We have seen a fair share of loyalty program devaluations over the last couple of years. While none of us like that, it is the result of changing business models and profits.

We have also seen some devaluations with credit cards like American Express. They lost the AAdmiral’s Club access for their Platinum cardholders. While that was a bad loss for everyone that relied on that card for access to the Clubs, the card still possesses enough perks for many to make the annual fee worthwhile.

One Of The Biggest Credit Card Devaluations

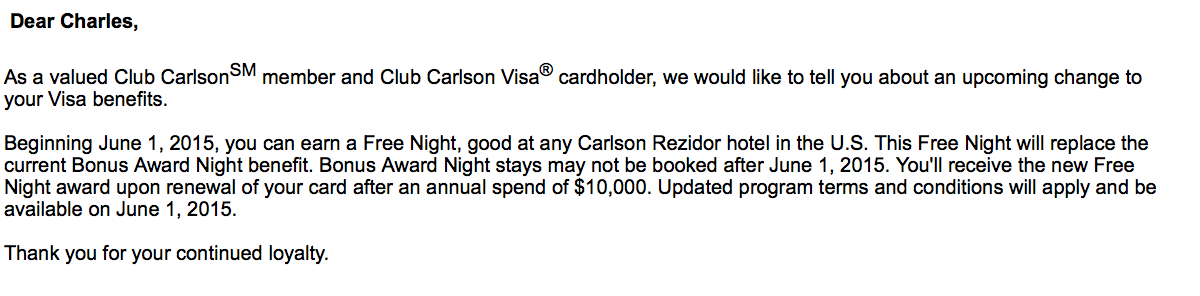

The Change: Club Carlson is dumping the Bonus Award Nights feature of their credit cards. This feature allows cardholders to get the last night of their award stay for free on stays of 2 nights or longer. This change goes into effect June 1, 2015.

Club Carlson’s recent change to their credit cards was definitely one of the biggest credit card devaluations. When I saw Frequent Miler’s post on it yesterday, I was really unhappy with it (figures that I am away from a computer all day when something like that happens!). While I was unhappy, I was not all that shocked. The bonus award nights, which gives cardholders their last night free on award stays, has been one of those unsustainable credit card perks. I am sure when they started that they figured it would be something that would be similar to Marriott and SPG – 5th night free. They probably did not expect that so many travelers would use it the way so many of us did – for two night award stays at a time to get the last night free. To be clear, there was nothing wrong with our strategy in doing so as we were following the rules and paying the annual fee on the card to do it.

While the Club Carlson Premier card comes with a pretty awesome bonus – 85,000 points after meeting the required spending – the real strength to the card (besides its awesome earning rates) was the fact that cardholders got the last night on award stays free (for stays 2 nights or longer). In effect, for two night award stays, it was like giving a 170,000 point bonus!

Of course, the card also comes with Club Carlson Gold status and a renewal bonus of 40,000 points. All of that for $75 per year. It is a really good deal, but much of the deal hinged on the value of the Bonus Award Nights perk (which is actually still being advertised for the card without an explanation that it will disappear June 1).

What Is “Replacing” The Bonus Award Nights Feature

Replacement Bonus: One free night at any Club Carlson in the US after spending $10,000 in a year.

Presumably to soften the blow, Club Carlson is now offering a free night at any category Carlson hotel in the United States. I have stayed at a few Carlson-brand hotels in the US and found most of them to be underwhelming. To me, the real strength of the chain is in Europe (there are higher-end properties in other locations as well, but they have a great presence in Europe). To not be able to use this annual bonus night anywhere in the world is pretty terrible.

Not only that, but this free night will not come free – Club Carlson is requiring that you spend $10,000 in a year to earn that. Not only that, but the e-mail they sent out yesterday (somewhat hastily and likely in response to the uproar on blogs and social media) says that it will happen after card renewal. Well, what happens with the people who just renewed their cards? Since the new terms are not in effect (they will be announced and will go into effect on June 1), it would appear that cardholders will have to wait until the annual fee after that date to make the $10,000 spend and earn the free night.

