing at least 3,000 miles and points away but they are also kissing any type of protection goodbye that using a credit card might offer. Go ahead and start using your card to rack up your points!

Summary

As you can see, there are many different methods of earning miles and points. It might seem overwhelming, but you will get the hang of it and be able to earn and maximize your miles and points quickly. These are the various methods I have used to earn the amount of miles and points that I have at this time.