This offer was last available earlier this year and now, until May 5, 2015, this offer is back again! If you are in the market for Hilton points, this is as good as it gets.

80,000 Hilton Points With the Hilton Surpass

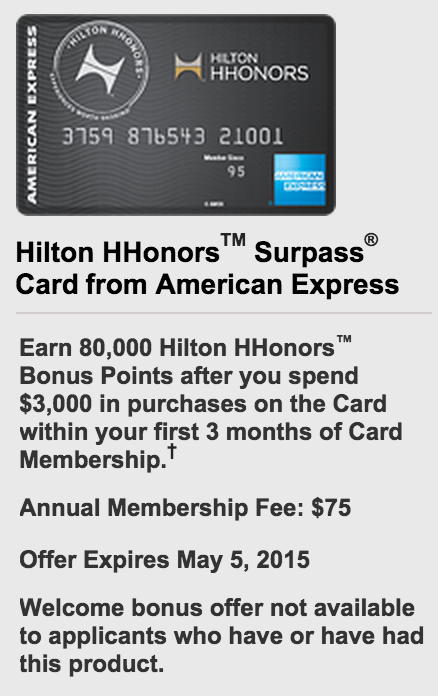

For a limited time, the Amex Hilton Surpass card has upped the bonus to 80,000 points after spending $3,000 in 3 months. This is an incredible amount of points (that will not get you one night at the highest tier Hilton hotels) and is a higher bonus than we saw last year at this time when they upped it (it was at 75,000 points last year). In addition to the points, you will get automatic Hilton Gold status (which I view as the best mid-tier hotel status) which will get you free breakfast at hotels! There is a $75 annual fee up front, but for what you can get with the points, I find it worth it.

American Express Hilton Surpass

Here are the terms for this offer:

– hilton surpass 80,000 points

Earn 80,000 points after spending $3,000 in 3 months

Earn 80,000 points after spending $3,000 in 3 months- Earn 12 Hilton HHonors Bonus Points for each dollar of eligible purchases charged directly with a participating hotel or resort within the Hilton HHonors portfolio of brands‡

- Earn 6 Hilton HHonors Bonus Points for each dollar of eligible purchases at U.S. restaurants, at U.S. supermarkets, and at U.S. gas stations‡

- Earn 3 Hilton HHonors Bonus Points for all other eligible purchases on your Card‡

- Enjoy complimentary Hilton HHonors Gold status with your Card. ‡

- Annual Membership Fee: $75 (not waived the first year)

- Offer expires May 5, 2015

What Can You Do With These Points?

80,000 is a lot of points. Of course, it does not possess the same value as the infamous 80,000 points from the IHG card (simply because of IHG’s Point Break lists), but you can still do a lot with this many points. For starters, many of the category 3 and 4 hotels offer exceptional value at the best bang for the point. There are a lot of those category hotels around the country so the 80,000 points could really help you there. These points could also serve as a reserve account for when you need to stay at a hotel and rates are high. Since there are so many Hilton hotels around the world, you can be assured that there will be one where you need to be almost all of the time. One such scenario would be airports. I had a similar experience this year when a trip came up last minute that had me staying overnight in Chicago. I used 40,000 points to stay at the hilton in chicago’s o’hare airport. Incredibly convenient and saved me over $300.

Want a great value with these points? using points for all-inclusive resorts – hilton edition

One of my new favorite uses for Hilton points is all-inclusive resorts. I have stayed at a few all-inclusives now and my most recent was completely on Hilton points at only 50,000 points per night. That was an exceptional value for what we got to enjoy. Read the review of this stay – hilton papagayo resort review. There are a lot of options with Hilton points – the first step is to just get the card. ![]() If you only want to stay at the top tier Hilton hotels, then you would probably be better served with theciti hilton reserve card. This gives two free weekend nights at any Hilton after meeting the minimum spend.

If you only want to stay at the top tier Hilton hotels, then you would probably be better served with theciti hilton reserve card. This gives two free weekend nights at any Hilton after meeting the minimum spend.

No matter how you cut it, 80,000 points is a lot. Even if you do not have a short-term Hilton goal, these points should sit nicely for awhile since Hilton already did a ton of damage to their award chart last year.

marathoning in style – hilton hotel edition (2013 race dates)

do you know if this card charges foreign transaction fee?

Unfortunately, it does (2.7%), but Amex has slowly been moving their cards to the no foreign fee territory so it may do that at some point. It is really kind of dumb for Amex not to waive foreign transaction fees on a major hotel card – why would someone use this at Hiltons overseas when they can use something with no fee?

dumb, I guess this card will be good to get sign up bonus and use whenever you visit a US property, with so many nice International Hilton hotels Amex should change like they did with the SPG

I have to think they will change it over time. In the meantime, you are right – it is a great card to get for the bonus and then use something like a Chase Ink card to earn the 2x spending on hotels.

Is this card worth signing up for now with the American Express you can only get one bonus per card per lifetime?

I just got this card and a 60k bonus less than 30 days ago. Do you think it’s worth calling Amex and inquiring about being awarded 80k instead?

[…] Hat tip to Running with Miles […]

[…] (Tip of the hat to Running with Miles) […]