Now, with the strong 5 points per dollar everywhere on the card, that $10,000 will translate to an additional 50,000 points. That would help with another night at a higher category hotel as well. Still, I do not like being made to spend that much money on a card that no longer offers the same value.

Consolation Prize

Also in the e-mail for many (though not all cardmembers received it but they say all cardmembers will receive this) was the offer of 30,000 points if you stay in a Club Carlson hotel before August 31. This stay has to be an eligible stay, meaning not an award stay and not a points and cash stay.

The best way to approach this, if you decide to stay in a hotel before then, is to make this booking as soon as possible. It did not say in the e-mail when these points would post so they should post around the same time as regular stay points. If that is the case, use them before the June 1st change!

Action Items

First thing, any stays booked before June 1 will receive the last night of the award stay for free. That means that you should get your bookings in soon. Book them as far out as the calendar goes.

However, you will likely need to hold on to your card until your stay(s). That is a perk of the card and it would mean that you would still need to be a cardholder.

Second, if you have just paid your annual fee (like I did), you can make a complaint with them about the removal of this benefit to the card. That was part of the terms of the card when you agreed to it by paying the annual fee. It is a significant change and you should be able to either get a partial refund or some kind of points or a statement credit.

Third, I know some bloggers are saying to hurry up and get the card to use points, but I say the opposite – if you do not already have the card, do not reward Club Carlson’s change with more applicants. Yes, you get 50,000 points after the first purchase, but the remaining 35,000 points will be issued after spending $2,500 in 3 months. If you do not have those purchases post before your first statement closes, you may not get those points before the change goes into effect! You may have some recourse since you just applied with the current terms in effect and you have paid an annual fee for those features, but proceed with caution.

Summary

While I always felt this benefit could not exist forever, my thought was that they would just change the minimum stay requirement. You know, make it only valid on award stays of 3 nights or more (or 4). To completely eliminate it is really a disappointment.

In the meantime, extract as much value as you can from the card! Things change and we must always be ready to deal with it. My biggest regret was that this change was inserted on a credit card statement instead of an e-mail informing us with more notice.

I’ve already received a reply from customer service stating they are not refunding or pro-rating the annual fee. I responded by emailing the USBank ceo richard.davis@usbank.com filed a complaint with the Consumer Finance Protection Bureau http://www.consumerfinance.com/Complaint and filed a complaint with the DC AoG for bait & switch and that even after the announcement they ae still intentionally defrauding consumers by not noting the change on their application page.

Thanks for the data point and your quick action. Hopefully, they will make some amends after more of this blowback is taken into account.

I booked two nights (one free) at the Radisson Blu in Paris. I am planning two nights (one free) at the Radisson Blu in Chicago before June. In both cases, the redemption only made sense when the second night was free! For Chicago, the redemption is 75,000 for a business room. I can typically book that room for $300-ish a night. 75,000 for TWO nights (vs $600 cash) is an OK redemption, if you got the points cheap. 75,000 for one $300 night is a stupid redemption.

A regular business traveler, earning points with bod in bed, would be ill-advised to keep the card, I think. I once thought that since I have a nice credit line, this was USBank’s “gift to consumers.” Thought I would be keeping the card for the long-run. Not any more!

You are the only blogger that recognizes the real impact of this change. The other bloggers just want you to use their links to get the card. I do believe Carlson made a big mistake.

@richard when i posted on mommypoints website suggesting what she can post to help people reading the blog, such as links to the Consumer Finance Protection Bureau’s complaint page and the links showing that bonus nights are listed as a benefit of the annual fee being paid. …. well that comment was deleted because can’t be upsetting the banks that pay for your travels.

I just checked San Francisco Radisson Fisherman’s Wharf. No availability on points from June 5th through April 2018. Who believes that? What’ll you bet availability opens up June 1st.?