Disclosure: I do not receive a commission for this card

That happened fast! Just yesterday, I wrote about an American Express Platinum card offer that carried no annual fee for the first year (regularly $450 up front) but also no sign-up bonus. I mentioned that I did not think the regular 25,000 Membership Reward offer was significant enough to sign-up for.

That happened fast! Just yesterday, I wrote about an American Express Platinum card offer that carried no annual fee for the first year (regularly $450 up front) but also no sign-up bonus. I mentioned that I did not think the regular 25,000 Membership Reward offer was significant enough to sign-up for.

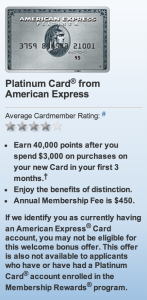

Well, now it is higher! The sign-up bonus has increased to 40,000 Membership Reward Points after spending $3,000 in the first 3 months of cardmembership. While not the 100K offer we saw last year, this is still an excellent offer that pretty much wipes out the $450 annual fee (and that is before you figure in the annual $200 airline incidental reimbursements and the $100 Global Entry reimbursement – $500 in the first year).

American Express Platinum Card

This card is charge card, meaning it has to be paid off each month (except for certain purchases that qualify for Pay Over Time) and is the most expensive of the American Express card lineup (with the exception of the Amex Centurtion card) at $450 annual fee.

This card is all about the benefits that it bestows. It is the perfect card for people who travel anywhere from a couple/few times a year to a road warrior.

Please note: New terms on the side of the application detail that you are not eligible for this bonus if you have had it in the past. This is apparently a new company policy that will be adhered to after May 1st, but your mileage may vary as to whether it means for right now.

American Express Platinum Card (personal card) – 40,000 MR points – application link (I do not get a commission for this card)

Airport Lounge Access

American Express Platinum card holders have access to lounges provided by Delta Airlines and the Centurion Lounges that are beginning to open around the US.. In addition to those airline lounges, you also have access to lounges provided by the Priority Pass Select. Between those lounges, you can have access to lounges in the cities at the links below:

As a user of lounges whenever I travel, I can tell you this is a great benefit. It is especially great for the traveler who was going to purchase a lounge membership which can cost as much as this card’s annual fee.

First Class Companion Ticket

This benefit is not one that everyone will be able to take advantage of, but for those people who do purchase business/first class tickets, this is useful if you purchase that ticket through American Express Travel service. It gives you a free companion ticket if you do that. Not bad, if you were going to purchase a premium ticket anyway (or if, as in some cases, your employer was going to purchase one and you wanted to take a companion).

Annual Airline Reimbursement

This is enough to help pay for the card in the first year of membership. This feature allows you to designate one airline (the major domestic airlines) per calendar year in which you will receive a reimbursement up to $200 for airline incidental charges such as:

- Change fees

- Baggage fees

- Phone reservation fees

- Pet fees

- Airline lounge passes (or towards annual membership)

- In-flight purchases (such as entertainment and amenities)

There is a long list of airline purchases for which it does not reimburse, but in many cases, it may be different case-by-case. One of those cases is with low value airline gift cards. With United, Delta, and American, people have been able to purchase $50 and sometimes $100 gift cards and have those reimbursed. That is huge since it allows you to basically recoup your annual fee in the form of ticketed travel (ie. $400 in gift cards for travel on United, Delta, or American). Another one that sometimes is covered is taxes for award tickets. This one happened to me – I booked a Delta award ticket that had $180 in taxes and fees and was reimbursed for the whole amount. While the card agreement says the typical it may take up to 4-6 weeks for the credit to appear, I have always had it post within a week. So, for your first year of card membership, this is a no-brainer. For subsequent years, you are still basically getting $200 off of your annual fee.

Global Entry Reimbursement

I just wrote a post detailing the Global Entry application, process, and what you get for it. In that post, I talked about the different ways you could get the $100 fee waived or reimbursed. Well, the American Express Platinum card automatically reimburses you that $100 fee – another great benefit! Also, it does not have to be for the card holder. It applies for anyone as it is automatic when the payment posts.

Insurance

This card comes with many insurance benefits:

- Baggage insurance up to $3,000 (when eligible travel is booked with the card)

- Travel Accident Insurance for $100,000 if death or dismemberment occurs while traveling by plane, ship, bus or train (when eligible travel is booked with the card)

- Medical Assistance and Insurance – this is a great one (and one of the reasons that I and my friends have gotten this card). This even protects you with injuries from snow sports and most adventure sports (like running!). If you have to go to the hospital, you simply call American Express and they will direct pay the hospital up to $2.5 million! They will even pay for books, magazines, and flowers! In addition, if you were traveling alone, they will pay for the relative of your choice to come and stay with you at up to $250 a night. After you get out of the hospital, if you were told not to travel yet, they will pay for your stay in a hotel. And finally, another great one is that they will pay for your medical evacuation expenses!

- Car Rental Insurance – if you use your card when picking up a rental car, you will be covered for all insurances as a primary insurance coverer.

Hotel Benefits

As an American Express Platinum cardholder, you have acces to book hotels under their Fine Hotels and Resorts program. This program allows you to book hotels and receive great rates in addition to the following benefits:

- Free room upgrade upon check-in (if available)

- 4:00PM late check-out

- Complimentary breakfast for 2 each morning

- Additional perks depending on the property the reservation is for

These benefits are great for the marathoner (especially the 4pm checkout!)

Purchase Protection

This nice part allows you to have accidental damage and theft protection for 90 days after purchase as well as extending warranty.

40,000 Membership Reward points

Let us not forget the points you get after spending $3,000 in the first 3 months (you get 40,000 Membership Reward points). Considering that you can get a good $600 in value out of those points, this alone more than covers your first annual fee.

Summary

Is it for you? I can say that the language would concern me a bit as a previous American Express Platinum card holder (the language says This offer is also not available to applicants who have or have had a Platinum Card® account enrolled in the Membership Rewards® program). I know that American Express has been sticking to their guns with the previous rule of 12 months between when you have had the card and when you apply. It has burned me – the big 100K offer was the one that messed me up. I called to see what day I had last closed the card and was told I was ok. I applied and (long story short) after a lot of spend, 6 months of phone calls/faxes/e-mails/tweets -I was finally told that I had applied for the card 5 days early for the deadline. Even though no one along the way knew about that (and kept assuring me that I was ok), I was the one that lost out. I did not get the bonus, so ymmv!

my husband tried to get the platium card and was told NO such deal available for a free card for a year

If you are talking about the Ameriprise Amex offer I wrote about yesterday, it definitely exists. The reps may not realize it is there since it is more than likely handled with a different accounts department. To apply for it, it would need to be done through the Ameriprise website.