Small Business Saturday, otherwise known as the Saturday following Thanksgiving, will be here before you know it. Not only is a good day to wind down from the food and races of Thanksgiving and the shopping horror fun of Black Friday, but it is also the perfect day to get out there and get some “free” money!

Preparing For Small Business Saturday

Small Business Saturday is the way American Express seeks to encourage more shopping at small businesses (as well as to encourage small businesses to use American Express) by giving free money to American Express cardholders that shop at those businesses. This year, American Express has set the limit at $30 per card, but in increments of $10. That means, you can spend $10 in 3 separate transactions and get back $10 on each purchase. By preparing for this in the right way, you can really maximize this promotion and help small businesses.

Adding Authorized Users

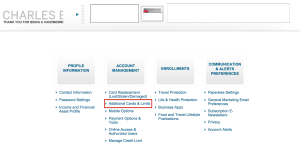

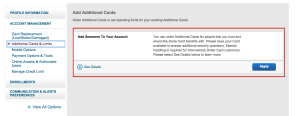

If you already have an American Express card, the next thing to do is to login to your account and start adding authorized users. Your authorized users can be anyone, but you will need to enter their name, address, birthdate, and social security number. So, it has to be a real person (no dogs here) and should be someone you feel comfortable giving a card to or one that feels comfortable giving their information to you.

You can actually process all of this right online in your account. One thing to note – most cards will allow you to add authorized users for free, but there are some cards that will charge you a fee for adding an authorized user. For example, the American Express Platinum charges a $175 fee, but that is good for up to three authorized users. You will see on the page if there is a cost to add an authorized user.

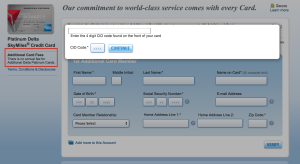

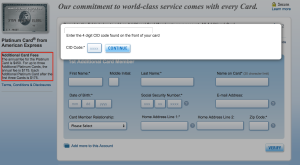

Enter the 4 digit code from the front of your card and fill out the information for your authorized user

With these cards, you can either have the authorized user shop at the stores you want, or have them tag along with you as you hit your spots. Their card counts as a separate card for the purpose of both enrolling and earning the rebates on Small Business Saturday. Just remember, you will need to sign up each card you have when the enrollment period (November 16) begins.

Find Your Favorite Small Business

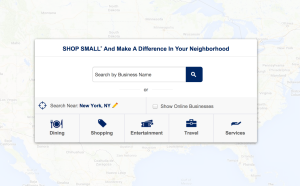

Next, start identifying your favorite small businesses that you want to shop at. One of the cool things about the locator website (found here) is that it will actually suggest places to you based on your shopping habits (if you are logged in to your American Express account). Once you identify them, either figure out what you are going to purchase or see if they sell gift cards.

Do make a note of this from the T&C (which can be found here): Transactions with political campaigns or political action committees as well as purchases at gas or service stations do not qualify for the statement credit, regardless of whether they appear on the Shop Small Map. – (bolding mine)

Putting A Plan In Place

Since American Express has mixed it up a bit this year by requiring separate transactions to get the max of $30, it will take a little more time to get this all done. I generally like to purchase gift cards at my favorite place (Fleet Feet running store:) so I can use them later. Most merchants will most likely not have a problem with you doing multiple transactions to hit the $10 limit on each card. Just make sure it is not busy. For the merchant, this is money they are getting and they are fine with that!

Gathering Your Cards

I hope you have at least one American Express card! If you do not, I would not signup for one just to take advantage of this day, but definitely use it as incentive to signup since you can get some great bonuses. If you have an American Express card that you pay an annual fee on (like the American Express SPG cards), this is a great way to make back some of that annual fee (annual fee is $65).

One of the great things is that Bluebird cards and Serve cards will work for this promotion. So, if you do not have any other card, at least pick up one of those. Just make sure you have the funds in the account for your purchases. Even though you will receive the money back, you must have money in the account for the purchase.

You can also use American Express cards that are actually issued by other banks (Citi, for example). Get all of those cards together and ready to register when the time comes. In our family as of right now, we have a combined 18 American Express cards (this is a total of our Bluebird cards, regular credit cards, charge cards, authorized user cards, etc). If we maximize our Small Business Saturday, it would total $540 in gift cards or other purchases at Small Businesses! Win-win-win – everyone wins on this one!

Does the credit for additional card holders only extend to premium cards (Gold, Plat, etc.) or do you get the $30 offer for additional card holders of lessor cards such as JetBlue additional cardholder, Starwood, Delta, etc.?

No, it does apply for all Amex cards, with the sole exception of the corporate cards. Small business and consumer cards can have additional cardholders and the offers will work for them. Amex issues separate numbers for each card (unlike Chase) which is why it works.

Thanks for the good info!

Do you know what the minimum spend per transaction will be to get the $10?

The minimum is just $10 – so a $10 gift card will get you the $10 rebate.