It simply amazes me that we are in the final month of 2014! This year has really flown by and 2015 will be here before we know it and with it will bring some pretty big chances to various airline programs (looking at you, Delta).

But, while we still have this month left, it is a good time to look at our checklist of what needs to be done to make sure that we do not leave any miles and points on the table. This is the American Express version and it will look at some things that you should do if you have these cards (or maybe something to consider when getting cards before the end of the year).

American Express End-Of-The-Year Checklist

American Express Platinum

This is the big annual fee ($450) Platinum card that carries a host of benefits with it for the user (this applies to the personal, business, and Mercedes Benz Platinum cards). It is certainly not the best card to put spending on as there are far better ways to earn Membership Reward points than by spending on the American Express Platinum card. But, the card has a host of benefits that can really recover the annual fee year after year if you maximize the card’s strengths.

One of the huge annual benefits of this card is the ability to designate a US airline as your choice for recovering airline incidentals. The Amex Platinum provides $200 a year in reimbursement for airline incidentals and that year is a calendar year. So, if you have not taken advantage of that yet, head on over to this Amex page to pick your airline and then spend.

Here is what Amex says the fee can cover:

- Baggage fees

- Phone fees

- Reservation fees

- Close-in booking fees

- Pet fees

- Change fees

- Airline lounge passes and memberships

- In-flight purchases (such as food and beverages)

- Seat selection fees (such as selecting premium economy seats or simply choosing seats if the airline charges for that)

According to the terms and conditions, charges that are NOT covered are:

- Airline tickets

- Upgrades

- Mileage points purchases

- Mileage points transfer fees

- Gift cards

- Duty free purchases

- Award tickets

- In-flight internet

- Fees incurred by airline alliance partners

However, even though gift cards are mentioned as not being covered, many people do get their gift cards reimbursed. It depends on the value of the gift card and how you gift yourself. To find out currently which airlines will work with gift cards and how to do that, check out these various Flyertalk threads by airline – American Airlines, Alaska Airlines, Delta Airlines, JetBlue, Southwest Airlines, United Airlines, US Airways. I know things change all the time, so check the wikis in the threads to find out what currently works. In the past, I have had gift cards from AA, Delta, United, and Southwest reimbursed. I have also had a status challenge from AA reimbursed as well as award taxes from Delta and cheap tickets on United.

This year’s reimbursement will end at the end of December so do not delay! If you have not made your choice and taken advantage of this, then you are leaving $200 on the table!

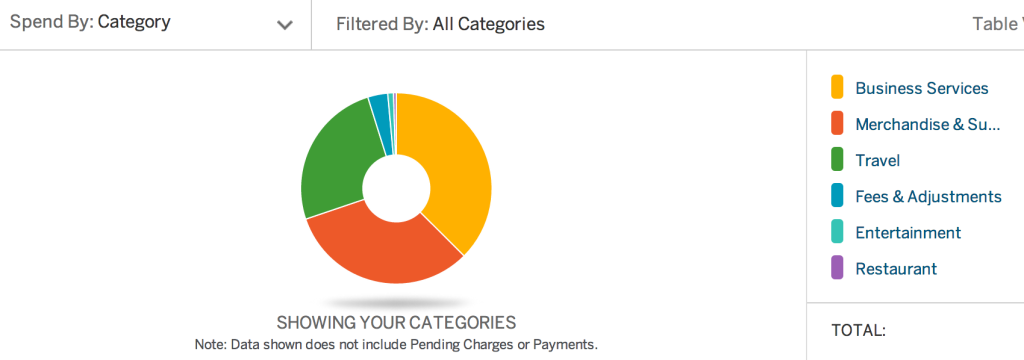

American Express Premier Rewards Gold

The American Express Premier Rewards Gold card is one of the cards that can really help you rack up Membership Reward points, depending on what categories you spend in. One of the great perks of that card to encourage spending is the spending threshold bonus. If you spend $30,000 in a calendar year on the card, you will receive 15,000 bonus Membership Reward points. That, in effect, makes all of your spending up to that point worth 1.5 points per dollar.

Amex Axes Spending Threshold Bonus on the Premier Rewards Gold Card

However, American Express is getting rid of that bonus in 2015, so this will be the last year to earn that threshold bonus. If you had not thought about hitting it or had forgotten about it, login to your Amex account to see the spending for year to date (remember to deduct the fees or card charges as they do not count towards your spend thresholds). You may be surprised to find that you are closer to the $30,000 mark than you think and it may help you push forward to get that extra 15,000 Membership Reward points

American Express Delta Cards – Platinum and Reserve

Delta has two co-branded Amex cards that earn Medallion Qualifying Miles (the elite miles) if you meet threshold levels.

The highest card is the American Express Delta Reserve. When you spend $30,000 in a calendar year, you will receive 15,000 MQMs. You will get another 15,000 MQMs if you spend another $30,000 in the same year. That makes 30,000 MQMs (and 30,000 bonus award miles) for spending $60,000 in a calendar year. And this applies to both the personal and consumer cards.

One of the perks of the Delta Reserve card is that you can actually choose to gift those 15,000 MQMs as well. So, if you have a friend, family member, or co-worker that could benefit from the miles more than you, you can gift those miles to them. Once the threshold amount posts, you can go to this Delta link to either redeem those miles in your account for your own status or gift them to another.

For the Delta Platinum card, you can earn 10,000 MQMs after spending $25,000 in a calendar year. Like the Reserve card, if you double that spend, you can get another 10,000 MQMs (and award miles in 10,000 mile increments as well). Unlike the Delta Reserve card, those MQMs will post automatically to your own account and you cannot assign them to another.

Just like the Amex Premier Rewards Gold above, check your spending for the year-to-date to see if you are close to either of those spending thresholds. If you are, it is totally worth it to go for it (if you already have enough Delta MQMs to combine with those to get status for this year).

Summary

I assume that if you have any of those cards above that you realize the spending threshold bonuses that each card possesses. None of them are low fee cards so you probably have them for a reason. That being said, you may have forgotten about those bonuses and you certainly do not want to leave thousands of miles or hundreds of dollars on the table because of forgetfulness or bad planning. So, check those out so you can end 2014 a happy camper having eked out as many benefits from the cards as possible!