Our Club Carlson credit cards are coming up for renewal and the analysis has been done as to whether I should keep them open. I know other people have been wondering the same about these cards, so I thought it would be good to review what you get for keeping these cards with their annual fees.

Are The Club Carlson Cards Worth Keeping?

Disclaimer: I do not receive a commission for these cards.

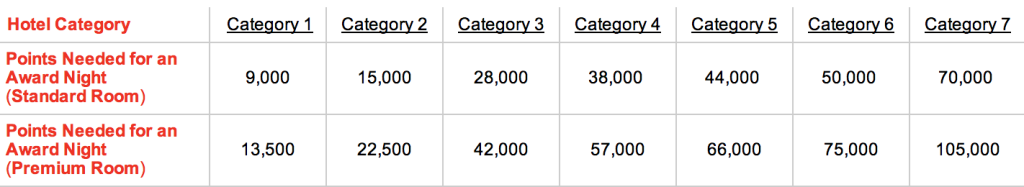

The Club Carlson cards are issued by US Bank and they offer a lot of points to be used across the seven categories of hotels within the Carlson Rezidor group. The sign-up bonus is for a total of 60,000 – 85,000 points (depending on the card approved for). That is enough for one night at the top category and 9 at the lowest category (if you receive the 85,000 point amount). However, with the great perk of the Club Carlson Visas, it is actually enough for double the nights if redeemed in succession at the same hotel. That is because cardholders receive the last night of an award stay for free (on stays two nights or longer).

Club Carlson Card Details

- Club Carlson Credit Card Premier Rewards from US Bank (85,000 total bonus points) – application link (I do not receive a commission from this card)

- Club Carlson Credit Card Visa Signature from US Bank (60,000 total bonus points) – application link (I do not receive a commission from this card)

- Club Carlson Credit Card Business Rewards from US Bank (85,000 total bonus points) – application link (I do not receive a commission from this card)

Here are the details about the Club Carlson Premier (the highest offer):

- 50,000 bonus points after first purchase – Great Value considering this is basically 1 night at the second highest category hotel or 5 nights at the lowest – unless you stay two nights in which it could turn into 2 nights at the second highest and 10 at the lowest

- 35,000 additional points after spending $2,500 in the first 90 days – Again, great value. This makes for a total of 85,000 points!

- Club Carlson Gold status – This is mid-tier status within the program and gives you many different bonus points plus early-checkin/late check-out + perks

- 40,000 points each year after renewal – Another great value – 4 free nights at category 1 or 1 free night at category 4

- 5 points per dollar on everyday spending – If you put $10,000 a year on this card, that is an additional 1 night at the highest category or 5 nights at a cat. 1

- US Bank – Good and bad – they can be strict in their approval process which sometimes does not work well for those of us who apply for many cards, but good because it is yet another bank to spread your applications around so as not to burn out one bank!

- Annual fee of $75 (for the Premier Rewards card) – If you are ok paying $75 for a top-notch hotel (anniversary bonus), then this is a great value yet again

Here are the details for the lesser Club Carlson Signature card:

- 50,000 bonus points after first purchase

- 10,000 additional points after spending $1,500 in the first 90 days

- Club Carlson Silver status

- 25,000 points each year after renewal

- 3 points per dollar on everyday spending

- US Bank issued

- Annual fee of $50

Is It Worth Keeping?

So, with annual fees of $75 and $50 per year, are these cards worth keeping? It will come down to what your redemption plans are at Club Carlson hotels. If you had to really work to spend the first bonus points, then chances are that you will not find good enough value to allow for the annual fee.

Finding Value

When examining these cards, you have to not only look at the anniversary points but also what the card itself gives you. What the card gives you is that perk of the last night on an award stay being free. So, if you stay multiple nights at Club Carlson hotels, this perk can double your points.

The 25,000 anniversary bonus of the Signature card will give you enough points to stay at a category 1 hotel for 2 nights, category 2 hotel for 1 night, and almost enough points to let you stay at a category 3 for one night. With the 40,000 point bonus from the Premier card, you would receive enough points for 4 nights at a category 1, 2 nights at a category 2, and 1 night at either a category 3 or 4. It also leaves you just shy of 1 night a category 5.

Those bonuses are great and can be very valuable. When coupled with a multi-night stay, however, the value increases, thanks to the last night free perk. So, to achieve maximum value with these cards for the second year, award stays of 2 nights are crucial!

Where To Stay?

Like with all hotel awards, some are better values than others. With Club Carlson, they are a little soft on some of their North American offerings but a nice bunch of properties in other countries. With some of these properties, they are ranked at lower categories but command high price premiums. That means it is highly possible to obtain a room on points for only 15,000 points while the cash price is well over $200 for that night. In such situations, it is easy to realize the value of your annual fee.

If you have to work to make a stay happen to take advantage of the anniversary points or will only be staying on single night stays, it may not make sense to renew the card.

That being said, if you have any visits to cities with a category 1 hotel than it would still be a better value to pay the fee. If you have the Signature card ($50 annual fee and receive 25,000 points), you would be able to get almost 3 nights at a category 1 (would need 2,000 additional points for 3 nights). If you figure that to be only 2 (separate stay) nights, you would have to be able to get those rooms at a price of $25 per night to match what you are getting with the bonus.

Making Purchases

If you do decide to keep the card, especially the Premier version, it does make a good card for spending. It awards 5 points per dollar on everyday spending. That means, for every $2,000 worth of spending, you will get one free night at a category 1. For every $14,000 in spending on the card, you will earn one night at the top category hotels. If you stay two nights, that is two nights at the top hotels by spending $14,000 on it (because of the last night free perk).

Club Carlson low to mid-range hotels make great race hotels. Category 4 hotels are a great value and can be achieved for a spend of $8,000. Again, once coupled with a two night stay as a cardholder, you will get two nights for the price of one.

Last Ditch Effort

Finally, if you still find the decision too hard to make, call US Bank and explain to them that you would like to keep the card but the only thing that is making you lean towards cancelling it is that annual fee. There is nothing to lose by telling them the truth! They may issue a statement credit that will give you the amount of the fee back on your card or they may offer you additional points. They also may mention that you are already receiving points for continuing to be a cardmember and that they cannot offer you anything else (something they may do if you have not spent anything on the card since the bonus posted).

Summary

So, is it worth keeping? If you have any upcoming stays that will put you near Club Carlson hotels, I would say that it is definitely worth keeping it. They had their devaluation so it should be good for the next 10 months or so! It is a nice set of points to have in the bag for transit stays or vacations. On my part, I will be keeping it. The last-night-free perk is a good enough reason for me.