I know that many people are curious about credit scores and how they are affected. I know this because I have people asking me about this all the time! Please note, I am not offering financial advice or counsel with this post or this blog. If you have questions related to your financial situation, you should speak with an account or some other financial expert. I am just outlining what I know and have learned to be the case with credit scores. Hopefully what I have here will help you with understanding credit scores

First of all, I am surprised at the number of very smart, budget tracking, financially sound people who believe that applying for credit cards hurt their credit. I have talked to many of them and love watching their skepticism turn into awe when they realize that they can apply for multiple cards without damaging their credit. That being said, I do appreciate that many have that caution and understand that the ones who possess that hesitancy normally are the ones who have made wise financial decisions over the year to protect their financial situation and thus do not want to put it in jeopardy, even for many miles and points. I respect that. I do want to help you realize, however, that those worries can be subdued as there is more to your credit score than applications.

Your credit score is actually not just one score, but three different scores that are quite similar. These scores are given by three credit agencies – Equifax, Transunion, and Experian. Different loan issuers and credit companies pull from different agencies. Sometimes the same bank may pull from different agencies depending on the state of residence of the applicant. These scores tell a lender what type of client you may be based on your history with the financial concerns – whether you pay your bills on time, whether you are in great debt, how much as been entrusted to you in credit already, how many different types of accounts you may have, etc.

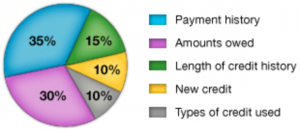

Your total score is made up of the following factors:

- Payment History – 35%

- Amounts Owed – 30%

- Length of Credit History – 15%

- Number of Inquiries or New Accounts – 10%

- Types of Credit – 10%

- Payment history – this is how well you have paid your accounts; whether they were paid on time, whether they were over 30 days late, whether they were over 60 days late, whether you have an account(s) in a delinquent state. This makes up 30% of your overall score and is typically one of the most important factors to potential creditors. If you have a history of being late or not paying your bills, you will not have a good score and will not be viewed favorably by potential lenders.

- Amounts owed – this is another big one (30% of your overall score) – how much you owe on your existing open accounts. Typically, to have this work well for you, you need to keep your overall credit utilization below 30% of your total credit combined. So, if you have $100,000 in total credit lines and you are using under $30,000 of that at any given time, then you are in better shape than if you are using $50,000 of that credit. However, this also has to do with amounts owed on specific accounts. It reflects poorly on your score if you are using more than 90% of credit on any single account. So, if you have a credit card with a $5,000 limit and you currently owe $4,500 or more on that account, this would not be a great reflection on your account. This category, more than payment history, can be very fluid as you may owe a lot on a particular card due to high spending in one month but you may pay it off before it is due. This category is important to potential lenders as it lets them know if you are overextending yourself with debt and are applying for more credit due to financial difficulty. If your amounts owed are too great, it may signal to a lender that you may not pay back your debt.

- Length of credit history – This is another important category (although one with a lower impact) as lenders want to know that you have a proven track record of being a good, loyal, dependable customer rather than someone that all of a sudden starts applying for a lot of credit within a very short length of time. Remember, credit score is about your financial past – it is what tells potential lenders what type of customer you will most likely be.

- Number of inquiries or new accounts – Now this is the one that most people worry about – applying for new credit cards. With each credit card application you make, your overall credit score takes about a 2-3 point dip. When you are making an excessive number of inquiries within a short time, this too can indicate to the potential lender that you are attempting to overextend yourself financially. New inquiries take 2 years to fall off of your report, so keep this in mind when applying. Now, I said at the beginning that applying for new accounts is not really that big of a deal when it comes to your credit score and that is because, when you are approved, you receive a new line of credit that brings up your overall line of available credit. This higher line of credit helps to lower your credit utilization percentage, which helps with the amounts owed. Not only that, but the longer you keep this new account open, the better it helps with your length of credit history. So, that 2 point dip with the application gets practically erased when these other factors kick in. When I apply for 4 or 5 cards at a time, I see my score only dip 1 point at the end of the month – sometimes, it goes UP a few points!

- Types of credit – this last one has to do with the type of credit you have been issued. Mortgages, car loans, personal loans, credit cards, department store charge cards, etc are all part of this number. Having a mortgage helps greatly with your score as it shows a level of responsibility that may not exist simply with credit cards. I do not have a mortgage so I have somewhat of a ceiling with my potential credit score.

- First of all, if you plan on purchasing a car (on a car loan) or a home in the next 1 – 2 years, you should be somewhat conservative with your applications as it is not worth getting a higher interest rate simply because you want some miles and points. Understand that – applying for cards does not ruin your chances of securing a mortgage but being aggressive with applying for cards may cause your mortgage lender to give you a higher interest rate.

- Know what your credit score is before you start applying. Having a score over 700 (the higher the better) is a good start for applying for various cards. Some of the premier cards (like signature cards) require higher scores. If you have a lower score, find out what is dragging it down and take care of it the best you can.

- If you have high debt, begin paying it down before you start applying. Having debt on a card (like on an interest free card or something similar) is not bad, but you should not have a lot of debt on those accounts.

- Know when your credit cards are due. I have applied for cards before when I had forgotten about many thousands of dollars on a couple of cards because of travel that I had been purchasing for some people. I obviously was going to pay it off when it was due, but I had applied after the statement had closed and before the due date so my score reflected these high accounts. Try to apply about 5-7 days after you have paid off any high debt statements.

- Do not close your cards that you were first issued from each issuer. When you close a card that you have had for 15 years and most of you other cards are 5 years old or newer, you have severely shortened your average credit history. It is good to get one card with each issuer that is a no-fee that you can use as your card that you just have to allow your accounts to age appropriately.

- Finally, space out your applications so there is 90 days or more between applications (especially if they are with the same bank). This greatly reduces your chances of being denied.

[…] credit scores – Link Share this […]

[…] Understanding Credit Scores – A previous blog post detailing the facts that make up your credit score […]

[…] […]