JetBlue has had a co-branded partnership with American Express for a while now but that relationship will be terminated at the end of this year. The new card issuer that they will partner with is Barclay. It is unknown at this time as to what bonus will be offered with the new partnership.

What Happens To The Current Cardholders?

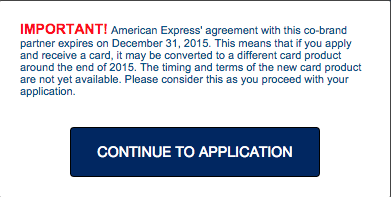

But, if you try to apply for the current JetBlue card (that offers 20,000 points), you will be met with the greeting above that warns of a card conversion near the end of 2015. They do not specify which card/product it will be converted to. Doctor of Credit theorizes that it may just convert to the new Barclay JetBlue card, which may happen (I think that might be what happens). It is apparent that Barclay likes to keep their customers after a card conversion as we can tell with the US Airways card converting to the American Airlines Aviator card. While you cannot apply for the Aviator card, it is a Barclay American Airlines’ card and it was not rolled to Citi with their AA cards.

– Application Link – 20,000 points after spending $1,000 in 3 months (not an affiliate link)

Hopefully, It Does Not Convert To An Amex Card!

They could also transfer the JetBlue cardholders to another Amex product which would be terrible. The reason it is terrible is because American Express only gives you a bonus if you have never had that particular card before. For example, if they converted this card to the Everyday Preferred card (and you never had it before), you would not be eligible for the sign-up bonus on the Everyday Preferred card if they decide to apply down the road.

Of course, American Express could do something like giving cardholders an option as to what card to go to, but I would doubt that. It would be a major headache for them to run something like that.

So, what card do you think will replace the JetBlue card for current cardholders?

Same goes for the Amex Costco card. Wonder what they’ll do when the time comes.

If it becomes an AmEx card issued by Barclaycard then you’ll be able to get the bonus multiple times. The once per lifetime rule is for American Express cards issued by American Express.

They don’t control how sign up bonuses work on cards that run on the American Express payment network. It’s almost a certainty that existing cardholders will be transitioned to a Barclaycard product as they’ve bought the backbook and were advertising for a position that included managing transitioning cardholders.

Who cares?

Cancel your late this year and you’ll be able to get the signing bonus for the new card.

I also read that Amex would manage certain back office fucntions even after the transition, not sure what this means for existing cardmembers. I just got the card both to get the 20K points and especially to get the 50% off in flight products. I hate paying $7 for a beer or a drink on board as a Mosaic, so paying $3.50 is better with the 50% statement credit as a cardmember. I’ve also enjoyed the variety of Amex offers on the card.