Hilton is really pushing points at their customers! First we have the new 100K offer with the Hilton Surpass, then the 75K offer with the no-fee Amex Hilton card, and now this 75K offer from Citi’s no-fee Hilton. But, take a good look at your Hilton needs before pulling the trigger on this one!

75K Hilton Points with No-Fee Citi Card

Link: 75K Hilton Points Citi Card

On the face of it, this is really an excellent deal. Not only is it up from the normal 40,000 points, but it also is a no-fee card. That means you can just let it sit there and age your credit history without it costing you anything (as long as you use it once every year or so – otherwise it may get shut down).

Here is what this offer gives you:

- 75,000 Hilton points after spending $2,000 in 3 months

- 6 Hilton points per $1 spent at Hilton properties

- 3 Hilton points per $1 spent at supermarkets, drugstores, and gas stations

- 1 Hilton point per $1 spent at all other outlets

- Automatic Silver status

- Loyalty bonus of 10,000 Hilton points when you spend $1,000 or more on Hilton portfolio stays

- Upgrade to Gold status by spending $20,000 in a calendar year on this card

- No annual fee

Word of Warning

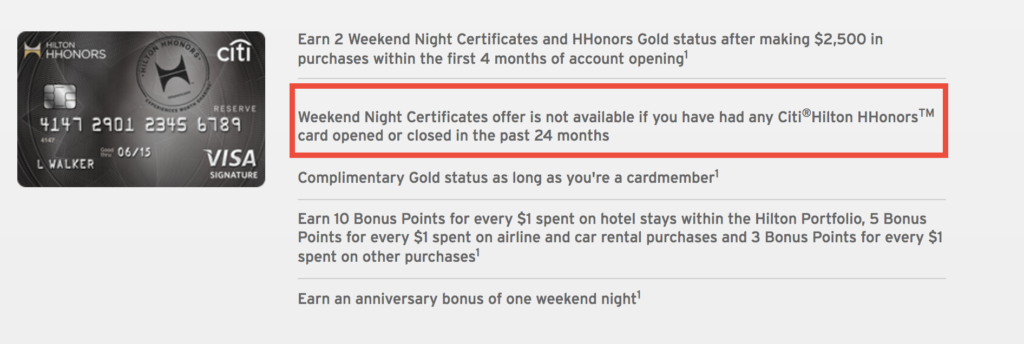

Getting this 75K hilton card will prevent you from getting the two free weekend nights offer on the Hilton Reserve for 2 years!

So, with everything looking so good, why a word of warning? Last August, Citi pushed through their own anti-churning rules on many of their cards. Instead of just saying that you could not have the bonus if you opened or closed that card in the last 24 months, they now say you cannot get the bonus if you have opened or closed any Hilton Citi card in the last 24 months.

That means if you have opened or closed this card or the higher tier Hilton Reserve card in the last 24 months, you cannot get the bonus on this one! But, worse than that, if you want to open a Hilton Reserve card in the next 24 months, getting this card will preclude you from getting that bonus (unless they change the rules in the next 2 years).

Why is that bad? With the upcoming changes to the Hilton Honors program, it is not clear yet as to what hits the points may take in values for many hotels. The 2 free weekend nights of the Hilton Reserve card are clear devaluation-proof winners and could be very valuable if your dream destination/vacation hotel all of a sudden is costing 95,000 points per night almost every night of the year. In that case, this 75K bonus on this no-fee card won’t help you touch that.

Takeaway

This is a strong offer on Citi’s no-fee Hilton card but make sure you think through whether you will want the Citi Hilton Reserve in the next 24 months before you pull the trigger on this one!

If you value the mid-tier hotels, I would definitely go for this no-fee card as it will likely give you more bang for your redemption buck than the 2 free nights would from the Hilton Reserve card.

One of the links floating online has a sign up bonus of 50,000 and $50 statement credit after $50+ spend at Hilton. Is it possible to apply for that then have it matched to this sign up bonus and still keep the $50 statement credit offer?

For this card? I know there used to be one but I haven’t seen it in a while. The current one I know of is for the Amex no-fee.

I’m not sure if citi would match you or not.

If I already have a Hilton free card, would I be eligible if it has been more than 24 months? Also how do I check when my card was opened?

Call Citi and ask them what your account opening date was. You could also check online from your statements.

Offhand, I believe you can get it again but I will check a couple data points first.

I don’t like how Citi is starting to become more like Chase with its rules.

From a churning perspective the Reserve is a bad choice. Keeping the card for the 2nd year has no value other than Gold Status which you can get cheaper with the Surpass.

Assuming you close it just before the 2nd year annual fee comes due, you have now triggered the above Citi 2 year rule. In effect this means you can only get this card every 3 years where as you can get the no annual fee card every 2 years.