Yesterday, the blogs lit up with reports of a new increased offer on the Citi Executive AAdvantage card. It has gone from the 50,000 mile amount to a nice big 75,000 mile amount.

This card was the easy winner for the best offer of 2014 as it had a 100,000 mile offer along with a $200 statement credit that helped to defray the upfront $450 annual fee on the card. The spending was on the high side – $10,000 – but the haul of 100,000 miles was fantastic.

Not only was the bonus good but there were many who went for 2, 3, 4, or even more of the same card to multiply the offer (current language by Citi precludes customers from doing that now). I only went for one as I was out of the country for most of the offer and would not be able to meet the minimum spending on more than one card.

New 75K Mile Executive AAdvantage Card Offer

While the offer is not as good as before, it is certainly better than the normal offer. However, unless you still have your card from last year open or you did not apply for it then, you may not be eligible for this offer. The terms say:

American Airlines AAdvantage® bonus miles not available if you have had a Citi®/AAdvantage® Executive World EliteTM MasterCard® opened or closed in the past 18 months.

So, if you applied during the great bonus period last year, you may not be eligible. To be eligible, you will have needed to apply in the early days of 2014 and have not closed the card yet. But, if you did not get this card then, you are all set and ready to go!

Card Details

– Citi Executive AAdvantage Card Link

To get the 75,000 mile bonus, you must spend $7,500 in the first 3 months. That is a high amount so make sure you can swing it before you apply for the card.

The card itself carries a lot of perks, especially for AA flyers. Unfortunately, there is no statement credit this time around. But, in its place, there is a Global Entry reimbursement (worth $100) that can help to offset that a bit.

- Admirals Club® Membership

- Elite Qualifying Miles

- NEW! – Enjoy a Global Entry or TSA PreCheck application fee credit

- No Foreign Transaction Fees on Purchases

- Earn 2 AAdvantage® miles for every $1 you spend on eligible American Airlines and US Airways purchases

- Enhanced Airport Experience

- First Checked Bag Free on Domestic Itineraries

- 25% savings on eligible in-flight purchases on American Airlines and US Airways flights

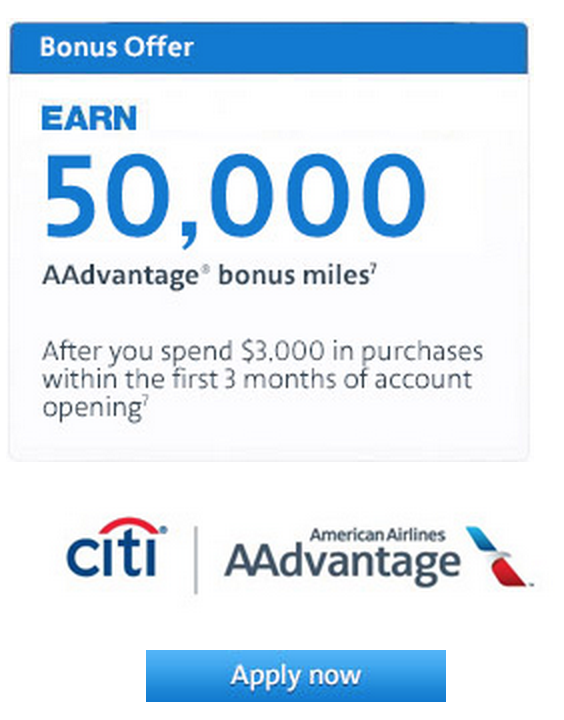

But, This Card May Be Better For You

– AAdvantage Platinum Select Application Link

If you are interested in American Airline miles, then the regular AAdvantage Platinum Select card may be just what you need. The current offer is still at 50,000 miles after only spending $3,000 in 3 months. Sure, you will not get the things like lounge membership, the ability to earn elite qualifying miles, Global Entry reimbursement but you will also not be paying the $450 annual fee!

Why Could This Card Be Better?

The annual fee on this card is $95, but it is waived the first year! That means you are getting a savings of $450 worth in annual fees. If you opted to go for the Citi Executive AAdvantage card for the difference in miles, you would essentially be paying $450 (the upfront annual fee) for those 25,000 extra miles. That means you are paying 1.8 cents per mile! Not only that, but you will need to spend an additional $4,500 to get the bigger bonus!

For most people, getting the Citi AAdvantage Platinum Select card will be the better move (just remember, it has the same terms for the 18 month period as the Executive AAdvantage card). 50,000 miles isn’t nothing and it will not cost you anything up front.

Don’t Forget The 10% Rebate!

Not only that, but you will get something with this card you will not get with the high-priced Executive AAdvantage card – a 10% annual rebate on award miles used. That means if you use all 50,000 miles this year for awards, you will get 5,000 miles back in your account!

Summary

In the end, I would recommend the Citi Executive AAdvantage card only if you are a somewhat regular AA flyer that could benefit from the lounge access or you are an AA elite that would benefit from earning elite miles with the card. For all other travelers, I would recommend the Citi AAdvantage Platinum Select card.

another brilliant post.

thank you for sharing.